Nebraska Assignment of LLC Company Interest to Living Trust refers to the legal process by which an individual or entity assigns their ownership interest in a limited liability company (LLC) to their living trust. This assignment allows for the seamless transfer of ownership and management rights of the LLC to the trust. A living trust is a legal arrangement that allows an individual (granter) to hold and manage their assets during their lifetime and designate beneficiaries to receive those assets upon their death. By assigning LLC company interest to a living trust, the granter ensures that the ownership interest is protected and can be managed according to their wishes. In Nebraska, there are different types of Assignment of LLC Company Interest to Living Trust, depending on the specific requirements and circumstances of the granter. Some common types include: 1. Irrevocable Assignment: This type of assignment cannot be altered or revoked once the transfer is made. It ensures a permanent and binding transfer of LLC company interest to the living trust. 2. Revocable Assignment: Unlike the irrevocable assignment, a revocable assignment can be modified or revoked by the granter during their lifetime. This allows flexibility in managing the ownership interest and beneficiaries of the living trust. 3. Partial Assignment: In some cases, the granter may choose to assign only a portion of their LLC company interest to the living trust. This type of assignment enables the granter to retain some ownership while still benefiting from the protections and management options offered by the living trust. The process of Nebraska Assignment of LLC Company Interest to Living Trust typically involves drafting a legal document known as an Assignment of Company Interest Agreement. This agreement outlines the intent to assign the LLC company interest, identifies the living trust as the assignee, and includes all essential details such as the effective date, percentage of interest assigned, and any special provisions. Once the document is prepared, it should be signed and notarized by the granter and any necessary witnesses. It is recommended to consult with an attorney specializing in estate planning or business law to ensure compliance with Nebraska state laws and to receive personalized advice regarding the assignment process. Overall, the Nebraska Assignment of LLC Company Interest to Living Trust provides a structured and legally recognized method for transferring ownership interest in an LLC to a living trust. This arrangement offers numerous benefits, including asset protection, efficient management of LLC company interest, and seamless transfer of ownership upon the granter's death.

Nebraska Assignment of LLC Company Interest to Living Trust

Description

How to fill out Nebraska Assignment Of LLC Company Interest To Living Trust?

If you wish to comprehensive, down load, or print out lawful record web templates, use US Legal Forms, the largest variety of lawful kinds, which can be found online. Take advantage of the site`s easy and hassle-free lookup to obtain the papers you need. Various web templates for organization and individual functions are sorted by groups and says, or key phrases. Use US Legal Forms to obtain the Nebraska Assignment of LLC Company Interest to Living Trust within a number of clicks.

If you are already a US Legal Forms consumer, log in in your account and then click the Obtain button to find the Nebraska Assignment of LLC Company Interest to Living Trust. Also you can access kinds you earlier downloaded in the My Forms tab of your own account.

Should you use US Legal Forms the very first time, refer to the instructions below:

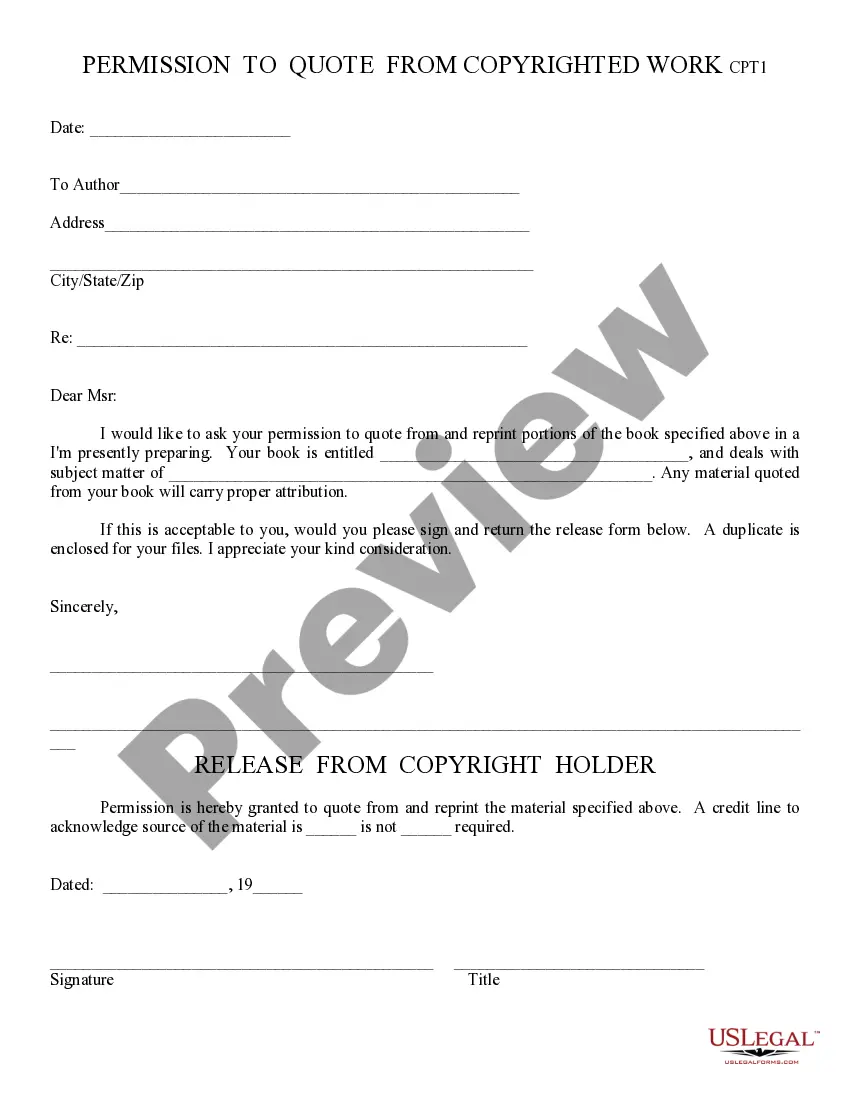

- Step 1. Be sure you have chosen the form for that right city/region.

- Step 2. Use the Preview solution to check out the form`s content. Don`t overlook to read through the explanation.

- Step 3. If you are not happy with all the form, make use of the Lookup discipline towards the top of the display screen to discover other types of your lawful form template.

- Step 4. After you have identified the form you need, click the Acquire now button. Pick the rates prepare you like and include your accreditations to sign up for the account.

- Step 5. Approach the purchase. You should use your bank card or PayPal account to accomplish the purchase.

- Step 6. Find the structure of your lawful form and down load it on your own system.

- Step 7. Comprehensive, modify and print out or sign the Nebraska Assignment of LLC Company Interest to Living Trust.

Every single lawful record template you buy is the one you have forever. You may have acces to every single form you downloaded within your acccount. Click on the My Forms portion and choose a form to print out or down load yet again.

Compete and down load, and print out the Nebraska Assignment of LLC Company Interest to Living Trust with US Legal Forms. There are many professional and state-particular kinds you can utilize for your personal organization or individual requirements.