In most states, the process for forming a nonprofit corporation is different from the process for forming a for-profit corporation. A nonprofit corporation must file additional documentation with state and federal authorities to be recognized and obtain the advantages of nonprofit status. You can complete and file the paperwork yourself, or use an online document preparation website. Recognition as a nonprofit corporation confers three main advantages: tax breaks for the corporation, tax breaks for donors, and the legal right to solicit donations. In most states, nonprofit corporations are governed by the Model Nonprofit Corporation Act.

Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association

Description

How to fill out Resolution To Incorporate ASCAP Nonprofit Corporation By Members Of Unincorporated Association?

Have you found yourself in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't straightforward.

US Legal Forms provides an extensive collection of form templates, including the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, which can be downloaded to meet federal and state requirements.

Once you find the right form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- You will then be able to download the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is suitable for your specific city/region.

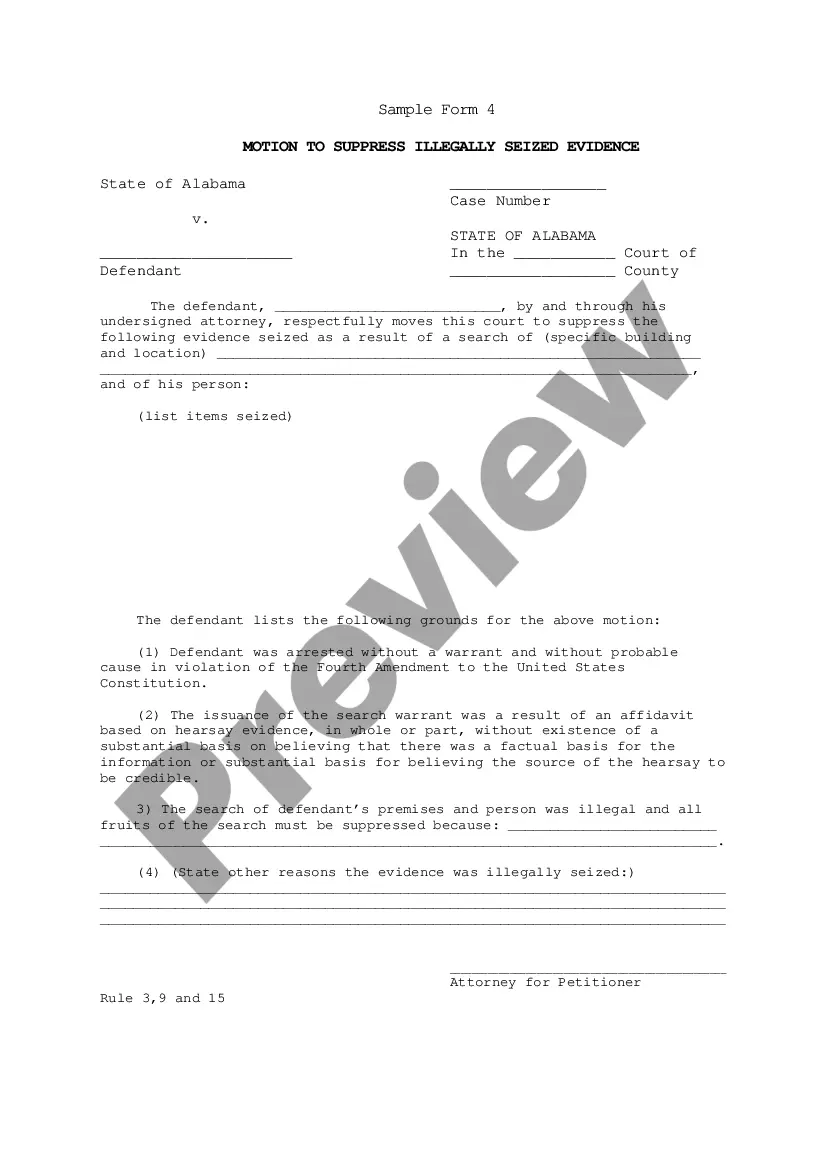

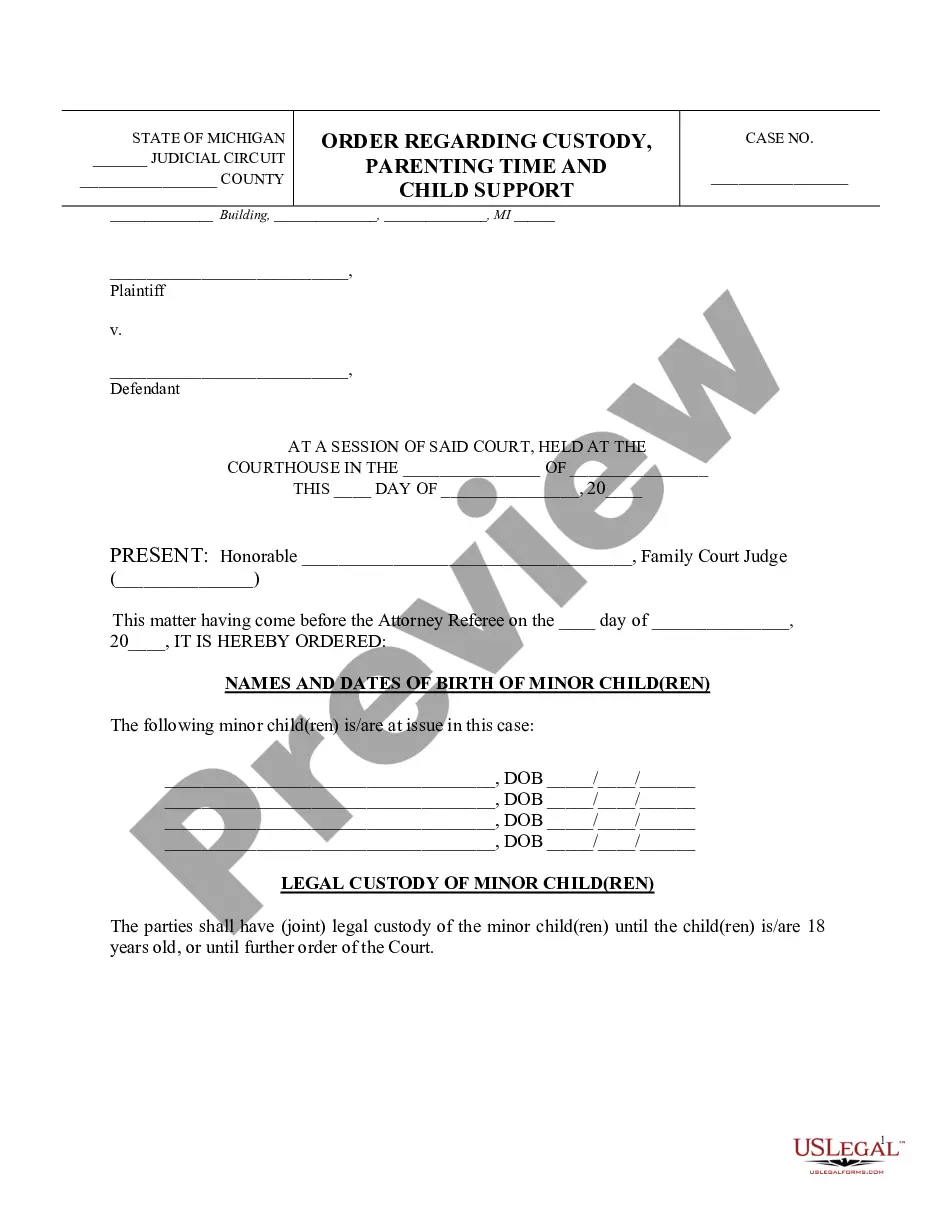

- Use the Preview button to review the form.

- Check the description to ensure you've selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find the form that meets your requirements.

Form popularity

FAQ

Nonprofit organization governing documents, including those for the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, outline the rules and regulations that guide the organization. These documents typically include the articles of incorporation, bylaws, and membership agreements. They establish how the organization operates, how decisions are made, and how members can participate. Having clear governing documents is vital to ensure transparency and compliance with legal standards.

To start a nonprofit organization in Nebraska, you should start with a clear mission statement and gather a group of founders. Then, draft your articles of incorporation and bylaws, ensuring they comply with state regulations. Finally, file these documents with the Nebraska Secretary of State and consider using uslegalforms for streamlined assistance in aligning with the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association.

To file for a nonprofit organization in Nebraska, begin by preparing your articles of incorporation and bylaws. After that, you need to submit these documents to the Nebraska Secretary of State, along with any application fees. Utilizing resources like uslegalforms can assist you in ensuring that your submission accurately reflects the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association.

Bylaws for a nonprofit board of directors outline how your organization operates and details meetings, member roles, and voting requirements. They should clarify the responsibilities of the board and how decisions are made. Establishing these bylaws is crucial for your Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, as they create a clear governance structure.

A nonprofit does not necessarily have to be incorporated, but incorporation provides significant advantages. By incorporating under the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, organizations can gain legal recognition, limited liability, and eligibility for grants. Incorporation enhances credibility and allows the nonprofit to operate more effectively in its mission.

A nonprofit organization is a group formed to provide benefits mainly to its members rather than to generate profit. When you consider the Nebraska Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, you see how such organizations prioritize member needs and services. These nonprofits often help in areas like education, health, and community support, ensuring that their members receive valuable resources and assistance.