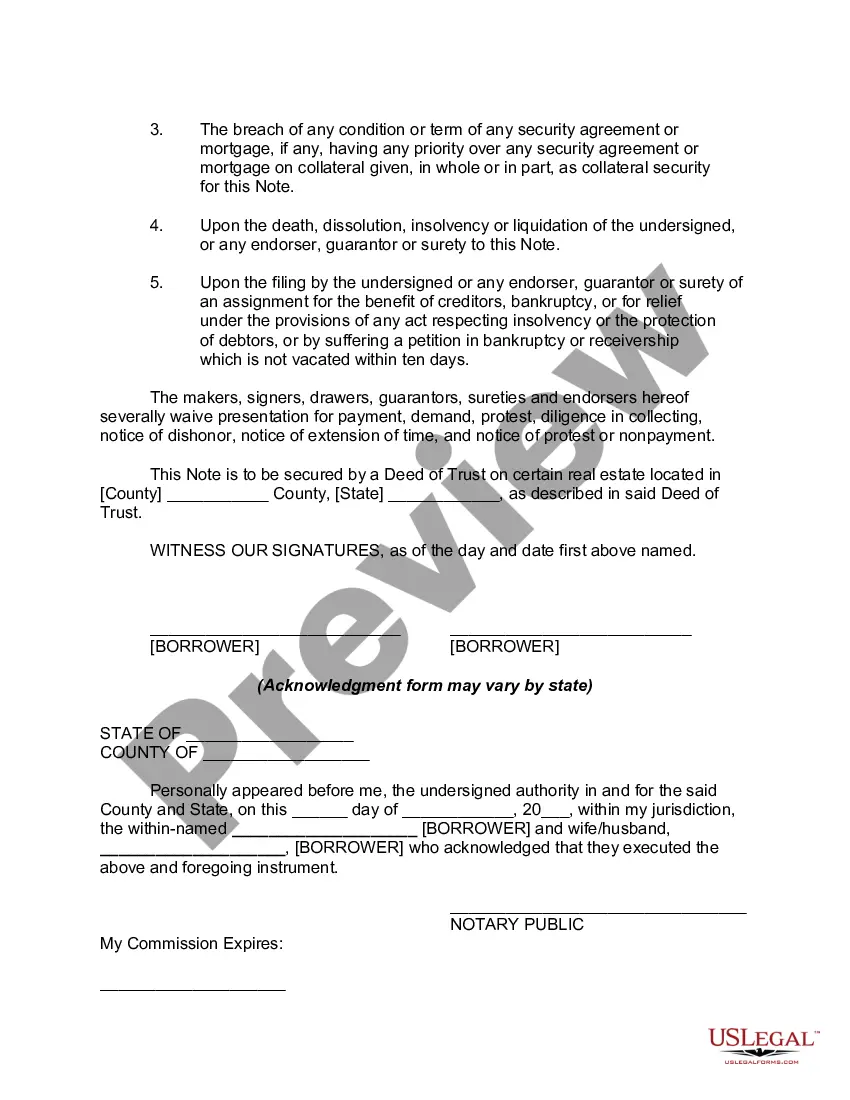

The acknowledgement is the section at the end of a document where a notary public verifies that the signer of the document states he/she actually signed it. Typical language is: "State of ______, County of ______ (signed and sealed) On ____, 20__, before me, a notary public for said state, personally appeared _______, personally known to me, or proved to be said person by proper proof, and acknowledged that he executed the above Deed." Then the notary signs the acknowledgment and puts on his/her seal, which is usually a rubber stamp, although some still use a metal seal. The person acknowledging that he/she signed must be prepared to verify their identity with a driver's license or other accepted form of identification, and must sign the notary's journal. The acknowledgment is required for many official forms and vital for any document which must be recorded by the County Recorder or Recorder of Deeds, including deeds, deeds of trust, mortgages, powers of attorney that may involve real estate, some leases and various other papers.

Acknowledgments may also be drafted to affirm a variety of matters, acting in effect as a written confirmation of an act such as receipt of goods, services, or payment.

A Nebraska Promissory Note — With Acknowledgment refers to a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Nebraska. This type of promissory note includes an acknowledgment section, which is a key element that allows the lender to have proof of the borrower's acknowledgment of their obligations outlined in the note. The Nebraska Promissory Note — With Acknowledgment includes various essential details such as the names and contact information of both parties, the principal amount of the loan, the interest rate, and the repayment terms. By signing this note, the borrower acknowledges their responsibility for repaying the borrowed amount along with any accrued interest, ensuring that both parties are aware of their rights and obligations. Different types of Nebraska Promissory Note — With Acknowledgment may include: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral or security and relies solely on the borrower's creditworthiness. In case of default, the lender may have limited options for recovering the debt. 2. Secured Promissory Note: This note requires the borrower to provide collateral, such as real estate or personal property, which the lender can claim in case of default. This type of note provides more security to the lender. 3. Demand Promissory Note: Also known as a "demand loan," this note allows the lender to request repayment of the outstanding balance at any time they see fit. The borrower must fulfill the payment demand upon receipt. 4. Installment Promissory Note: This note outlines a repayment plan in which the borrower repays the loan amount and interest over a series of regular installments. Each installment includes both principal and interest portions, making it easier for the borrower to manage their payments. 5. Balloon Promissory Note: This note features regular payments of interest and smaller installments towards the principal. However, a larger "balloon" payment is due at the end of the loan term, requiring the borrower to settle the remaining balance. It is important to note that the information provided above is a general overview and should not be considered as legal advice. Consulting with a qualified attorney is recommended to draft a specific Nebraska Promissory Note — With Acknowledgment that meets the unique requirements of both the lender and borrower.