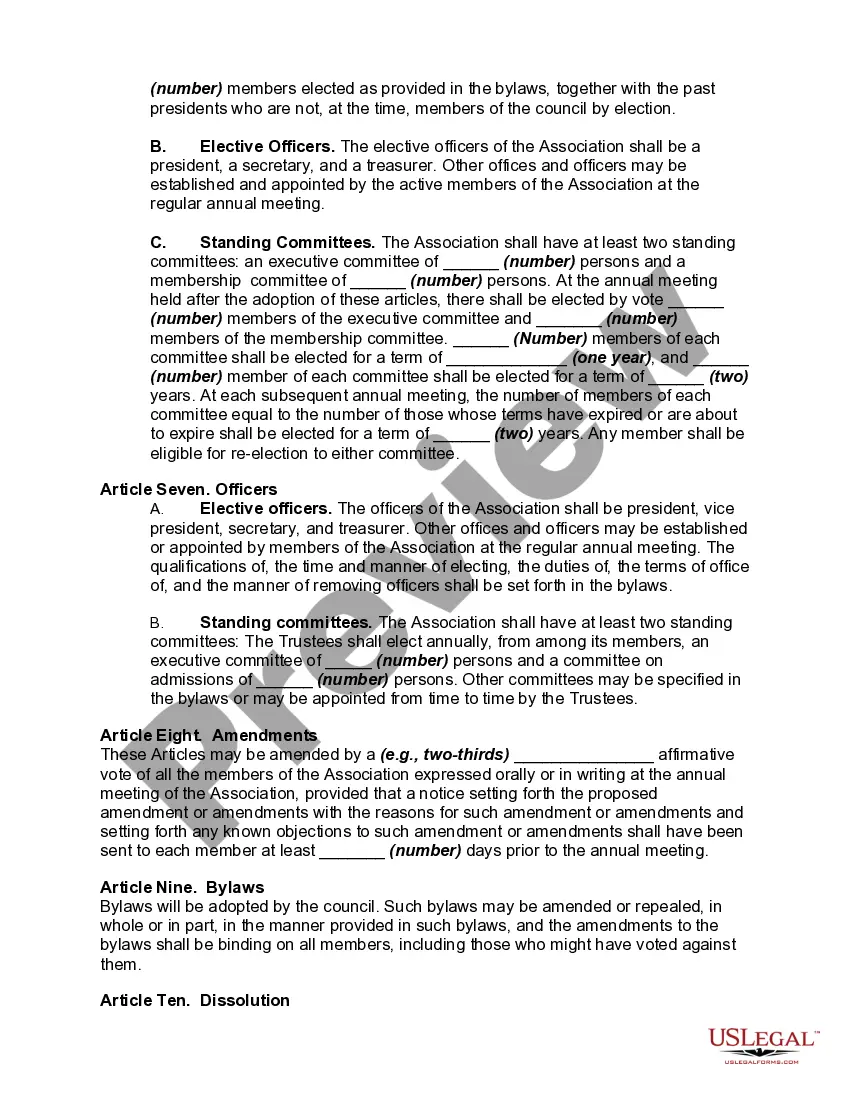

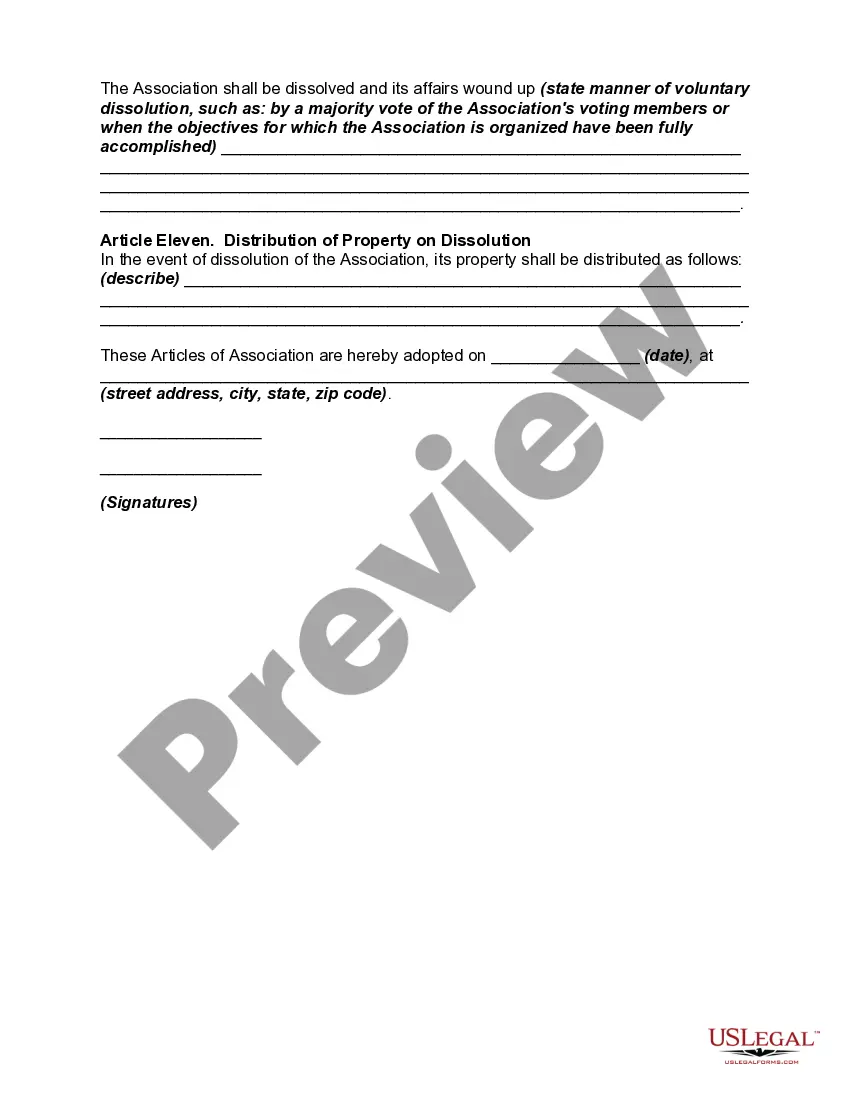

Nebraska Articles of Association for Social Club

Description

How to fill out Articles Of Association For Social Club?

Choosing the right legal file web template can be quite a battle. Naturally, there are a variety of web templates available online, but how would you obtain the legal kind you require? Take advantage of the US Legal Forms internet site. The services provides a large number of web templates, like the Nebraska Articles of Association for Social Club, which you can use for organization and private needs. All the types are inspected by pros and meet federal and state specifications.

If you are already listed, log in to the accounts and click the Down load option to have the Nebraska Articles of Association for Social Club. Make use of your accounts to check with the legal types you possess ordered earlier. Go to the My Forms tab of your own accounts and obtain another version of your file you require.

If you are a new customer of US Legal Forms, listed here are easy guidelines so that you can follow:

- Initially, make sure you have chosen the correct kind for your personal city/area. You can look over the form making use of the Preview option and read the form outline to make certain this is the right one for you.

- In the event the kind is not going to meet your requirements, utilize the Seach field to get the correct kind.

- When you are sure that the form is suitable, click on the Get now option to have the kind.

- Choose the costs strategy you need and type in the required details. Design your accounts and pay money for the transaction making use of your PayPal accounts or charge card.

- Pick the file structure and download the legal file web template to the gadget.

- Complete, edit and produce and indicator the acquired Nebraska Articles of Association for Social Club.

US Legal Forms is the greatest library of legal types that you can discover a variety of file web templates. Take advantage of the company to download appropriately-produced paperwork that follow express specifications.

Form popularity

FAQ

The purpose of the Notice of Organization is to inform and notify the public that your LLC has been created in the state of Nebraska. Your Notice of Organization must include certain information about your LLC, as spelled out in section 21-117 (see 'b') of the Nebraska Revised Statutes: The name of your Nebraska LLC.

If you have not yet formed a Nebraska business, you can become your own Nebraska registered agent when you fill out the formation documents. There is space on the formation documents for the address and name of the business' registered agent; put your information here.

Nebraska LLC Approval Times Mail filings: In total, mail filing approvals for Nebraska LLCs take 1-2 weeks. This accounts for the 2-3 business days processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Nebraska LLCs take 2-3 business days.

Benefits of Starting a Nebraska LLC Protects your personal assets from your business liability and debts. Easy tax filing and potential advantages for tax treatment. Quick and simple filing, management, compliance, regulation and administration. Low LLC filing fee ($109)

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office. It typically takes the state 10 days to process your paperwork after they receive it.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office.

Here are the steps to forming an LLC in Nebraska Search your LLC Name. Search your Nebraska LLC Name to make sure it's available in the state. ... Choose a Nebraska Registered Agent. ... File Nebraska LLC Certificate of Organization. ... Create a Nebraska LLC Operating Agreement. ... Get an EIN for your LLC. ... Publish a Newspaper Notice.

Choose a Name for Your LLC. Under Nebraska law, an LLC name must contain the words "Limited Liability Company" or the abbreviations "LLC" or "L.L.C." ... Appoint a Registered Agent. ... File a Certificate of Organization. ... Prepare an Operating Agreement. ... Publication Requirements. ... Obtain an EIN. ... File Biennial Reports.