A shareholder has the right to authorize another to vote the shares owned by the shareholder. This is known as voting by proxy.

Nebraska Members General Proxy For Meetings of the Members of a Nonprofit Corporation

Description

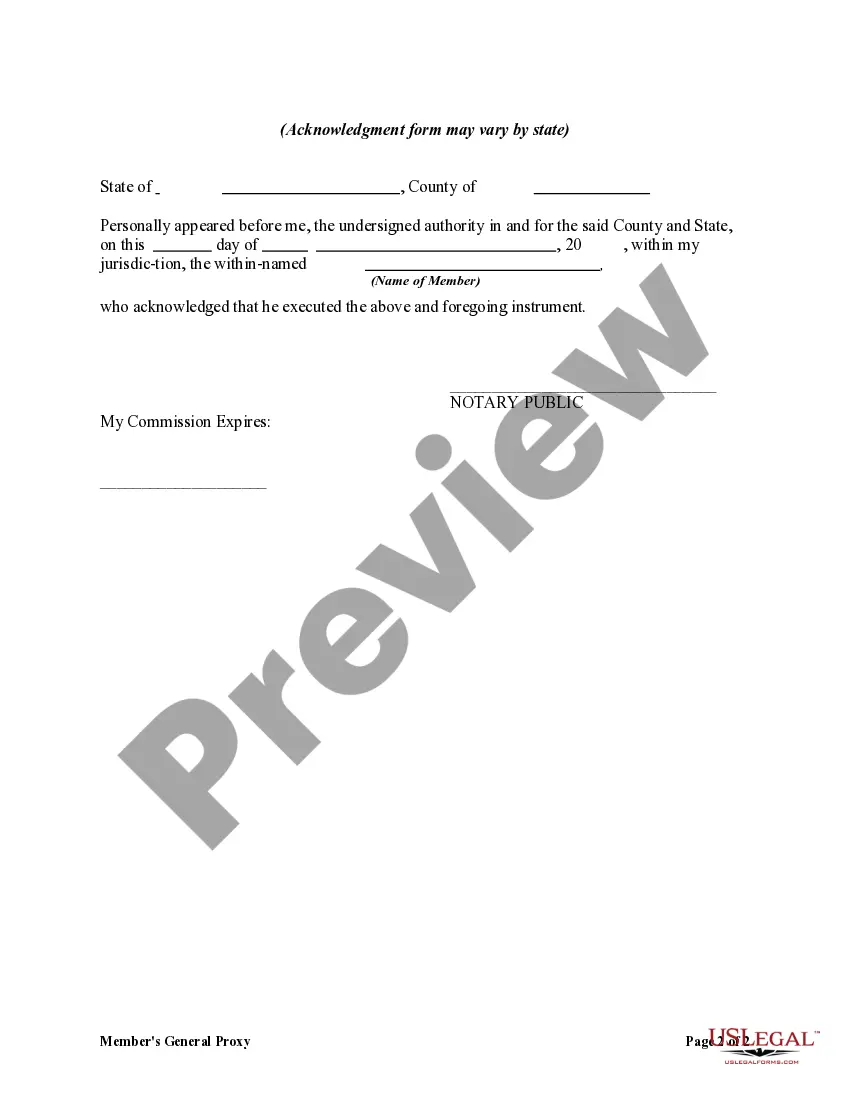

How to fill out Members General Proxy For Meetings Of The Members Of A Nonprofit Corporation?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal record templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest editions of forms such as the Nebraska Members General Proxy For Meetings of the Members of a Nonprofit Corporation within minutes.

If you are already a subscriber, Log In to retrieve the Nebraska Members General Proxy For Meetings of the Members of a Nonprofit Corporation from your US Legal Forms library. The Download button will appear on every form you encounter. You will have access to all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your system.

Make modifications. Fill, edit, print, and sign the downloaded Nebraska Members General Proxy For Meetings of the Members of a Nonprofit Corporation.

Every template you saved to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Nebraska Members General Proxy For Meetings of the Members of a Nonprofit Corporation through US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a plethora of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Make sure you have selected the correct form for your region/locale. Use the Preview button to review the contents of the form.

- Check the form details to confirm that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find one that does.

- If you are happy with the form, confirm your selection by clicking on the Purchase now button.

- Then, select the payment plan you prefer and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

Choose who will be the initial directors for your nonprofit. In Nebraska, your nonprofit corporation must have three or more directors.

Can my board of directors contain family members? Yes, but be aware that the IRS encourages specific governance practices for 501(c)(3) board composition. In general, having related board members is not expressly prohibited.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

A sole member structure is really appealing when an individual or corporation creates a new nonprofit and wants to retain long term control over the nonprofit's mission and activities. By making themselves the sole member, the founder can give themselves the power to appoint or remove board members.

Can the same person be the President, Secretary and Treasurer of a corporation? Yes. A single individual may simultaneously serve as President, Secretary and Treasurer. This is common in small corporations.

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

Can a founder be on the board of directors? We run into this thought process if a founder is generally overly cautious or has a fear of there being a conflict of interest. However, founder is not actually a designated role recognized by the IRS or any state. So, yes, a founder can be on the board.

Yes and no. In most states it is legal for executive directors, chief executive officers, or other paid staff to serve on their organizations' governing boards. But it is not considered a good practice, because it is a natural conflict of interest for executives to serve equally on the entity that supervises them.

According to a study by Bain Capital Private Equity, the optimal number of directors for boards to make a decision is seven. Every added board member after that decreases decision-making by 10%. Nonprofits can use that as a starting metric before considering the organization's life cycle, mission and fundraising needs.