Nebraska Disputed Accounted Settlement

Description

How to fill out Disputed Accounted Settlement?

Are you currently in a position that you need paperwork for sometimes enterprise or individual functions almost every time? There are plenty of lawful file templates accessible on the Internet, but discovering types you can trust isn`t effortless. US Legal Forms gives a huge number of develop templates, such as the Nebraska Disputed Accounted Settlement, which are composed to meet state and federal specifications.

When you are previously knowledgeable about US Legal Forms web site and possess your account, merely log in. Afterward, you are able to download the Nebraska Disputed Accounted Settlement design.

If you do not come with an account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is for the right area/area.

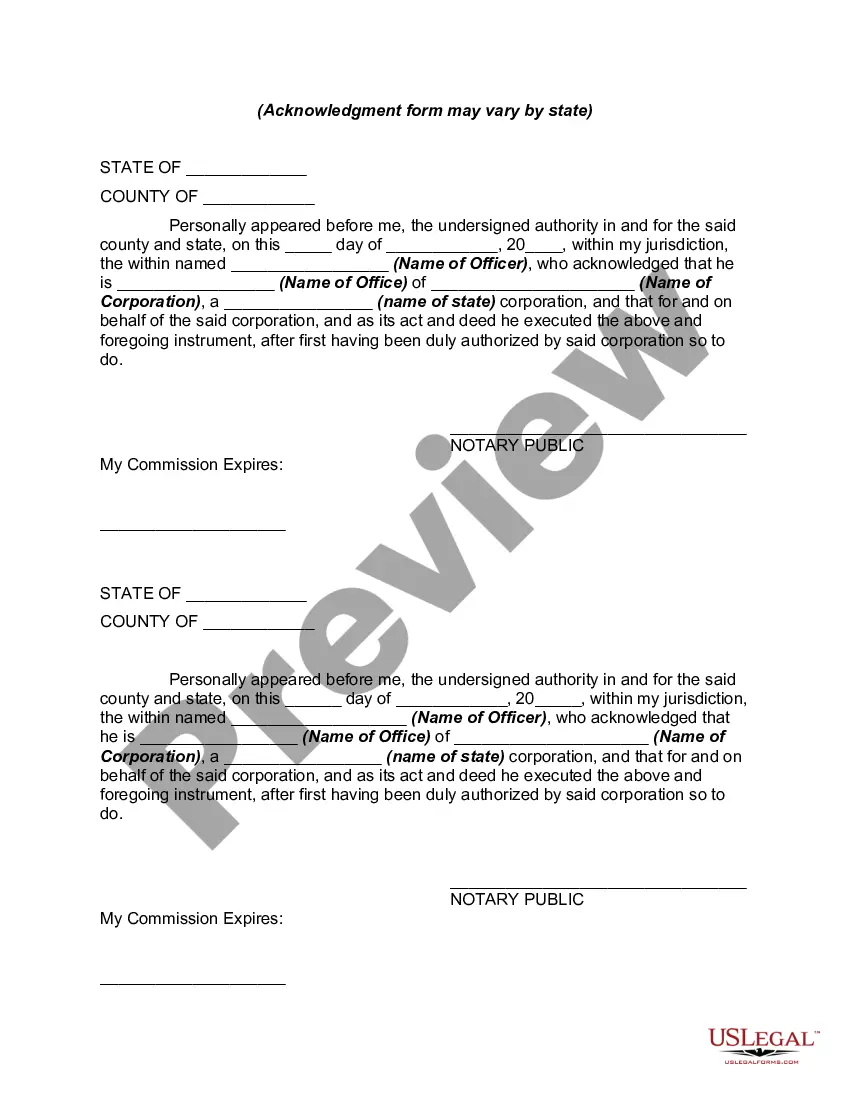

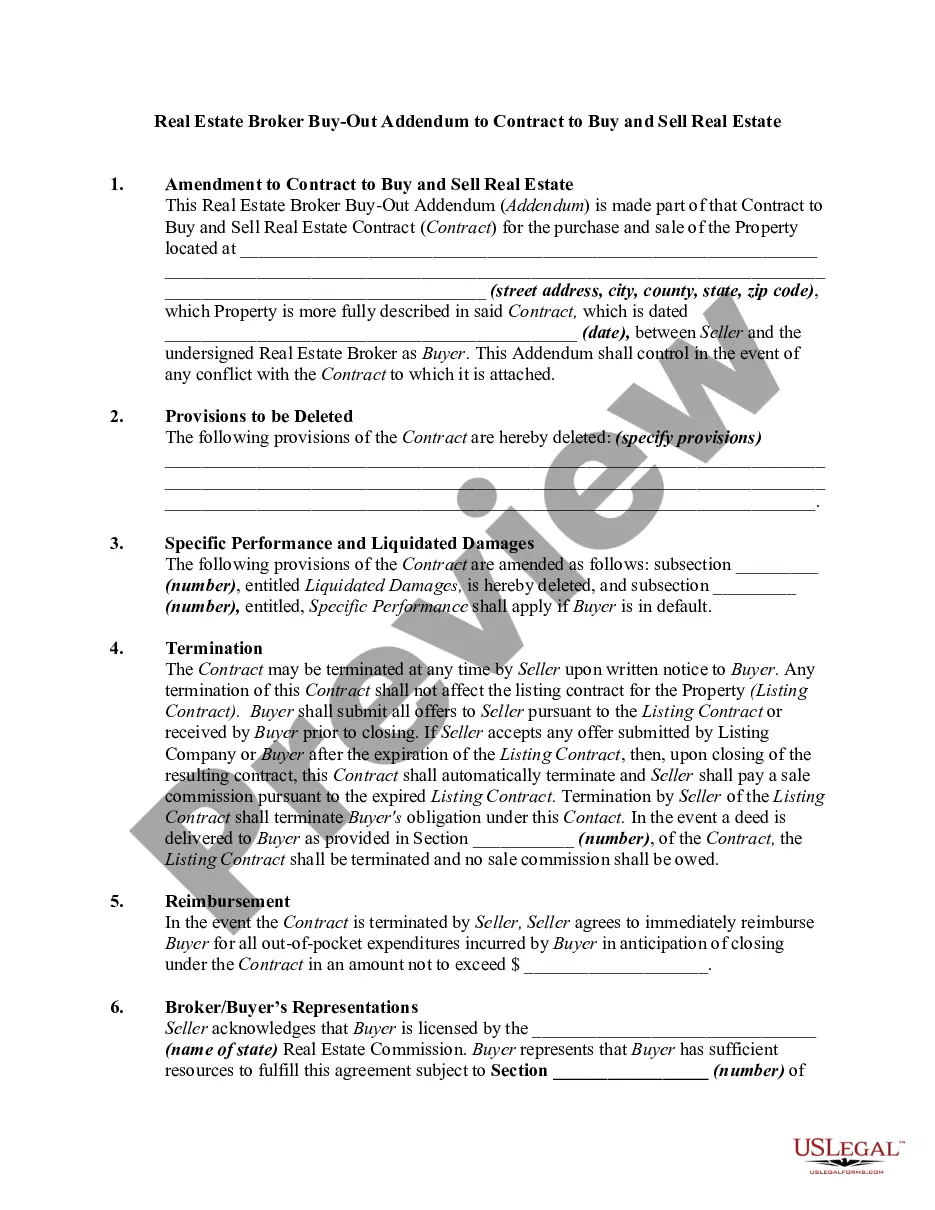

- Take advantage of the Review switch to analyze the form.

- Browse the information to actually have selected the correct develop.

- In case the develop isn`t what you`re seeking, take advantage of the Search field to get the develop that fits your needs and specifications.

- Whenever you discover the right develop, click Buy now.

- Choose the rates prepare you want, fill in the specified info to make your bank account, and pay money for an order using your PayPal or bank card.

- Choose a practical paper formatting and download your duplicate.

Get every one of the file templates you possess purchased in the My Forms food selection. You may get a additional duplicate of Nebraska Disputed Accounted Settlement any time, if possible. Just go through the essential develop to download or produce the file design.

Use US Legal Forms, probably the most substantial assortment of lawful forms, to save time as well as avoid errors. The support gives expertly manufactured lawful file templates that you can use for a variety of functions. Create your account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

Nebraska is an equitable distribution state, meaning that the marital property will be split between the spouses in a way that is just and reasonable.

Are Pension And Retirement Programs Divided The Same As Other Property In A Nebraska Divorce? Retirement assets which could include 401(k)s, IRAs, and pensions are divided in the same manner as all assets in Nebraska, which means that anything that was accumulated during a marriage would be divided equally.

Is Nebraska a 50/50 state in divorce? No, Nebraska is not a 50/50 community property state. This means that a judge will determine the division of property during a divorce under equitable distribution policy and not automatically divide assets in half.

Under the divorce and family laws in Nebraska, alimony or spousal support may be granted on a transitional, temporary or permanent basis. The amount awarded may also be modifiable or non-modifiable depending on the court's determination and what the parties contractually agreed to during divorce negotiations.

Non-marital property is property that was owned by one of the spouses prior to the marriage or gifted to one spouse during the marriage. Non-marital property does not get divided between the parties, but remains with the spouse that either owned it prior to marriage or received it as a gift during the marriage.

If it is equitable and reasonable, the court could give you 90% of the marital property and leave your spouse with the other 10%. Although that's possible, most of the time the court will award a spouse one-third to one-half of the marital property to achieve an equitable result.

The Court is required to make a reasonable division of the assets based on the circumstances of the parties, duration of the marriage, a history of the contributions to the marriage by each party, including contributions to the care and education of the children, and interruption of personal careers or educational ...

The Court is required to make a reasonable division of the assets based on the circumstances of the parties, duration of the marriage, a history of the contributions to the marriage by each party, including contributions to the care and education of the children, and interruption of personal careers or educational ...