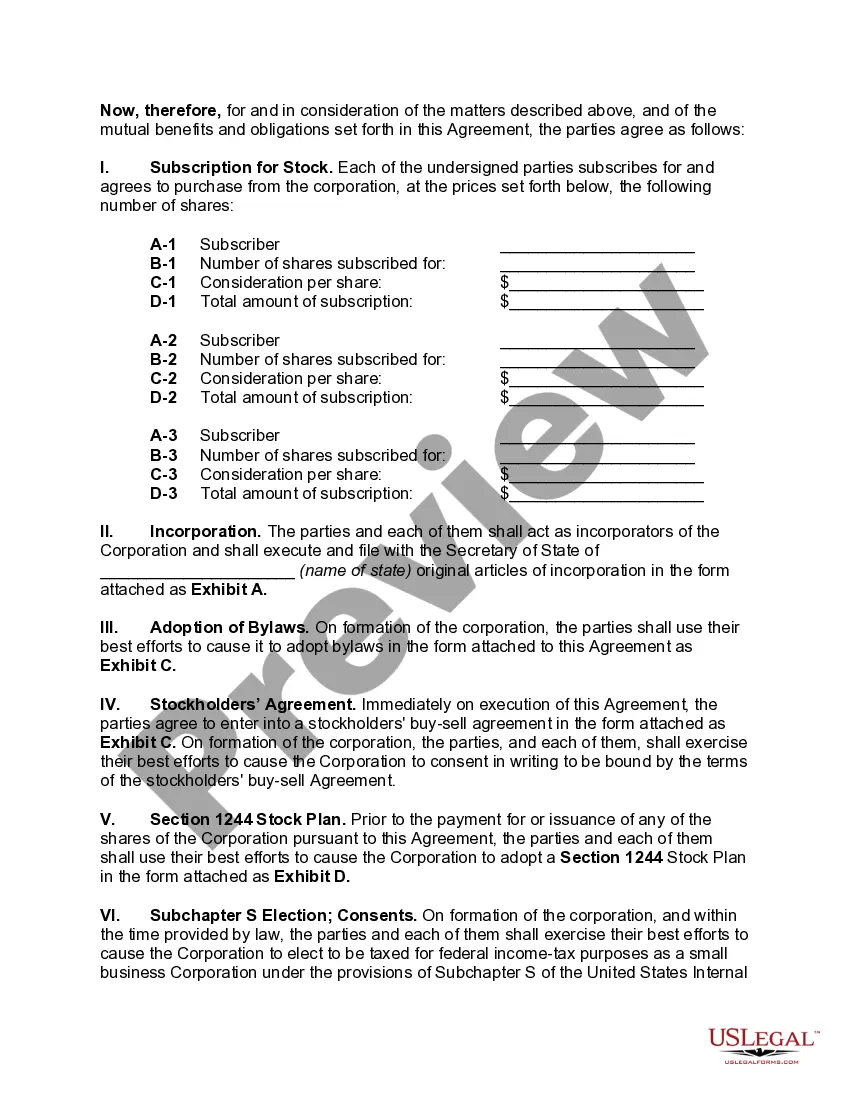

Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock The Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is a legal document outlining the process of incorporating as a Small Business Corporation (S Corp) in the state of Nebraska while also qualifying for Section 1244 Stock treatment. This agreement involves specific requirements and considerations unique to Nebraska's business laws and tax regulations. By incorporating as an S Corp in Nebraska, small businesses can take advantage of several benefits, such as limited liability protection for shareholders, pass-through taxation, and potential tax savings. Additionally, qualifying for Section 1244 Stock treatment offers certain tax advantages for qualifying small businesses. There are different types of Nebraska Agreements to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, including: 1. General Nebraska Agreement to Incorporate as an S Corp with Qualification for Section 1244 Stock: This type of agreement is suitable for small businesses in Nebraska looking to incorporate as an S Corp and qualify for Section 1244 Stock treatment. It outlines the specific requirements, provisions, and obligations necessary for compliance with Nebraska state laws and Section 1244 of the Internal Revenue Code. 2. Nebraska Agreement to Incorporate as a Small Business Corporation with Qualification for Section 1244 Stock: This agreement caters to small businesses in Nebraska that are specifically seeking to incorporate as a Small Business Corporation while also qualifying for Section 1244 Stock treatment. It takes into account the unique rules and regulations applicable to Nebraska and Section 1244, thereby ensuring proper compliance. 3. Nebraska Agreement to Incorporate as an S Corp and as a Small Business Corporation: This comprehensive agreement covers all aspects of incorporating as both an S Corp and a Small Business Corporation in the state of Nebraska. It encompasses the necessary requirements and qualifications for both statuses, ensuring the business can enjoy the benefits associated with both classifications. Whether a small business entity aims to incorporate as an S Corp, a Small Business Corporation, or both, it is crucial to consult with a legal professional well-versed in Nebraska business law and tax regulations. Navigating the incorporation process with the proper knowledge and guidance will allow businesses to establish a solid legal foundation while maximizing potential tax advantages through Section 1244 Stock qualification. In summary, the Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is a vital legal document for small businesses in Nebraska seeking to establish themselves as S Corps and qualify for Section 1244 Stock benefits. By choosing the appropriate type of agreement based on their specific requirements, businesses can ensure compliance with Nebraska's laws and regulations while positioning themselves for success.

Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Nebraska Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

US Legal Forms - one of the most significant libraries of authorized forms in the United States - offers an array of authorized file templates it is possible to obtain or printing. Utilizing the web site, you can find a large number of forms for company and person reasons, categorized by classes, says, or keywords and phrases.You will find the latest models of forms like the Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock in seconds.

If you have a subscription, log in and obtain Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock from your US Legal Forms library. The Down load key will show up on every single type you look at. You get access to all previously downloaded forms within the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed here are simple recommendations to help you started out:

- Be sure to have selected the right type for the town/state. Click on the Preview key to check the form`s information. Look at the type information to actually have chosen the correct type.

- When the type does not match your needs, utilize the Search industry towards the top of the monitor to obtain the one who does.

- If you are pleased with the shape, affirm your choice by simply clicking the Get now key. Then, opt for the rates strategy you prefer and provide your qualifications to register for an accounts.

- Method the transaction. Use your Visa or Mastercard or PayPal accounts to complete the transaction.

- Pick the format and obtain the shape on your own product.

- Make changes. Load, edit and printing and signal the downloaded Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock.

Each and every template you added to your bank account does not have an expiration day which is yours eternally. So, if you would like obtain or printing another version, just proceed to the My Forms portion and click on around the type you require.

Obtain access to the Nebraska Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock with US Legal Forms, one of the most considerable library of authorized file templates. Use a large number of expert and state-particular templates that fulfill your company or person requires and needs.

Form popularity

FAQ

HW: How are gains from the sale of § 1244 stock treated? losses? The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

In order to qualify as §1244 stock, the stock must be issued, and the consideration paid by the shareholder must consist of money or other property, not services. Stock and other securities are not "other property" for this purpose. However, cancellation of indebtedness may be sufficiently valid consideration.

Form 4797, Sales of Business Property, is used to report an ordinary loss on the sale of Section 1244 stock or a loss resulting from the stock becoming worthless. Attach Form 4797 to Form 1040.

Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test. Common stock does not include securities convertible into common stock, nor common stock convertible into other securities.

Section 1244 of the Internal Revenue Code is the small business stock provision enacted to allow shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than as a capital loss, which is limited to only $3,000 annually.

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.