Nebraska Wire Transfer Instruction to Receiving Bank

Description

How to fill out Wire Transfer Instruction To Receiving Bank?

US Legal Forms - among the greatest libraries of lawful kinds in the United States - offers an array of lawful record templates it is possible to obtain or produce. Using the site, you can get a huge number of kinds for company and person purposes, categorized by types, claims, or keywords and phrases.You can get the latest models of kinds like the Nebraska Wire Transfer Instruction to Receiving Bank within minutes.

If you already have a monthly subscription, log in and obtain Nebraska Wire Transfer Instruction to Receiving Bank from the US Legal Forms library. The Download switch will show up on each and every type you perspective. You have accessibility to all earlier saved kinds inside the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, here are easy recommendations to obtain started off:

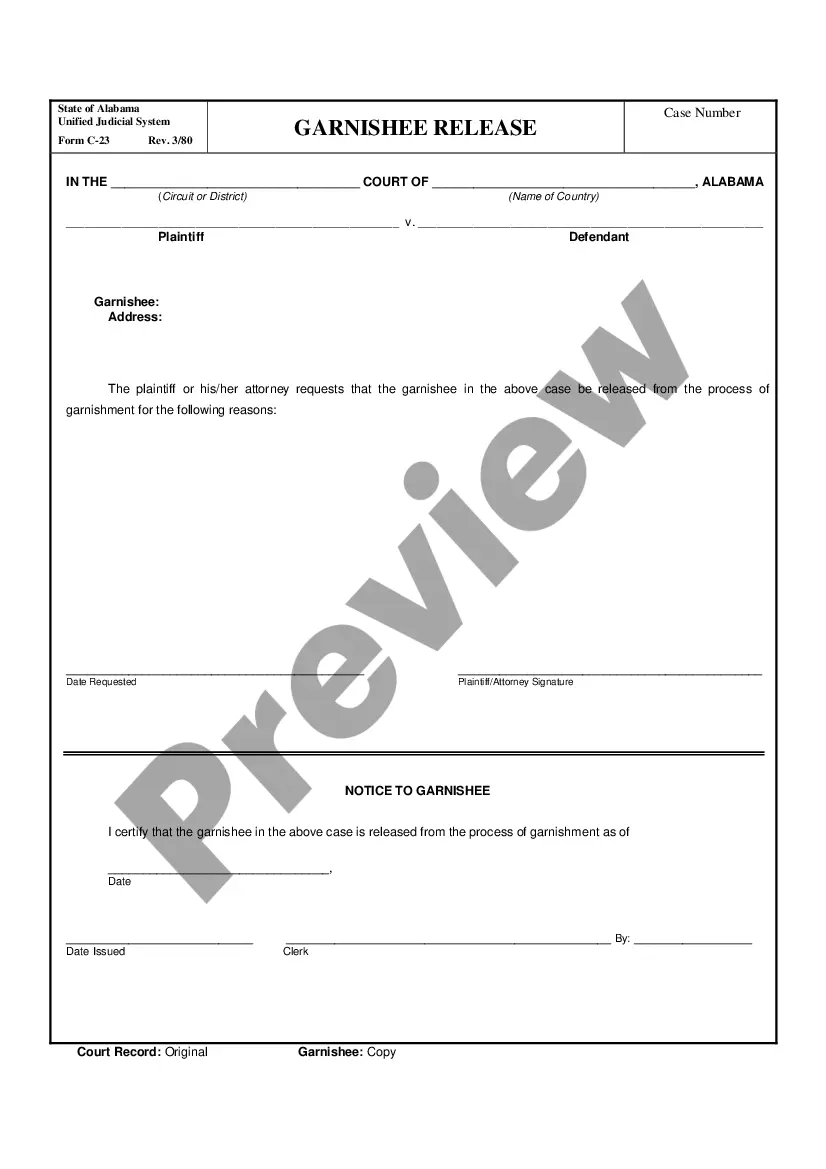

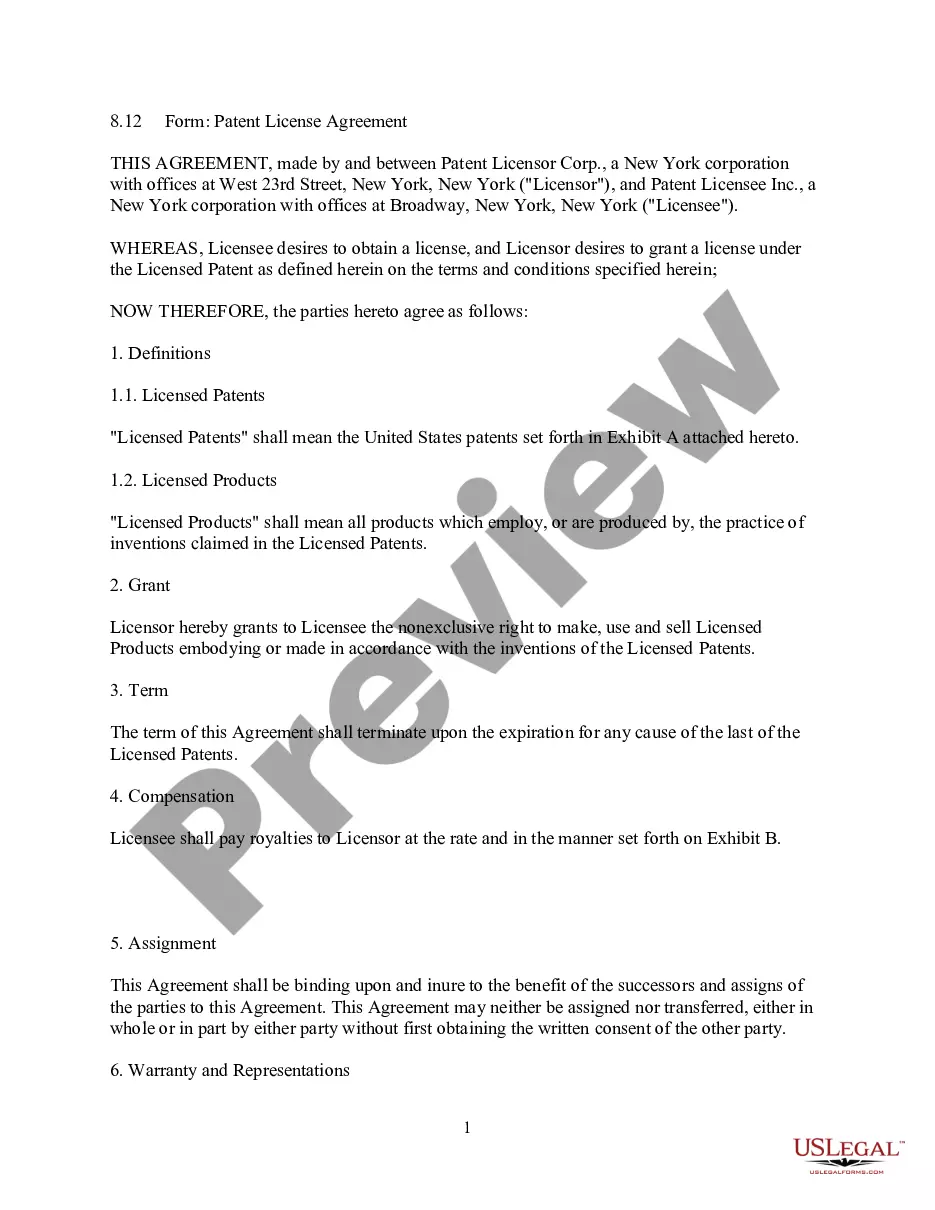

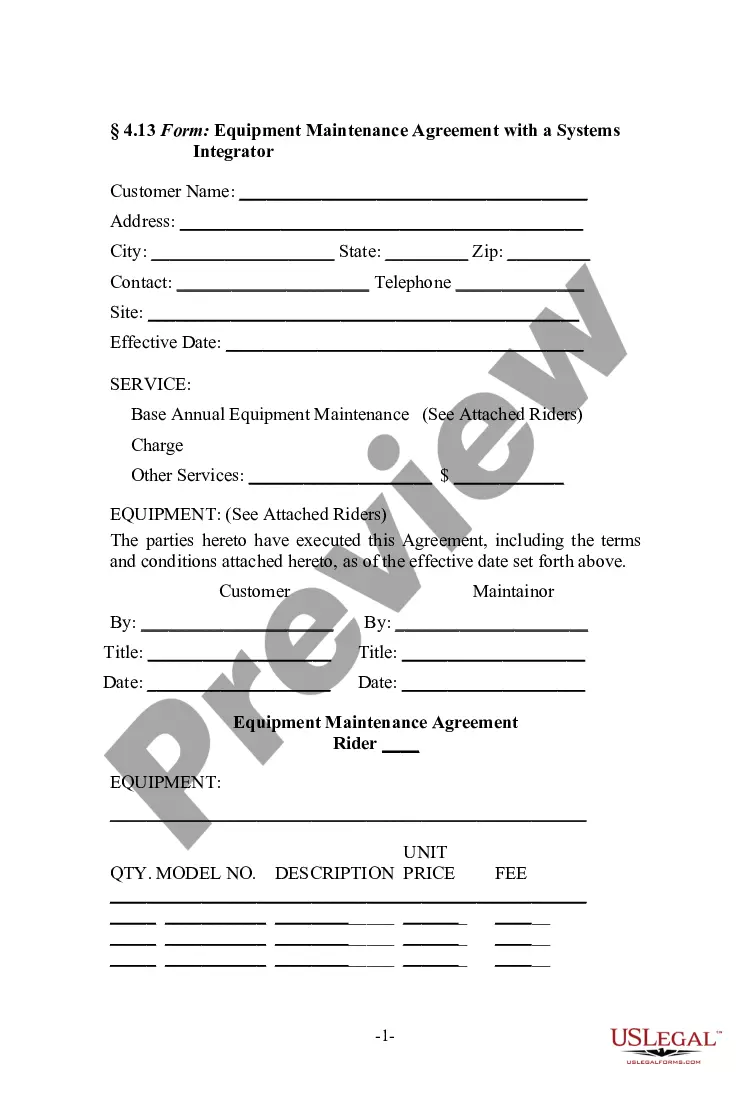

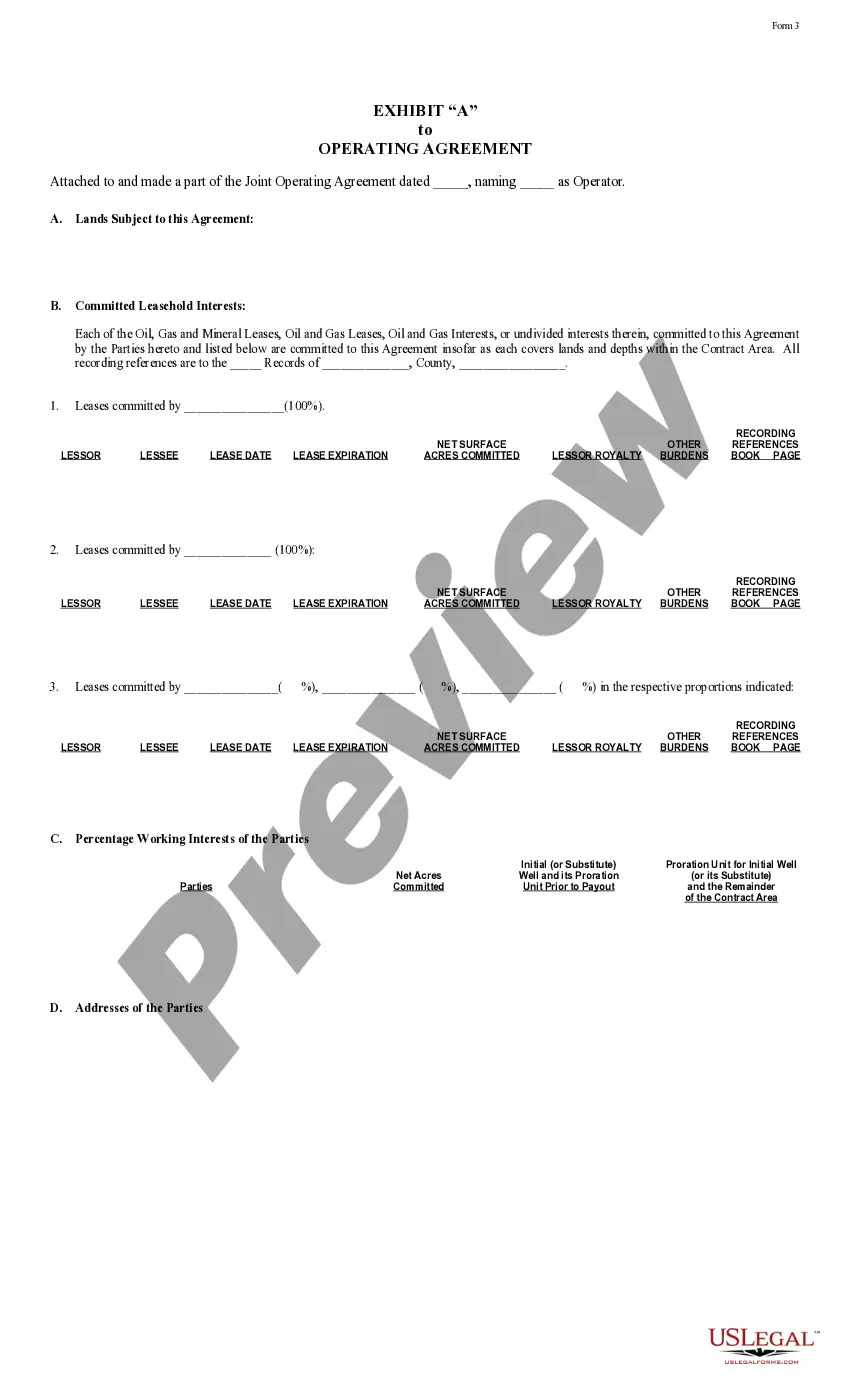

- Ensure you have picked the correct type for your metropolis/region. Click on the Review switch to review the form`s information. Browse the type outline to actually have selected the correct type.

- If the type does not satisfy your specifications, make use of the Research discipline towards the top of the screen to obtain the one which does.

- In case you are satisfied with the shape, validate your selection by clicking on the Acquire now switch. Then, choose the pricing prepare you favor and give your credentials to sign up to have an bank account.

- Procedure the financial transaction. Use your charge card or PayPal bank account to finish the financial transaction.

- Pick the formatting and obtain the shape on your own product.

- Make changes. Complete, edit and produce and indicator the saved Nebraska Wire Transfer Instruction to Receiving Bank.

Every template you included with your money lacks an expiry day and it is yours forever. So, if you wish to obtain or produce yet another duplicate, just proceed to the My Forms section and then click about the type you will need.

Obtain access to the Nebraska Wire Transfer Instruction to Receiving Bank with US Legal Forms, probably the most comprehensive library of lawful record templates. Use a huge number of specialist and express-specific templates that satisfy your company or person needs and specifications.

Form popularity

FAQ

Banks can hold deposited funds for various reasons, but, in most cases, it's to prevent any returned payments from your account. In other words, the bank wants to make sure that the deposit is good before giving you access to the money.

While most banks will process funds within 24 hours, it could be a day or two before they arrive in the recipient's account. Most banks will advise 24 to 72 hours before funds land and are available.

You must have all the information about the wire funds transfer in front of you to properly initiate this request. You also need to ask your bank to contact the fraud department of the receiving bank immediately so they can freeze the funds in the recipient account.

If transfers occur between accounts at the same financial institution, they can take less than 24 hours. Wire transfers via a non-bank money transfer service may happen within minutes. If you're sending money to another country, however, it may take as many as five days for the recipient to receive their funds.

Technical Issues: If the wire transfer was not completed due to technical issues, such as a system error or internet outage, the transfer can be reversed. Recipient Cooperation: In some cases, the recipient may be willing to cooperate with the sender to reverse the wire transfer.