Nebraska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

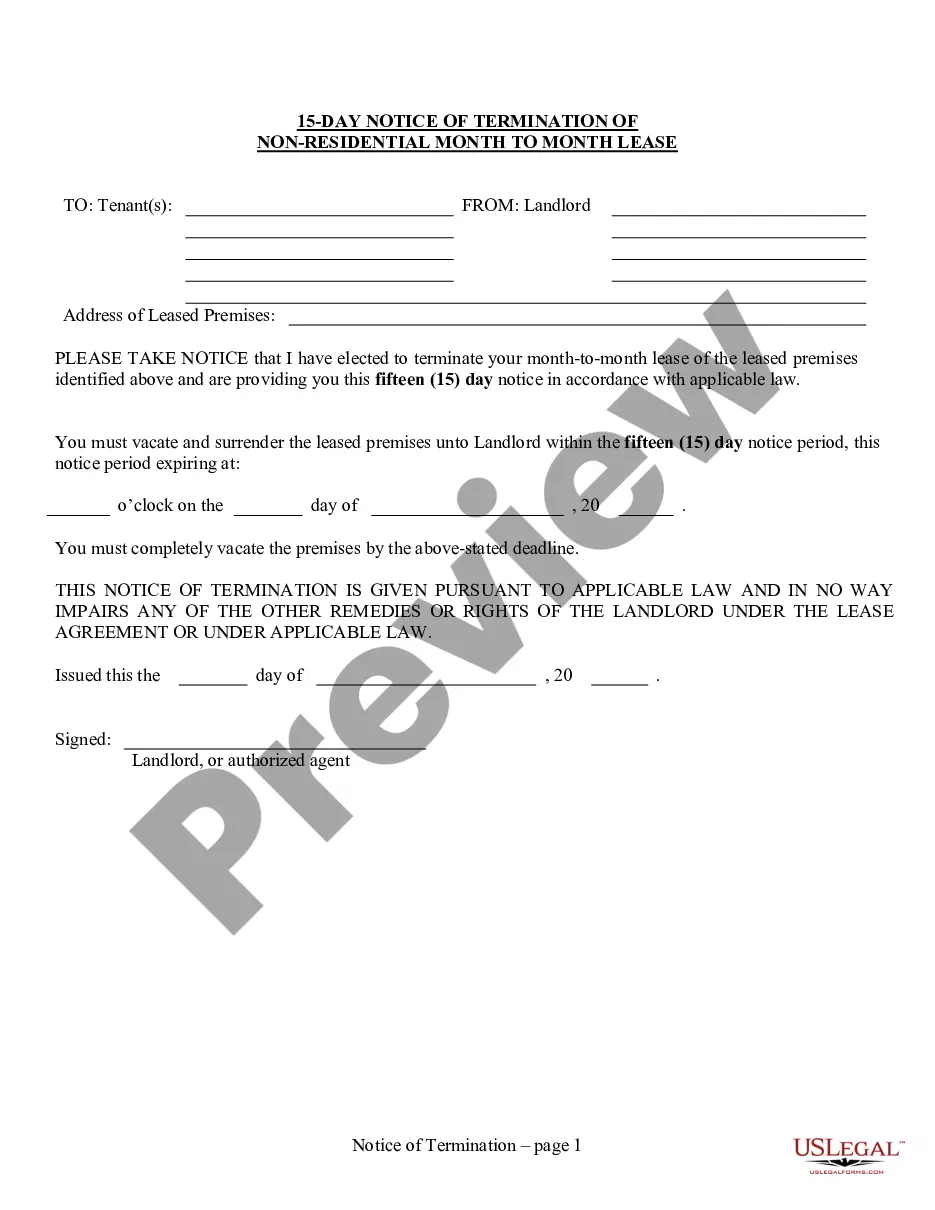

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

If you desire to complete, acquire, or create legal document templates, utilize US Legal Forms, the most significant compilation of legal forms, which can be accessed online.

Leverage the site`s user-friendly and straightforward search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Nebraska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Clauses in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Nebraska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Clauses.

- You can also access forms you previously submitted electronically in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to view the document`s content. Don’t forget to review the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other variations in the legal form template.

Form popularity

FAQ

compete clause in a shareholders agreement restricts a shareholder from competing against the corporation for a specified period and within a defined area. This clause is crucial for protecting the company’s interests and maintaining its market position. When drafting a Nebraska Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, including such clauses can help safeguard trade secrets and business strategies. This approach creates a more secure environment for all shareholders.

The term MOI is an abbreviation for Memorandum of Incorporation. It is a document that sets out the rights, duties and responsibilities of shareholders, directors and other persons involved in a company.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

A share purchase agreement is a legal contract between two parties: a seller and a buyer. They may be referred to as the vendor and purchaser in the contract. The contract is proof that the sale and the terms of it were mutually agreed upon.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.

A 'share sale' typically involves the sale of the shares of a company. The legal contracting parties to the share sale agreement will be the actual shareholder of the company (ie, as the seller) who is disposing of his shares in the company, and the buyer who will become the new shareholder of the target company.

An agreement to sell is a crucial precursor to the sale deed. This document, which has legal sanctity, states the seller's intention to sell the property and the buyer's intention to purchase the same in the future.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.