This form may be used to collect information necessary for the preparation of the most common forms of material contracts for a business. The term sheet may be used as a guide when conduct client interviews and should also be consulted during the drafting process. The items in the term sheet are also useful when reviewing contracts that may be drafted by other parties.

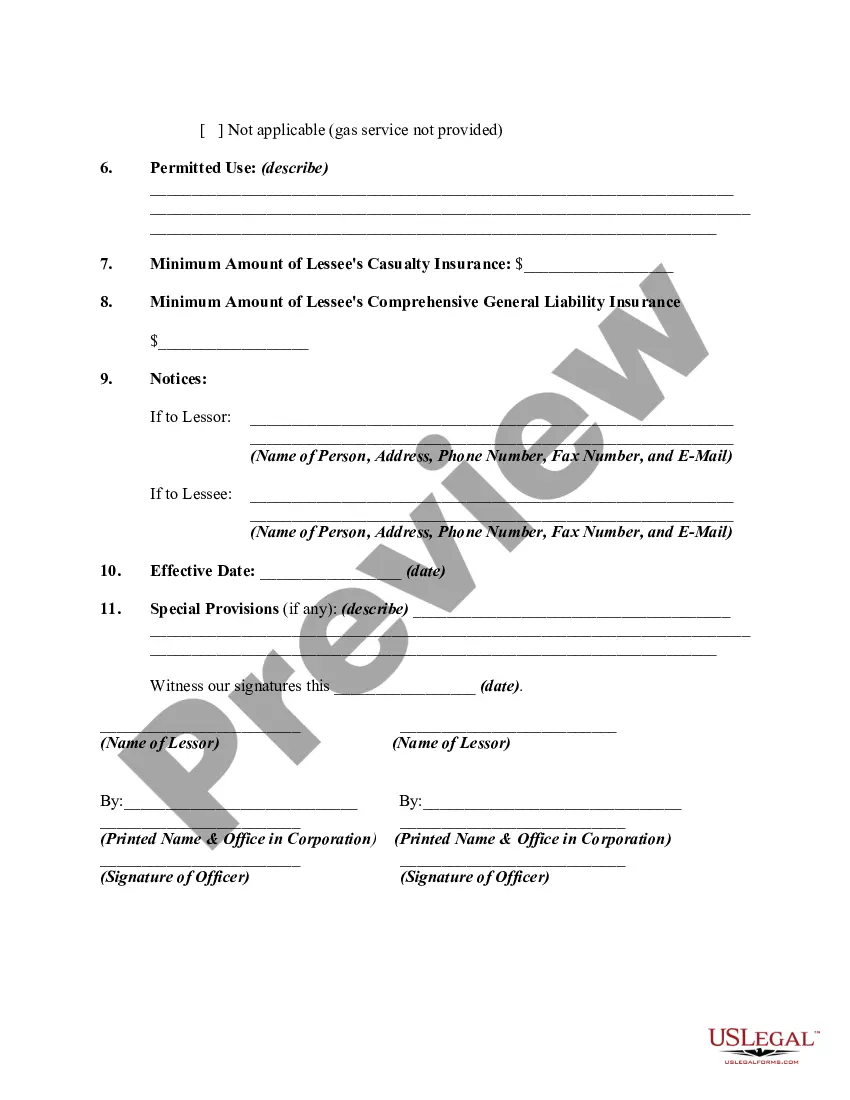

A Nebraska Terms Sheet for Commercial Lease Agreement is a comprehensive document that outlines specific terms and conditions related to a commercial lease agreement in the state of Nebraska. It serves as a precursor to the final lease agreement and provides a summary of key provisions that both the landlord and tenant must agree upon before moving forward with the leasing process. Key terms typically covered in the Nebraska Terms Sheet for Commercial Lease Agreement include: 1. Parties involved: The names and addresses of both the landlord (lessor) and the tenant (lessee) are identified at the beginning of the document, establishing their roles in the lease agreement. 2. Property description: The terms sheet will include a detailed description of the commercial property being leased, specifying its location, size, boundaries, and any other relevant details. 3. Lease term: This section outlines the duration of the lease agreement, including the start and end dates. It may also cover provisions for renewal or termination options. 4. Rent and payment terms: The amount of rent, frequency of payment (monthly, quarterly, annually), as well as details about any applicable late fees, security deposits, or rent escalation clauses, are specified to ensure clarity and avoid disputes. 5. Permitted use: The permitted use of the leased premises is a crucial aspect of any commercial lease agreement. This section defines the specific activities or business operations allowed within the premises. 6. Operating expenses and utilities: The terms sheet may include information on the tenant's obligation to pay for utilities, property taxes, insurance, and any other operating expenses related to the leased premises. 7. Maintenance and repairs: This section outlines the responsibilities of both the landlord and tenant for maintenance and repairs. It clarifies who is responsible for which areas and highlights any potential cost-sharing agreements. 8. Alterations and improvements: If the tenant is allowed to make alterations or improvements to the leased premises, this section will specify the conditions, permissions, and potential restoration requirements upon lease termination. 9. Insurance requirements: The landlord may require the tenant to maintain specific insurance coverage during the lease term and provide proof of such coverage, protecting both parties from potential liabilities. 10. Default and remedies: This section covers the consequences of non-compliance with the lease terms, such as late payments or breaches of contractual obligations. It outlines the remedies available to the aggrieved party, which may include lease termination or legal action. Nebraska offers different types of terms sheets for commercial lease agreements depending on the specific needs of the parties involved. Some common variations include: 1. Gross Lease Terms Sheet: This type of terms sheet specifies a fixed rent amount, which typically includes all operating expenses and utilities. The landlord is responsible for paying these costs. 2. Net Lease Terms Sheet: In a net lease, the tenant pays a base rent and is also responsible for additional costs like property taxes, insurance, and maintenance expenses. 3. Triple Net Lease Terms Sheet: This type of terms sheet places the burden of operating expenses, property taxes, insurance, and maintenance solely on the tenant, in addition to the base rent. By understanding the intricacies of a Nebraska Terms Sheet for Commercial Lease Agreement and the different variations available, landlords and tenants can negotiate and tailor the lease agreement to suit their specific requirements and protect their interests.