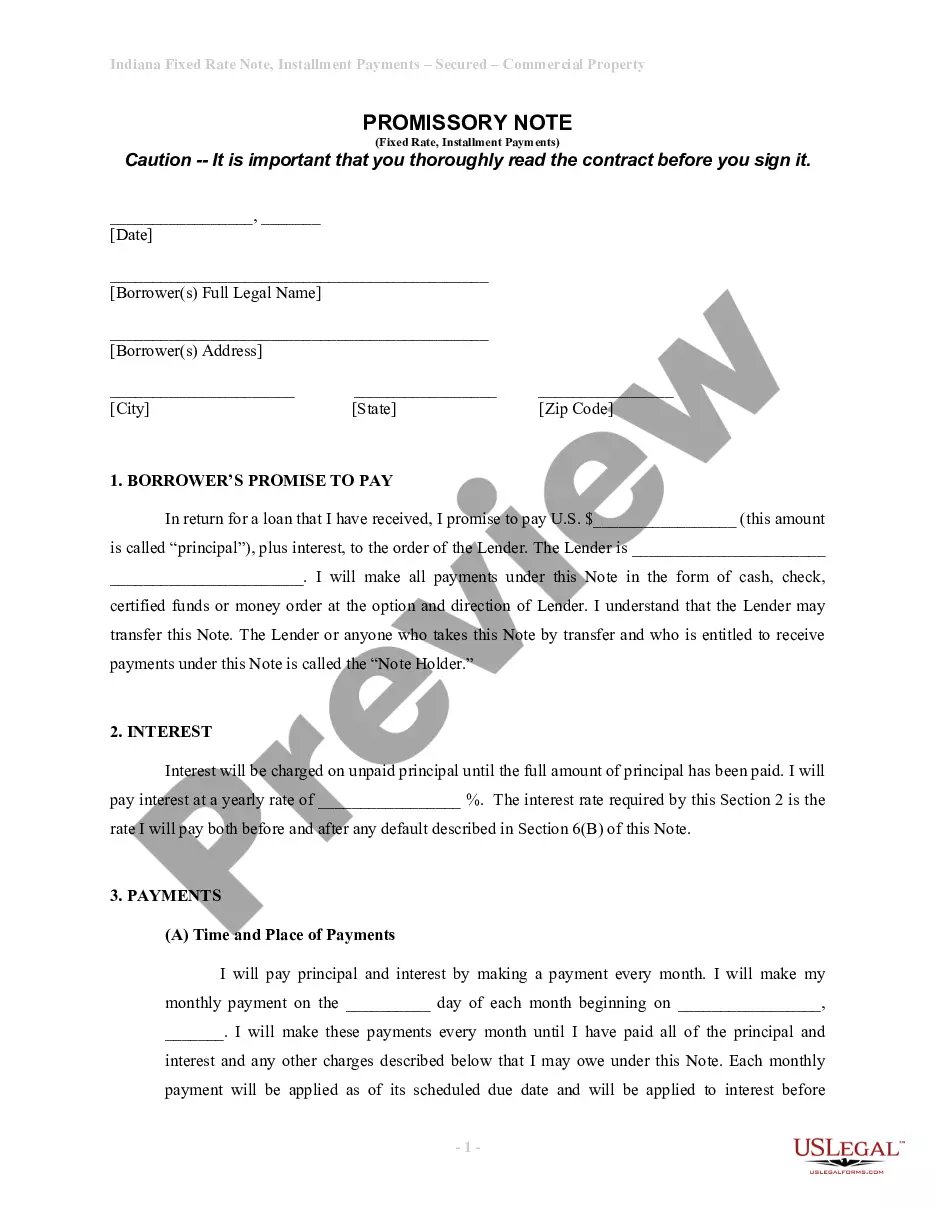

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

Nebraska Consultant Agreement with Sharing of Software Revenues is a legal contract that outlines the terms and conditions between a consultant and a client in the state of Nebraska, specifically related to the sharing of software revenues. This type of agreement is commonly used when a software consultant or developer agrees to assist a client in creating, implementing, or maintaining software applications, platforms, or solutions, and seeks to have a share in the revenue generated from the software. The Nebraska Consultant Agreement with Sharing of Software Revenues is a comprehensive document that covers essential details such as the scope of work, payment terms, ownership rights, confidentiality clauses, termination procedures, and revenue sharing percentages. It ensures that both parties are clear on their roles, responsibilities, and how revenue generated from the software developed will be distributed. There are two main types of Nebraska Consultant Agreement with Sharing of Software Revenues: 1. Fixed Percentage Agreement: This type of agreement specifies a predetermined percentage that the consultant will receive from the revenue generated by the software. The percentage is agreed upon by both parties and remains constant throughout the contract duration. 2. Performance-based Agreement: In this type of agreement, the revenue sharing percentage is determined based on the performance of the software. It might involve tiered percentages, where the consultant's share increases as the revenue from the software surpasses certain milestones or targets. This type of agreement incentivizes the consultant to actively contribute to the success of the software project. When drafting a Nebraska Consultant Agreement with Sharing of Software Revenues, it is crucial to include vital keywords such as: — Nebraska consultancagreementen— - Software revenue sharing — Consultanagreementen— - Software development contract — Revenue sharing term— - Payment terms and conditions — Scopfuroror— - Intellectual property rights — Confidentiality annondisclosureur— - Termination clauses — Performance-based revenusharingin— - Fixed percentage revenue sharing — Software development service— - Consultant responsibilities It is important for both parties involved to carefully review the agreement, seek legal advice if necessary, and ensure that all relevant keywords and details are present in the contract to protect their rights and clarify their obligations.