Nebraska Invoice Template for Bakery is a professionally designed document that assists bakers and bakery owners in effectively managing their billing and invoicing processes. This template is tailored specifically for bakery businesses operating in Nebraska and takes into account the unique requirements and regulations of the state. It is essential for bakers to have a comprehensive and organized system for generating invoices, tracking sales, and maintaining financial records, and this invoice template serves as an indispensable tool for fulfilling these needs. The Nebraska Invoice Template for Bakery includes all the necessary sections and functionalities to ensure accurate and professional invoicing. It typically consists of: 1. Business Information: This section enables bakery owners to input their company's name, address, contact details, and logo for easy identification. 2. Customer Details: This crucial segment allows bakers to enter their client's information, such as name, address, and contact details, facilitating seamless communication and record keeping. 3. Invoice Number and Date: Each invoice generated using this template is assigned a unique identification number, helping bakery businesses to easily track and identify each transaction. The invoice date is also mentioned, providing clarity on the billing period. 4. Itemized List of Bakery Products or Services: This section permits bakers to list all the bakery products or services rendered to the client. It allows for the inclusion of item descriptions, quantities, rates, and subtotal amounts for each item, ensuring transparency and accuracy. 5. Taxes and Discounts: If applicable, the Nebraska Invoice Template for Bakery allows for the inclusion of sales or goods and services taxes, adhering to the state's tax regulations. Additionally, discount options can be incorporated if bakery owners wish to offer promotional prices to their customers. 6. Total Amount Due and Payment Terms: This segment offers a clear breakdown of the total amount due to the bakery business, taking into consideration all items, taxes, discounts, and any additional charges. It also outlines the payment terms and methods accepted, providing clarity to clients regarding payment obligations. 7. Additional Notes: This section enables bakery owners to include any additional information or special instructions related to the invoice or payment process, fostering effective communication and addressing any specific client requirements. Different types of Nebraska Invoice Templates for Bakery may vary based on their design, layout, and additional features. Some templates might provide options to include hourly rates for custom orders or labor costs, while others may have detailed sections for tracking and invoicing recurring orders or subscriptions. In conclusion, the Nebraska Invoice Template for Bakery provides a comprehensive and user-friendly solution for bakery businesses in Nebraska to streamline their invoicing procedures. By utilizing this template, bakers can create professional invoices swiftly, maintain accurate financial records, and ensure a smooth payment process, ultimately contributing to the overall success and growth of their bakery ventures.

Nebraska Invoice Template for Bakery

Description

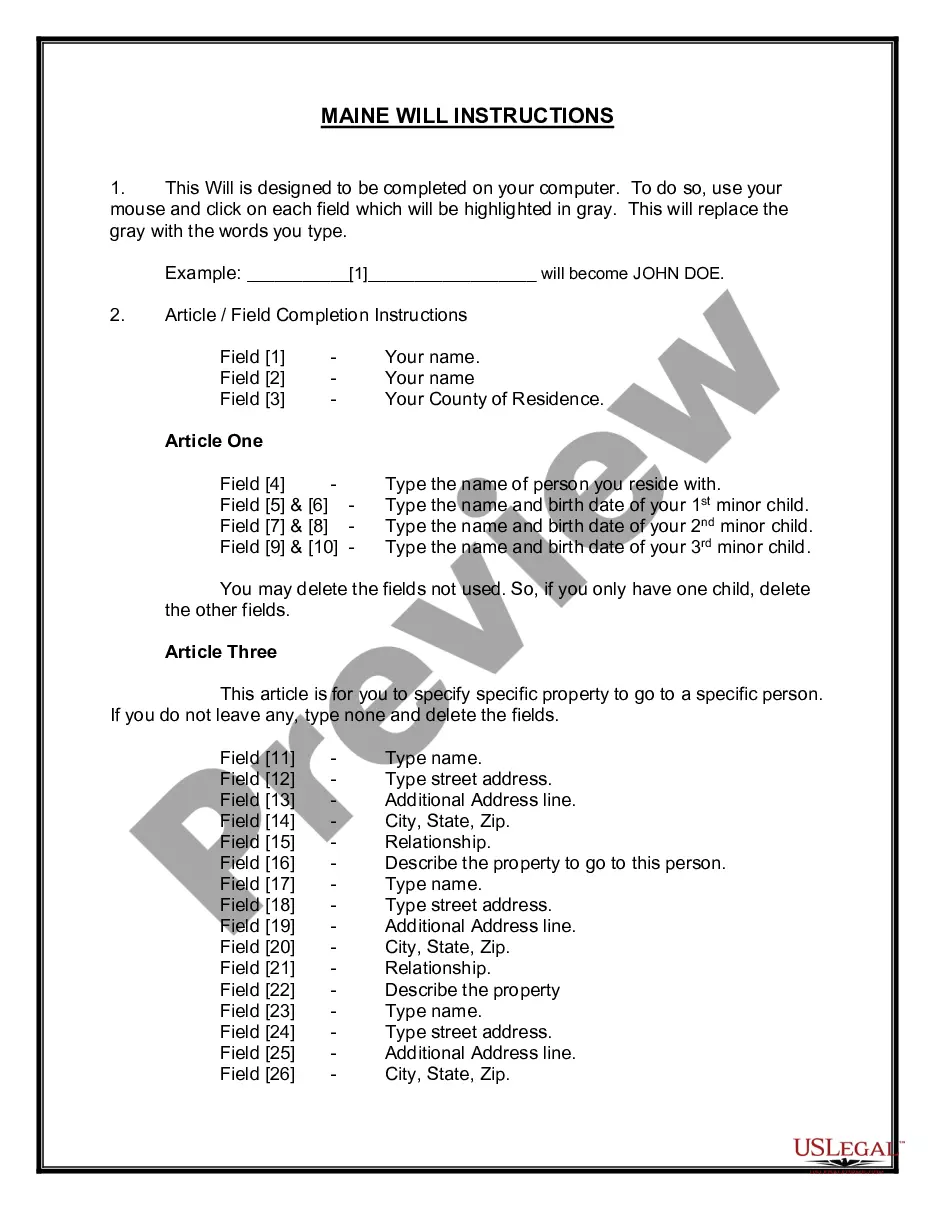

How to fill out Nebraska Invoice Template For Bakery?

US Legal Forms - one of several biggest libraries of authorized varieties in America - offers an array of authorized document web templates you can obtain or printing. Using the website, you can find a huge number of varieties for enterprise and specific uses, categorized by groups, says, or keywords.You will discover the most up-to-date versions of varieties such as the Nebraska Invoice Template for Bakery in seconds.

If you currently have a monthly subscription, log in and obtain Nebraska Invoice Template for Bakery from your US Legal Forms collection. The Obtain button can look on each develop you perspective. You have access to all previously downloaded varieties inside the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, allow me to share basic guidelines to get you began:

- Ensure you have selected the correct develop for the town/area. Click on the Review button to review the form`s information. Look at the develop explanation to ensure that you have chosen the proper develop.

- In case the develop does not suit your needs, make use of the Search field towards the top of the monitor to obtain the the one that does.

- Should you be content with the shape, verify your option by clicking on the Acquire now button. Then, choose the rates strategy you like and supply your credentials to sign up to have an bank account.

- Approach the purchase. Make use of credit card or PayPal bank account to finish the purchase.

- Choose the file format and obtain the shape on the system.

- Make changes. Fill out, revise and printing and signal the downloaded Nebraska Invoice Template for Bakery.

Each format you added to your account lacks an expiration day which is your own property for a long time. So, if you would like obtain or printing one more backup, just proceed to the My Forms section and click on in the develop you want.

Get access to the Nebraska Invoice Template for Bakery with US Legal Forms, one of the most extensive collection of authorized document web templates. Use a huge number of expert and condition-distinct web templates that meet up with your company or specific demands and needs.