A Nebraska Loan Agreement between Stockholder and Corporation is a legal document that outlines the terms and conditions of a loan given by a stockholder to a corporation in the state of Nebraska. This agreement sets forth the obligations, rights, and responsibilities of both parties involved in the loan transaction. In this type of loan agreement, the stockholder (also known as the lender) provides funds to the corporation (also known as the borrower) under agreed-upon terms, such as interest rate, repayment schedule, and any collateral or guarantees required. The loan could be utilized for various purposes, including working capital, expansion, or other business-related needs. The Nebraska Loan Agreement between Stockholder and Corporation typically consists of several key elements and provisions. These may include: 1. Loan Amount: Specifies the principal amount being lent by the stockholder to the corporation. 2. Interest Rate: Specifies the interest percentage that will be charged on the loaned amount. It may be a fixed rate or variable rate, depending on the agreement. 3. Repayment Terms: Defines the repayment schedule, including the frequency of installments (e.g., monthly, quarterly), the due dates, and the method of payment (e.g., check, bank transfer). 4. Collateral and Guarantees: Addresses whether any collateral, such as assets or properties, or personal guarantees are required to secure the loan. This clause protects the lender's interest in case of default. 5. Default and Remedies: Outlines the consequences and remedies in the event of loan default, including the stockholder's rights to accelerate the loan, seek legal actions, or exercise other remedies as agreed upon. 6. Representations and Warranties: Require the borrower to make certain assertions regarding their financial status, legal compliance, and the accuracy of provided information. 7. Confidentiality and Non-Disclosure: Specifies that the terms of the loan agreement remain confidential and may not be disclosed to third parties without the written consent of both parties. 8. Governing Law: States that the loan agreement will be interpreted and enforced according to Nebraska state laws. Different types of Nebraska Loan Agreements between Stockholder and Corporation may include variations in terms and conditions, depending on the specific needs of the corporation and the stockholder. Some variations may include secured loans (with collateral), unsecured loans (without collateral), bridge loans (short-term financing), and demand loans (payable on demand). In conclusion, a Nebraska Loan Agreement between Stockholder and Corporation is a vital legal document that formalizes a loan arrangement between a stockholder and a corporation. It ensures that both parties have a clear understanding of their obligations and helps protect their interests while facilitating the financial needs of the corporation.

Nebraska Loan Agreement between Stockholder and Corporation

Description

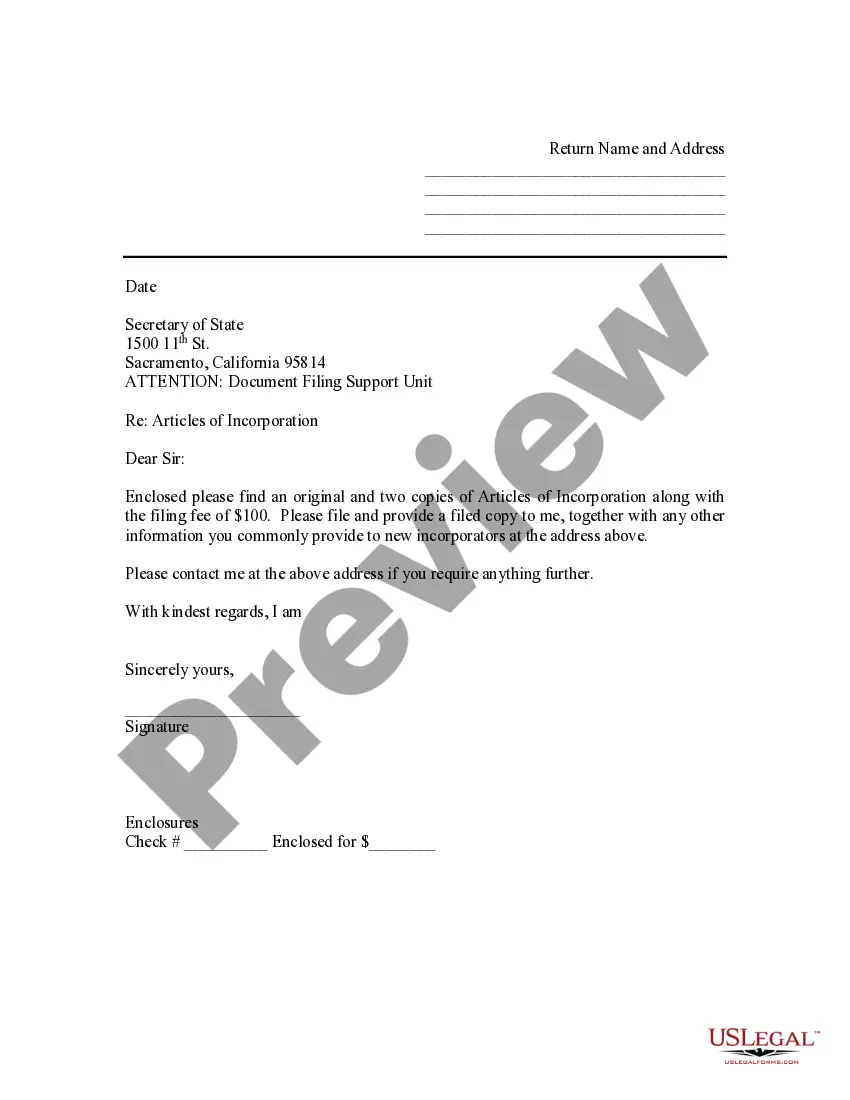

How to fill out Nebraska Loan Agreement Between Stockholder And Corporation?

US Legal Forms - one of the greatest libraries of lawful kinds in the United States - delivers an array of lawful papers layouts you may acquire or print out. While using site, you can get a huge number of kinds for organization and individual reasons, sorted by classes, suggests, or keywords.You will discover the most recent versions of kinds much like the Nebraska Loan Agreement between Stockholder and Corporation in seconds.

If you have a subscription, log in and acquire Nebraska Loan Agreement between Stockholder and Corporation through the US Legal Forms collection. The Obtain button will show up on every single kind you see. You have access to all in the past saved kinds from the My Forms tab of your own profile.

If you would like use US Legal Forms initially, allow me to share basic instructions to get you started:

- Be sure to have selected the proper kind to your town/county. Click on the Review button to examine the form`s information. See the kind explanation to actually have selected the proper kind.

- If the kind doesn`t fit your requirements, take advantage of the Search industry towards the top of the screen to obtain the one that does.

- If you are happy with the shape, confirm your selection by visiting the Buy now button. Then, pick the prices prepare you favor and provide your accreditations to register to have an profile.

- Procedure the financial transaction. Utilize your charge card or PayPal profile to complete the financial transaction.

- Find the formatting and acquire the shape on your device.

- Make changes. Fill out, edit and print out and signal the saved Nebraska Loan Agreement between Stockholder and Corporation.

Every single template you included in your bank account does not have an expiry day and is also the one you have permanently. So, if you would like acquire or print out an additional copy, just go to the My Forms portion and then click around the kind you will need.

Get access to the Nebraska Loan Agreement between Stockholder and Corporation with US Legal Forms, by far the most substantial collection of lawful papers layouts. Use a huge number of skilled and status-certain layouts that fulfill your company or individual needs and requirements.

Form popularity

FAQ

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.

One of the shareholders gives the S corporation a personal loan on the expectation that the corporation will get a loan in the near future and repay the shareholder within a short period of time. Because there is no bank note, the loan is considered to be an open account debt.

Making a Loan to your Business If you want to loan money to your business, you should have your attorney draw up paperwork to define the terms of the loan, including repayment and consequences for non-repayment of the loan. For tax purposes, a loan from you to your business must be an "arms-length" transaction.

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.

How do I create a Shareholder Loan Agreement?Determine how the corporation will make payments.State the term length.Specify the loan amount.Determine the payment details.Provide both parties' information.Address miscellaneous matters.Sign the document.

Shareholders often loan money to their corporation in order to keep the business operating. There are rules and regulations in the Internal Revenue Code (IRC) that must be adhered to in order for loans to be treated as such, and not an equity contribution.

If your company has extra cash on hand, a shareholder loan can be a convenient and low-cost option but it's important to treat the transaction as a bona fide loan. If you don't, the IRS may claim the shareholder received a taxable dividend or compensation payment rather than a loan.

Conclusion. Shareholder loans are a hybrid of debt and equity much like preferred stock. They are used by sponsors in transactions as a vehicle to carry the bulk of their investment as they carry a fixed rate of return.

You have one year from your fiscal year-end date to pay it back. This can be repaid as a direct repayment, salary, or dividend. Be careful doing so since your shareholder loan will be reported to CRA as an asset on your balance sheet at fiscal year-end.

Shareholders often loan money to a corporation in order to keep the business operating, but be aware there are rules and regulations, which must be adhered to, so the loan is treated as a loan, and not reclassified as an equity contribution.