Nebraska Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee

Description

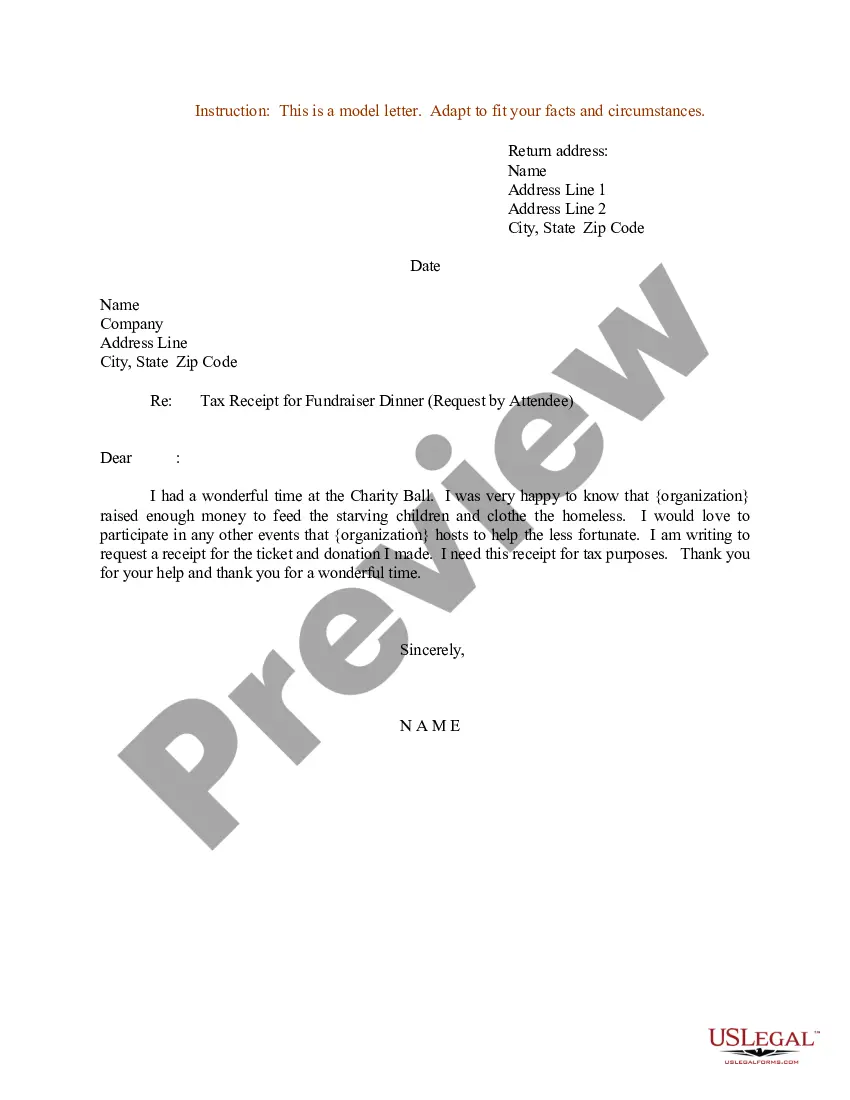

How to fill out Sample Letter For Tax Receipt For Fundraiser Dinner - Request By Attendee?

Locating the appropriate legal document template can be a challenge. Of course, there are many designs available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Nebraska Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee, suitable for both business and personal purposes. Each form is reviewed by professionals and complies with federal and state regulations.

If you are already a member, sign in to your account and click the Download button to obtain the Nebraska Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee. Use your account to search for the legal forms you have previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you need.

Fill out, modify, print, and sign the downloaded Nebraska Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Use this service to download professionally crafted documents that conform to state regulations.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your region/state. You can view the form using the Preview button and read the form description to confirm this is the right choice for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- When you are confident that the form is correct, click the Purchase now button to acquire the form.

- Select the payment plan you desire and provide the necessary information. Create your account and complete your order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

What's the best format for your donation receipt?The name of the organization.A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number.Date that the donation was made.Donor's name.Type of contribution made (cash, goods, services)More items...

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

How to Write(1) Date.(2) Non-Profit Organization.(3) Mailing Address.(4) EIN.(5) Donor's Name.(6) Donor's Address.(7) Donated Amount.(8) Donation Description.More items...?

Thank you for your generous gift of (Full Description) which we received on (Date). Your generous contribution will help to further the important work of our organization.

The charity you donate to should supply a receipt with its name, address, telephone number and the date, preferably on letterhead. You should fill in your name, address, a description of the goods and their value. If the charity gives you anything in return, it must provide a description and value.

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

Here's what you should include in your own donation receipts:The donor's name.The organization's name, federal tax ID number, and a statement indicating that the organization is a registered 501(c)(3)Date of the donation.The amount of money or a description (but not the value) of the item(s) donated.More items...

How to Write a Fundraising LetterAddress your recipient personally.Tell a story.Define the problem.Explain your mission and outline your goal.Explain how your donor can make an impact.Call the reader to action.