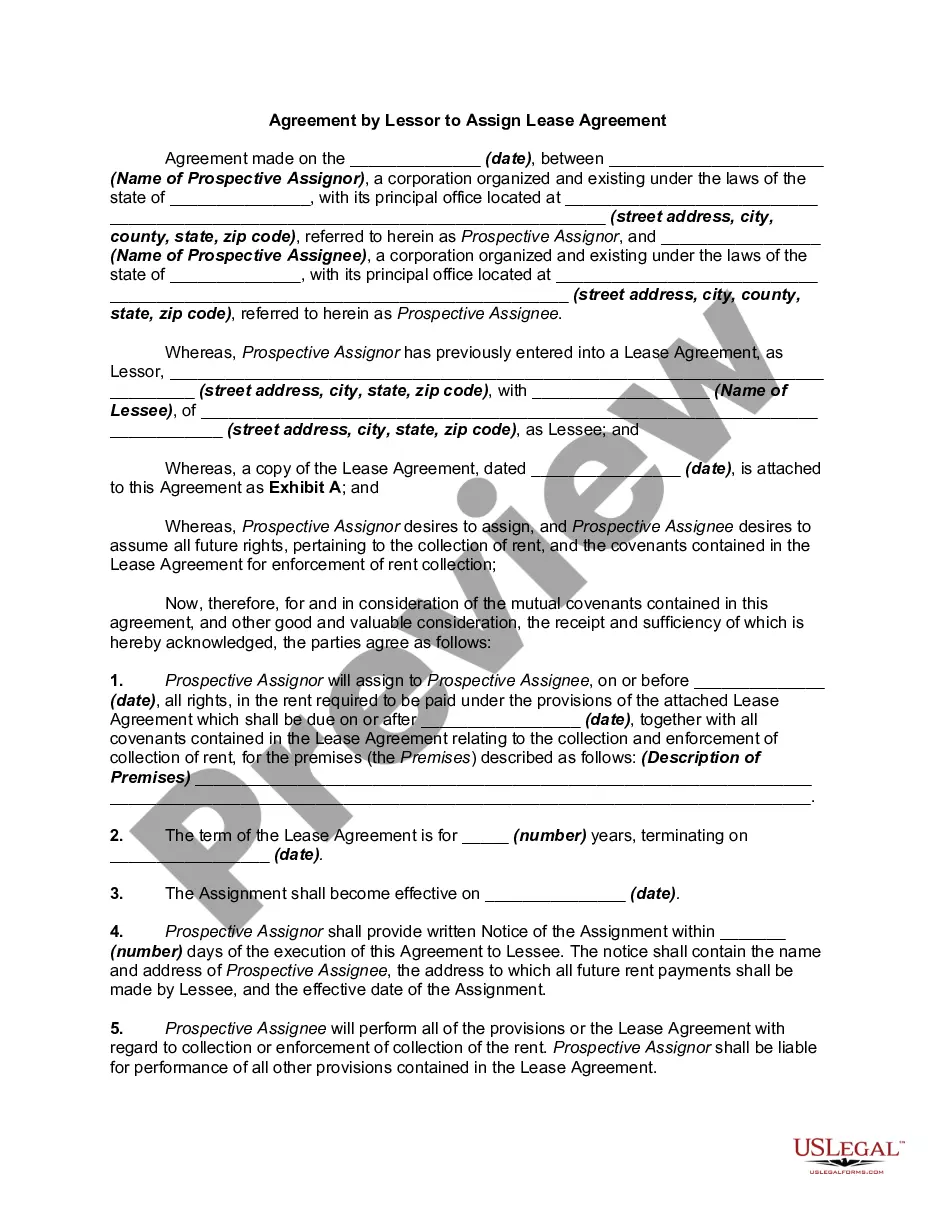

Subject: Request for Tax Exemption — Scheduled Meeting Dear [Nebraska Department of Revenue], I hope this letter finds you well. I am writing to request a scheduled meeting to discuss a tax exemption application for [organization/business name]. As an entity dedicated to [describe the cause, purpose, or objectives of the organization/business], we believe we meet the criteria for tax exemption under Nebraska tax laws. First and foremost, I would like to provide some background information about our organization/business. [Organization/Business name] is a registered [non-profit organization/charitable organization/business entity] operating in the state of Nebraska. Our primary mission is to [describe in detail the mission, goals, or services provided by the organization/business]. By serving the community in this manner, we contribute to the betterment of society and support the overall well-being of Nebraskans. We strongly believe that our activities align with the provisions set forth in Nebraska tax laws, specifically under [mention the relevant section, code, or legislation number]. In order to accurately present our case for tax exemption, we kindly request a meeting with the appropriate tax officer at the Nebraska Department of Revenue. This meeting will provide us with the opportunity to discuss our organization/business in greater detail, present any supporting documents or financial records, and address any questions or concerns that may arise. We understand the importance of being fully compliant with state regulations and are committed to providing any additional information or documentation required to facilitate the review process. We aim to meet and exceed all necessary qualifications in order to secure tax exemption status and ensure the resources we generate are solely directed towards advancing our mission. Please let us know a convenient time and date for the scheduled meeting. We are available at your earliest convenience and are eager to address any inquiries or suggestions you may have. Furthermore, please inform us of any specific documents or information you would like us to bring to the meeting to support our application. We genuinely appreciate your attention to this matter and the opportunity to engage in a productive dialogue regarding our tax exemption status. Your guidance and expertise will be invaluable in helping us navigate through the extensive process. We are eager to collaborate with the Nebraska Department of Revenue and contribute to the development and prosperity of our great state. Thank you for your time and consideration. We look forward to receiving your prompt response and arranging the scheduled meeting as soon as possible. Sincerely, [Your Name] [Title/Position] [Organization/Business Name] [Contact Information] Different types of Nebraska Sample Letter for Tax Exemption — Scheduled Meeting may include letters for: 1. Non-profit organizations seeking tax exemption. 2. Charitable organizations requesting tax exemption. 3. Business entities applying for tax exemption. 4. Religious organizations seeking tax exemption. 5. Educational institutions applying for tax exemption.

Nebraska Sample Letter for Tax Exemption - Scheduled Meeting

Description

How to fill out Nebraska Sample Letter For Tax Exemption - Scheduled Meeting?

If you want to complete, download, or printing authorized papers layouts, use US Legal Forms, the most important assortment of authorized forms, that can be found on the web. Take advantage of the site`s basic and practical search to obtain the paperwork you need. Numerous layouts for enterprise and individual functions are categorized by categories and suggests, or keywords. Use US Legal Forms to obtain the Nebraska Sample Letter for Tax Exemption - Scheduled Meeting with a number of click throughs.

When you are presently a US Legal Forms buyer, log in in your bank account and click on the Acquire option to obtain the Nebraska Sample Letter for Tax Exemption - Scheduled Meeting. Also you can access forms you previously downloaded within the My Forms tab of your own bank account.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the appropriate area/region.

- Step 2. Utilize the Review solution to look over the form`s content. Never overlook to learn the explanation.

- Step 3. When you are unhappy using the type, make use of the Research field on top of the screen to discover other models of your authorized type web template.

- Step 4. After you have found the shape you need, click the Buy now option. Opt for the rates program you like and put your qualifications to sign up on an bank account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the format of your authorized type and download it on your device.

- Step 7. Complete, edit and printing or indication the Nebraska Sample Letter for Tax Exemption - Scheduled Meeting.

Every authorized papers web template you purchase is the one you have forever. You may have acces to every type you downloaded with your acccount. Select the My Forms section and choose a type to printing or download once again.

Remain competitive and download, and printing the Nebraska Sample Letter for Tax Exemption - Scheduled Meeting with US Legal Forms. There are many specialist and status-specific forms you can utilize for the enterprise or individual requires.