Nebraska Collection Report

Instant download

Description

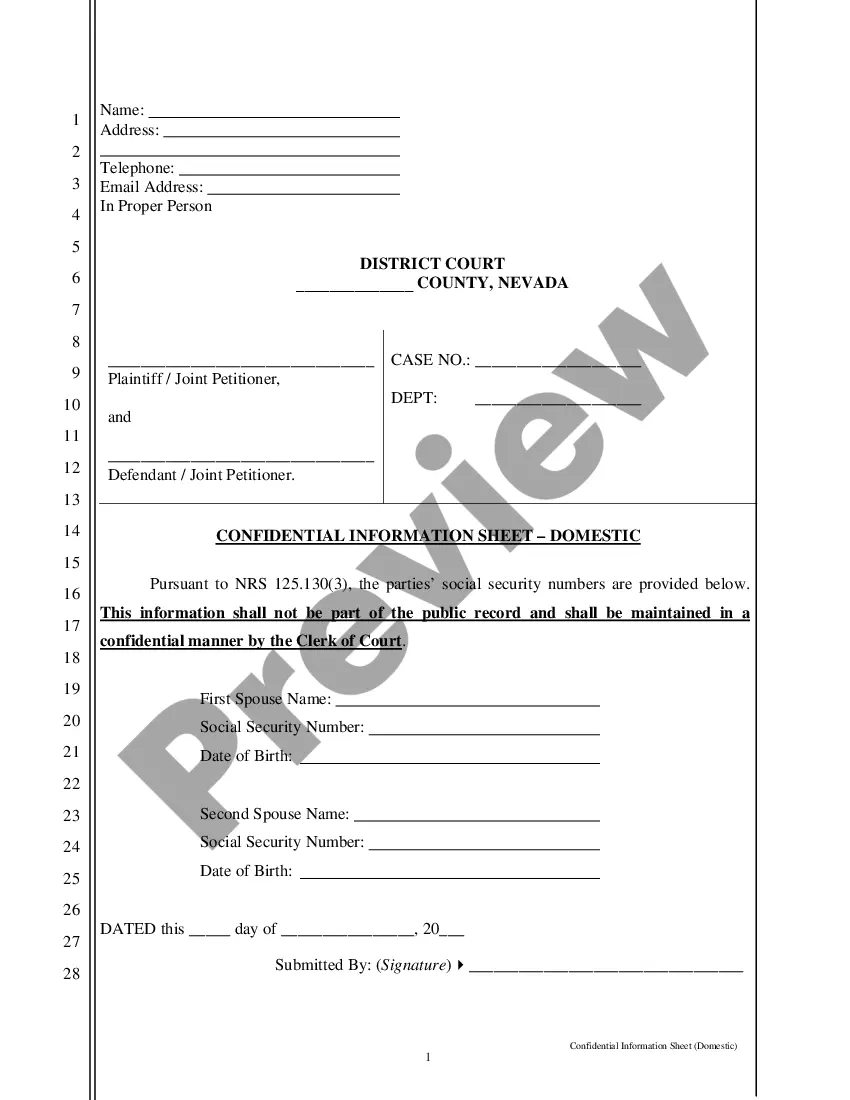

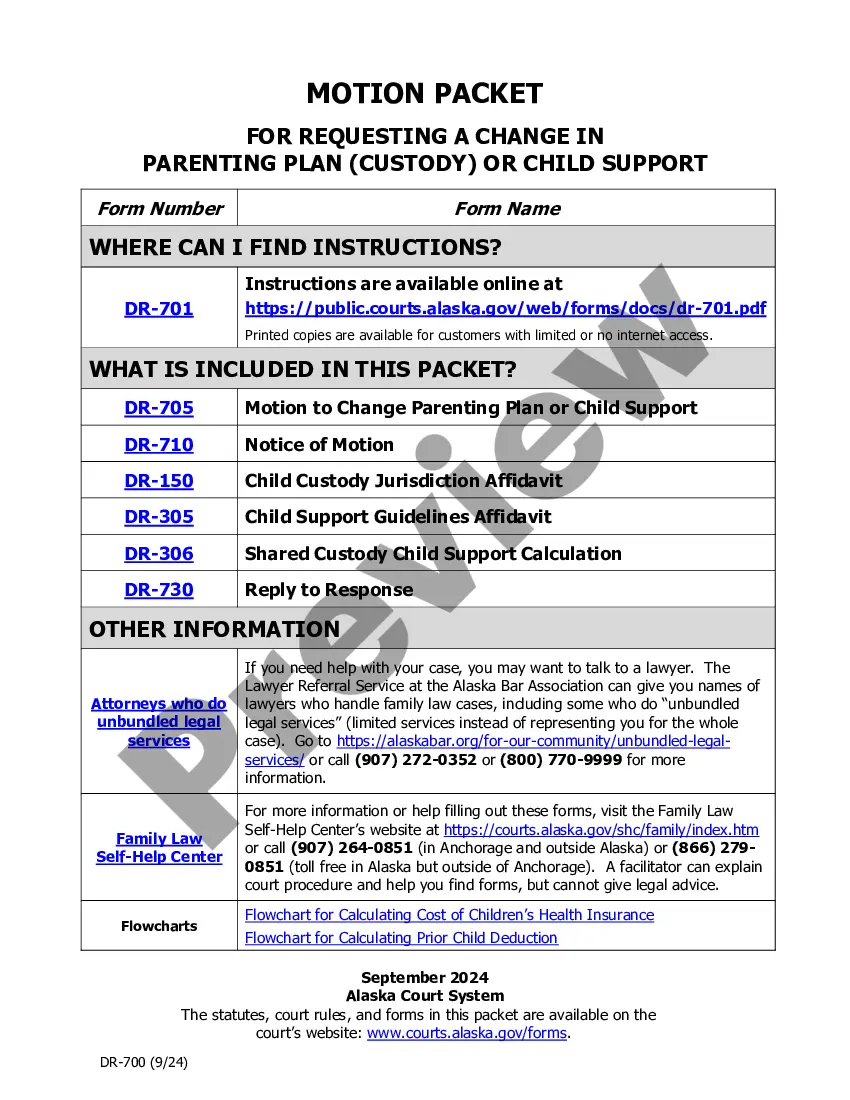

This form gives the status of an unpaid account along with recommended action.

How to fill out Collection Report?

You can dedicate hours online searching for the legal document template that fulfills the state and federal regulations you seek.

US Legal Forms provides a vast array of legal forms that are vetted by experts.

You can access or create the Nebraska Collection Report through our service.

If available, utilize the Review option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you may complete, edit, print, or sign the Nebraska Collection Report.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents section and click the appropriate selection.

- If you are using the US Legal Forms website for the first time, follow these straightforward steps.

- Firstly, ensure that you have selected the correct document template for your chosen county/region.

- Check the form description to guarantee you have chosen the right document.