A Nebraska Promissory Note is a legal document commonly used in transactions involving the transfer of funds between a College and a Church. It serves as a written promise by the College to repay the borrowed amount to the Church, usually with specified interest, within a predetermined period of time. The purpose of utilizing a Promissory Note in this context is to establish a legally binding agreement that safeguards the interests of both parties involved. It outlines the terms and conditions of the loan, including repayment terms, interest rates, and any additional fees that may be applicable. Nebraska Promissory Notes can come in various forms, depending on the specific nature of the transaction and the parties involved. Here are a few types commonly seen: 1. Unsecured Promissory Note: This type of Promissory Note does not require any collateral as security for the loan. The Church, in this case, relies solely on the College's promise to repay the borrowed amount. 2. Secured Promissory Note: Unlike an unsecured Promissory Note, a secured Promissory Note involves the provision of collateral. It means that if the College fails to fulfill its repayment obligations, the Church has the right to claim the specified collateral, such as assets or property. 3. Installment Promissory Note: This type of Promissory Note allows for the repayment of the loan in equal, periodic installments over a specified period of time. Each installment typically includes both principal and interest, allowing for gradual repayment of the borrowed amount. 4. Demand Promissory Note: A demand Promissory Note grants the Church the right to request repayment of the loan at any time they desire. The College is obligated to repay the amount within a reasonable period specified by the Church once the demand is made. 5. Fixed-Rate Promissory Note: A fixed-rate Promissory Note specifies a fixed interest rate that remains constant throughout the duration of the loan. This provides both parties with a clear understanding of the interest charges and repayment amount. When preparing a Nebraska Promissory Note, it is crucial to include relevant information such as the names and contact details of the College and the Church, the loan amount, interest rate, repayment schedule, and any provisions for late payments or penalties. In conclusion, a Nebraska Promissory Note for a College to Church transaction establishes a legally binding agreement between the parties involved, ensuring the repayment of the borrowed funds. Different types of Promissory Notes exist, including unsecured, secured, installment, demand, and fixed-rate Promissory Notes, each offering distinct features suited to specific circumstances.

Nebraska Promissory Note College to Church

Description

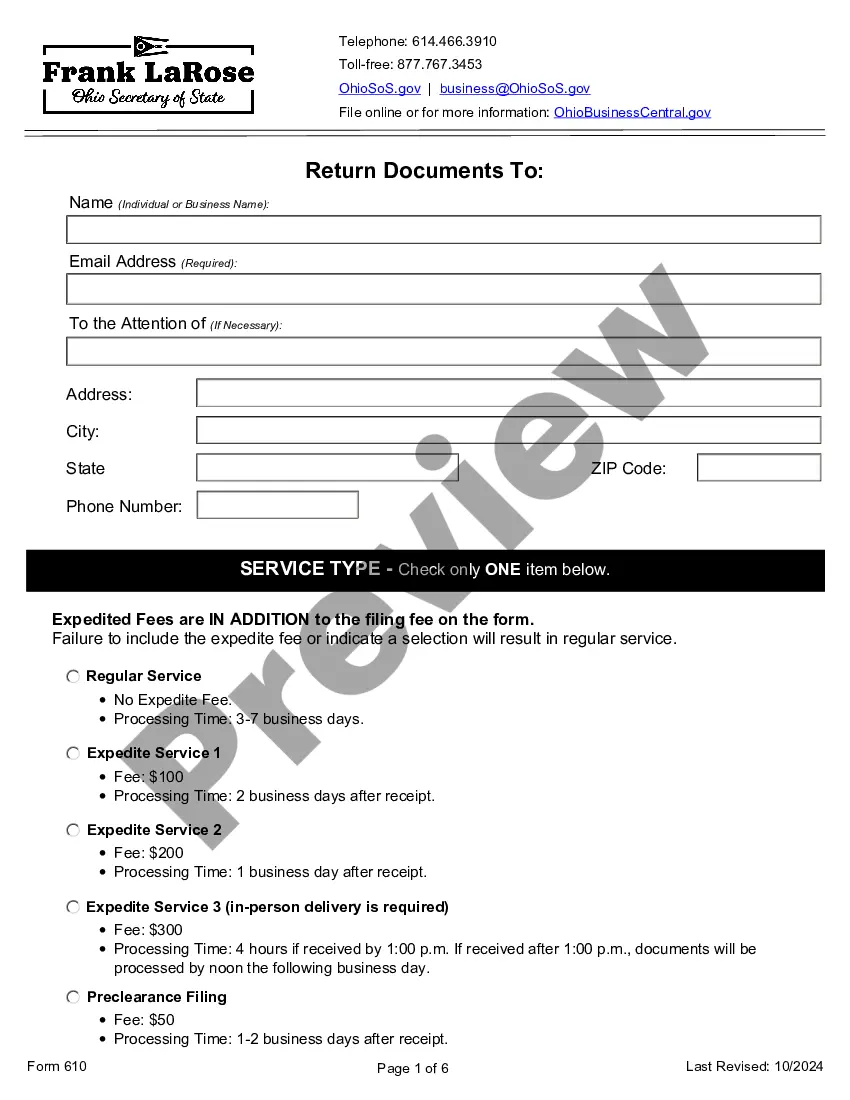

How to fill out Promissory Note College To Church?

You have the capability to devote time online seeking the approved document template that meets the state and federal criteria you require.

US Legal Forms offers a wide array of legal forms that are assessed by professionals.

You can effortlessly download or print the Nebraska Promissory Note College to Church from your service.

In order to find another version of your form, utilize the Search field to locate the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Then, you can fill out, modify, print, or sign the Nebraska Promissory Note College to Church.

- Each legal document template you acquire will remain yours indefinitely.

- To acquire an additional copy of the obtained form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

To get a copy of your promissory note, contact the financial institution or college that provided it. They can either provide you with a duplicate or direct you to where you might find it online. Keep in mind that having a copy is crucial for understanding your repayment obligations. You can also explore USLegalForms for assistance with document retrieval or replacements.

Recovering your promissory note can be straightforward. Start by reaching out to the lender or institution that issued the note; they often keep copies on file. Additionally, if you have changed addresses or schools, ensure they have your updated contact information for smooth communication. For legal document assistance, USLegalForms is a valuable resource to explore.

If you cannot locate your master promissory note, first contact your lender or school financial office. They can help you recover the document or provide a new version. It is essential to keep these documents accessible, as they outline your repayment terms. Using services like USLegalForms can simplify this process as they offer templates and guidance on managing legal documents.

To obtain your Nebraska promissory note, you typically start by contacting the institution that issued the note. They should have a record of your agreement. Furthermore, you can check your email or online account with them, as many institutions provide electronic copies. If you need further assistance, consider using platforms like USLegalForms to find the right resources.

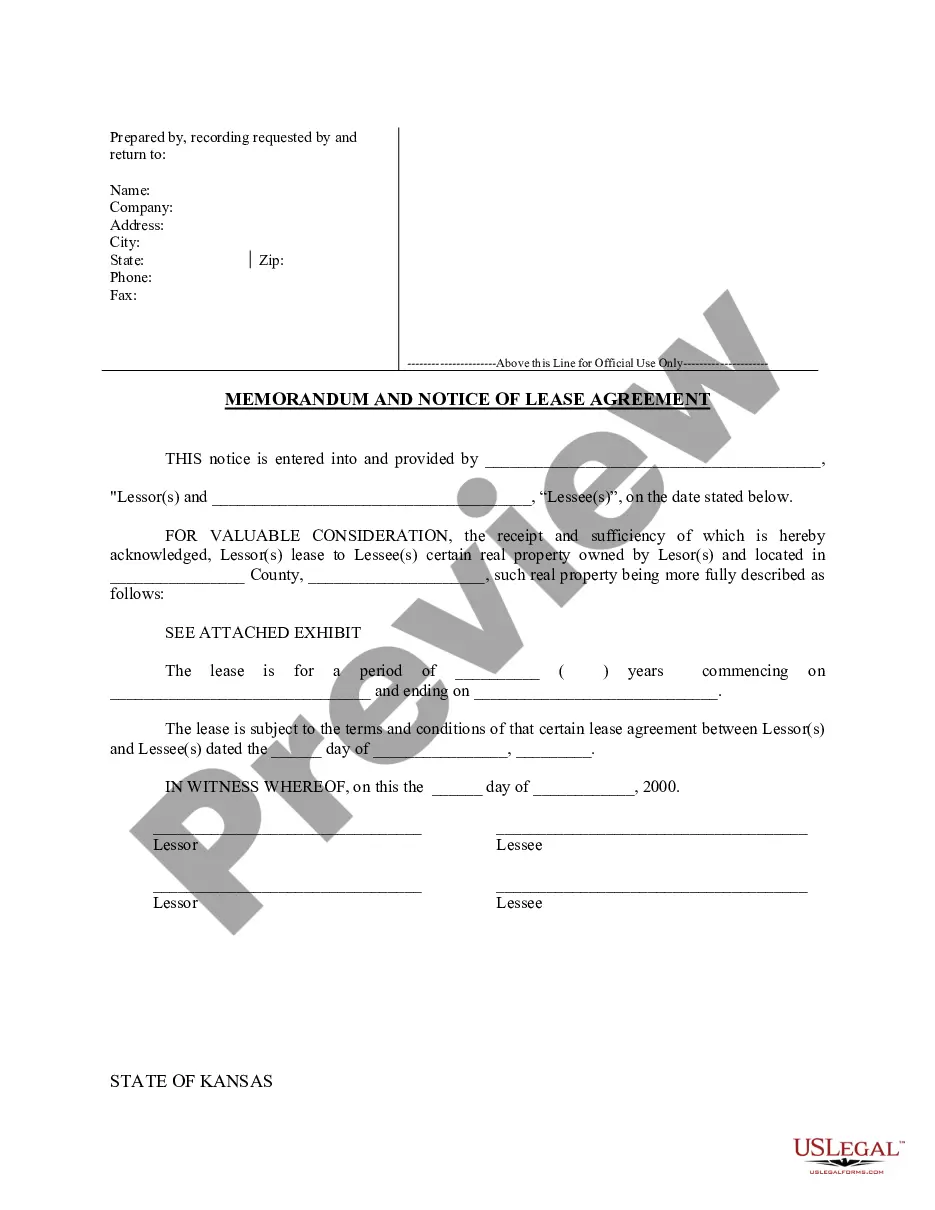

The format of a promissory note typically includes a title, the date, the names of the borrower and lender, the principal amount, interest rate, and repayment terms. You should also include space for signatures and witnesses, if necessary. By using the USLegalForms platform, you can access professional templates for creating your Nebraska Promissory Note College to Church efficiently.

Several issues can render a promissory note invalid, such as insufficient details, lack of signatures, or if both parties were not competent at the time of signing. Other reasons include illegality or if the note does not have a clear repayment structure. To avoid invalidation, ensure your Nebraska Promissory Note College to Church is drafted correctly and follows all necessary guidelines.

A promissory note can be voided for several reasons, including fraud, misrepresentation, or if it was signed under duress. Additionally, if the terms of the Nebraska Promissory Note College to Church violate public policy or involve illegal activities, it may also be considered void. Understanding these factors can help you navigate your agreements.

Promissory notes are generally enforceable in court as long as they adhere to legal standards. If you have a Nebraska Promissory Note College to Church that complies with state laws, it can be used as evidence in a legal dispute. This enforceability helps protect the interests of lenders and borrowers alike.

Yes, a promissory note can stand up in court, provided it meets certain legal requirements. To ensure your Nebraska Promissory Note College to Church is enforceable, it should be in writing, signed by all parties, and contain clear terms regarding payment. Courts typically recognize these documents as valid if they are properly executed.