Nebraska Agreement to Form Partnership in Future to Conduct Business

Description

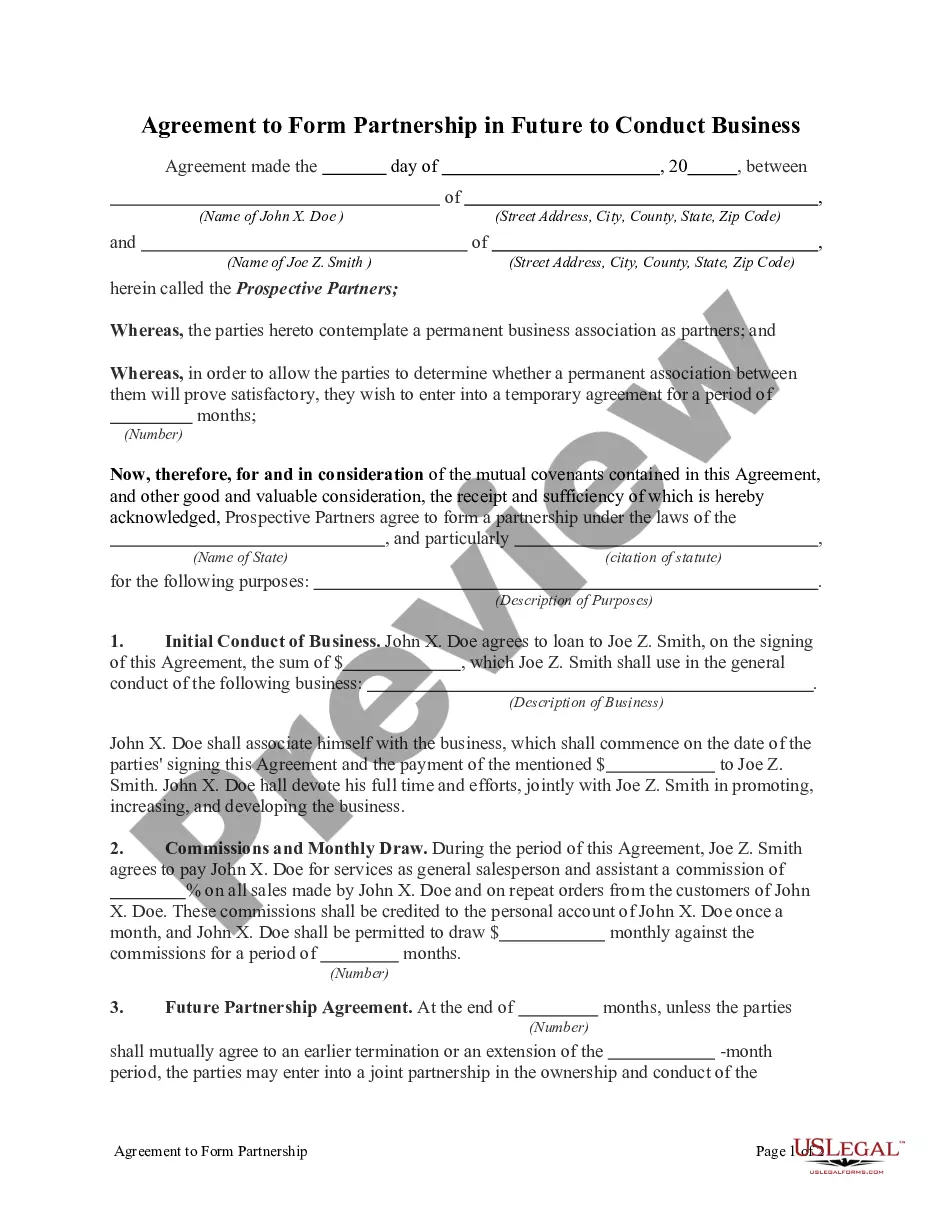

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Selecting the most suitable legal document format can be challenging.

Of course, there are numerous templates accessible online, but how do you find the legal document you require.

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Nebraska Agreement to Establish a Partnership in the Future for Business Activities, which can be used for both professional and personal needs.

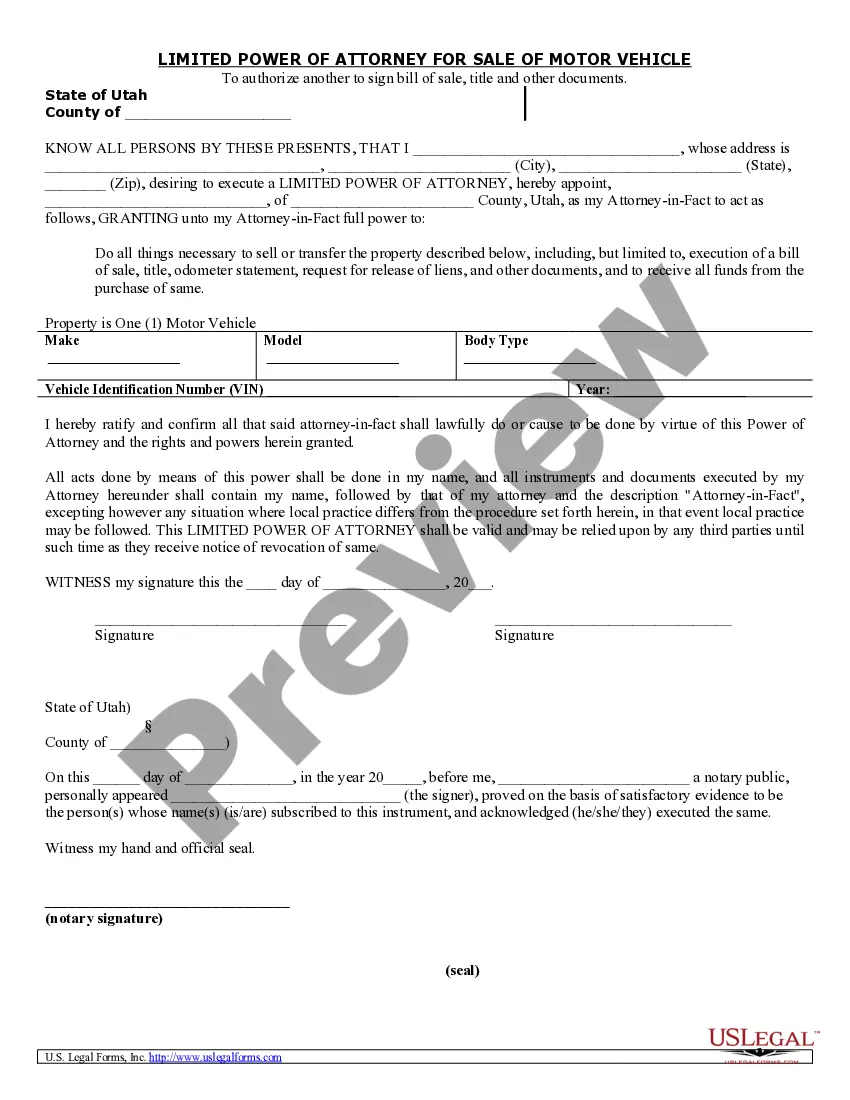

You can review the document using the Preview button and check the document description to verify this is the correct one for you.

- All documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Nebraska Agreement to Establish a Partnership in the Future for Business Activities.

- Use your account to search for the legal documents you have previously purchased.

- Go to the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, make sure you have selected the correct document for your city/state.

Form popularity

FAQ

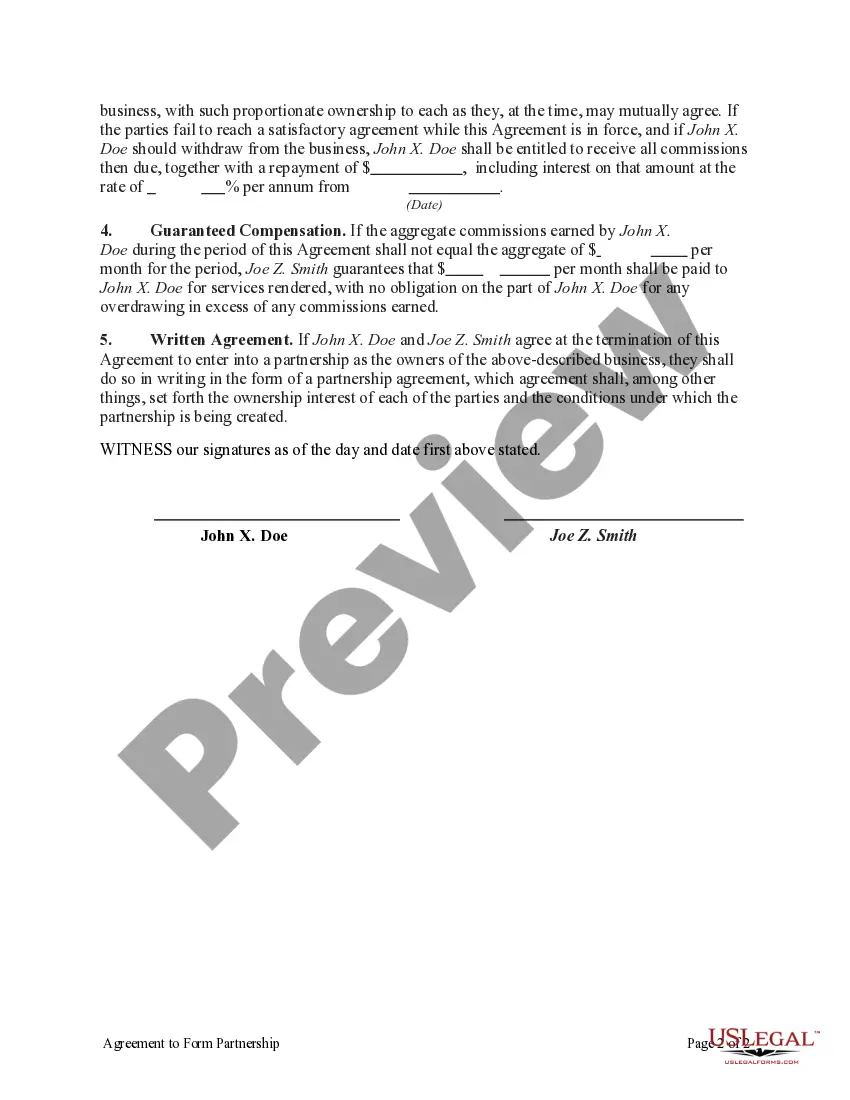

To form a partnership business, begin by creating a clear and comprehensive Nebraska Agreement to Form Partnership in Future to Conduct Business. This should detail each partner's contributions, roles, and profit-sharing. Afterward, make sure to meet any local licensing or regulatory requirements. Lastly, maintain open lines of communication with all partners to ensure a successful business relationship.

Choosing between a sole proprietorship or an LLC often depends on your business goals and risk tolerance. If personal liability is a concern, forming an LLC is typically the better option. A Nebraska Agreement to Form Partnership in Future to Conduct Business can help clarify your intention to work collaboratively if you decide to partner with others.

Tax implications depend on various factors, but generally, a sole proprietorship may result in lower initial taxes since it avoids some of the ongoing costs associated with an LLC. However, liabilities can impact financial situations differently. It's essential to consult a tax professional to analyze your specific situation, as the type of business structure can influence your taxes considerably.

A sole proprietorship is owned and operated by one individual without formal registration, while an LLC, or limited liability company, provides personal liability protection to its owners. Both structures can operationally use a Nebraska Agreement to Form Partnership in Future to Conduct Business. With an LLC, your personal assets are generally shielded from business debts, unlike in a sole proprietorship.

In Nebraska, you typically do not need to file a specific form to establish a general partnership, but it's wise to create a Nebraska Agreement to Form Partnership in Future to Conduct Business. If you are forming a limited partnership, you need to file a Certificate of Limited Partnership with the Secretary of State. Always check the local requirements, as different counties may have unique regulations.

To form a partnership in Nebraska, you should start by drafting a Nebraska Agreement to Form Partnership in Future to Conduct Business. This agreement outlines the roles and responsibilities of each partner. Next, you may want to file the necessary paperwork with the state, although Nebraska does not require formal registration for general partnerships. Finally, consider obtaining any licenses or permits needed for your specific business.

To form a partnership, you need at least two partners, a clear partnership agreement, and an understanding of the business objectives. You should also consider any licensing requirements depending on your business type and location. To make this process simpler, a Nebraska Agreement to Form Partnership in Future to Conduct Business can guide you through the necessary steps and provide the framework needed for a successful partnership.

To fill out a partnership form, start by entering the legal names of all partners, the business address, and the nature of the business. Be sure to indicate how the partnership will be managed and how profits will be distributed. A Nebraska Agreement to Form Partnership in Future to Conduct Business can provide a comprehensive outline to follow, ensuring you cover all essential details.

Filling out a partnership agreement involves detailing the names of the partners, the purpose of the partnership, and how profits will be shared. Also, specify decision-making processes and how disputes will be handled. A well-structured Nebraska Agreement to Form Partnership in Future to Conduct Business will help clarify these aspects, making operations smoother for your partnership.

To file for a partnership in Nebraska, you typically need to choose a suitable business name, gather personal information of the partners, and draft a partnership agreement. Additionally, registering your partnership with the Nebraska Secretary of State may be required. Utilizing a Nebraska Agreement to Form Partnership in Future to Conduct Business can streamline this process and ensure compliance with state regulations.