A Nebraska Notice of Default on Promissory Note Installment is a legal document that serves to inform the borrower that they have failed to make the required payments on their promissory note according to the agreed-upon installment schedule. This notice is a crucial step in the process of defaulting on a promissory note and can have significant consequences for the borrower. Keywords: 1. Nebraska Notice of Default: This term refers specifically to the notice being issued in the state of Nebraska, highlighting its relevance to residents and legal proceedings within the state. 2. Promissory Note: A promissory note is a legally binding document that outlines the borrower's promise to repay a specific amount of money to the lender, typically through structured installment payments. 3. Installment: Installments refer to the periodic scheduled payments that the borrower must make towards the repayment of the promissory note. Failure to make these payments can lead to default. 4. Default: Default occurs when the borrower fails to meet their obligations as outlined in the promissory note. It may include missed payments, late payments, or failure to pay the full amount owed. 5. Legal Consequences: Defaulting on a promissory note can result in various legal consequences, such as the lender taking legal action to recover the remaining balance, imposing penalties or fees, or initiating foreclosure proceedings if the promissory note is secured by a property or asset. Types of Nebraska Notice of Default on Promissory Note Installment: 1. Notice of Default on Promissory Note Installment for Residential Property: This specific type of notice pertains to promissory notes related to residential properties, such as mortgages. It outlines the defaulted payment(s) and may specify a timeframe for the borrower to rectify the situation before further legal action is taken. 2. Notice of Default on Promissory Note Installment for Commercial Property: Similar to the residential type, this notice applies to promissory notes associated with commercial properties or loans. It notifies the borrower of the breach and provides an opportunity to address the default before more severe measures are pursued. 3. Notice of Default on Promissory Note Installment for Unsecured Loans: Unsecured loans do not have collateral attached to them, making this type of notice particularly important. It informs the borrower of the default and may outline alternative resolutions or repayment options available. 4. Notice of Default on Promissory Note Installment for Secured Loans: Secured loans are backed by collateral, such as real estate or other valuable assets. This notice highlights the breach of the installment schedule and specifies potential consequences related to the pledged property, such as foreclosure or repossession. 5. Notice of Default on Promissory Note Installment for Personal Loans: Personal loans, often involving individuals borrowing from friends, family, or private lenders, can also result in default. This type of notice serves to inform the borrower of the defaulted payments and may emphasize the shared expectation of repayment within a specified timeframe.

Nebraska Notice of Default on Promissory Note Installment

Description

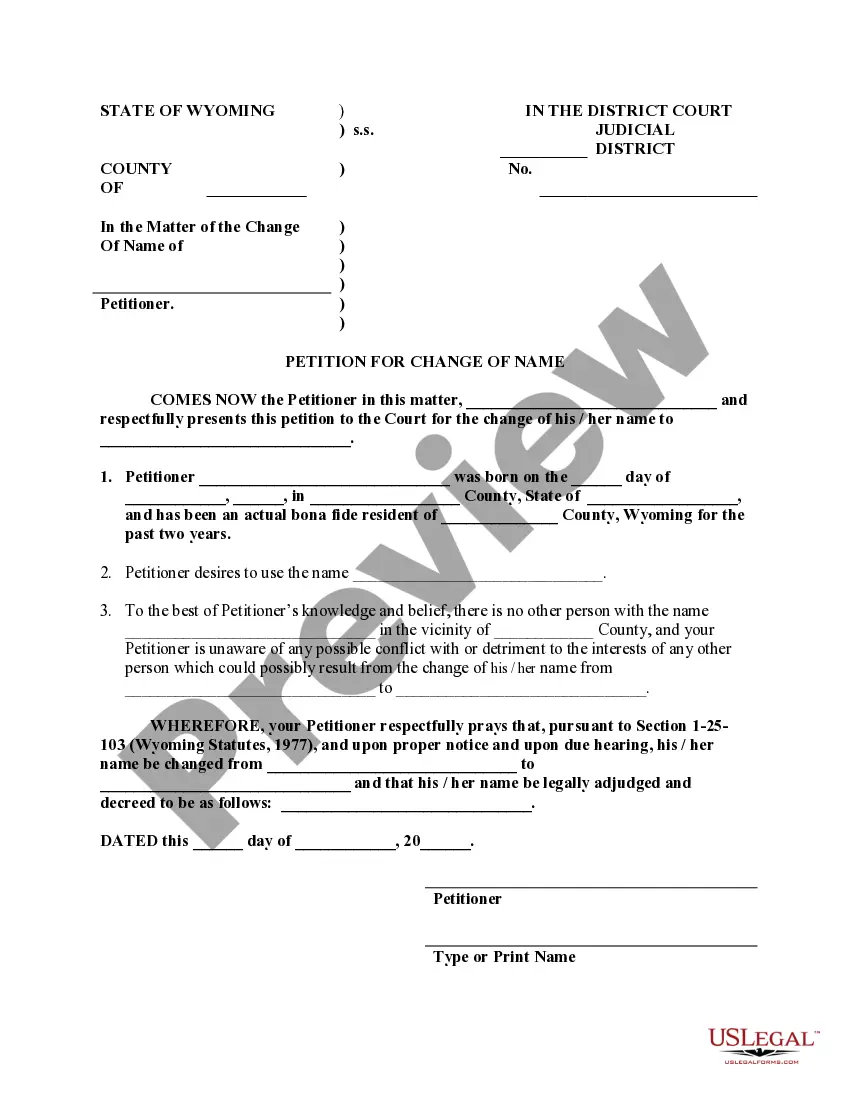

How to fill out Nebraska Notice Of Default On Promissory Note Installment?

US Legal Forms - one of several biggest libraries of authorized forms in the USA - gives an array of authorized papers themes you are able to acquire or print out. While using site, you will get a large number of forms for business and personal reasons, sorted by groups, suggests, or keywords.You will discover the newest models of forms much like the Nebraska Notice of Default on Promissory Note Installment in seconds.

If you already have a membership, log in and acquire Nebraska Notice of Default on Promissory Note Installment from your US Legal Forms local library. The Acquire button will show up on each form you perspective. You have accessibility to all in the past saved forms inside the My Forms tab of the account.

If you want to use US Legal Forms initially, here are simple recommendations to obtain started off:

- Ensure you have selected the right form to your town/region. Select the Review button to check the form`s content material. Read the form outline to actually have selected the correct form.

- In the event the form does not fit your requirements, make use of the Research discipline on top of the display to get the one that does.

- If you are content with the form, verify your selection by clicking on the Purchase now button. Then, choose the rates prepare you want and supply your qualifications to sign up for an account.

- Method the purchase. Utilize your charge card or PayPal account to finish the purchase.

- Choose the format and acquire the form on your own gadget.

- Make changes. Complete, modify and print out and sign the saved Nebraska Notice of Default on Promissory Note Installment.

Every single template you included with your account lacks an expiry time and is also the one you have permanently. So, if you wish to acquire or print out yet another duplicate, just go to the My Forms segment and click about the form you require.

Get access to the Nebraska Notice of Default on Promissory Note Installment with US Legal Forms, the most comprehensive local library of authorized papers themes. Use a large number of expert and status-certain themes that fulfill your organization or personal needs and requirements.

Form popularity

FAQ

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note. The promissory note itself should set out what constitutes default, so that both the lender and the borrower are clear on the terms.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Prepayment. Maker may prepay all or any part of the principal balance of this Promissory Note at any time without premium or penalty. Amounts prepaid may not be reborrowed.

A default on a loan happens when the borrower fails to make the scheduled payments in full. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

What invalidates promissory notes?Incomplete signatures. Both parties must sign the promissory note.Missing payment amount or schedule.Missing interest rate.Lost original copy.Unclear clauses.Unreasonable terms.Past the statute of limitations.Changes made without a new agreement.

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?