Nebraska Irrevocable Life Insurance Trust (IIT) is a legal arrangement designed to protect and manage life insurance policies for beneficiaries. It offers beneficiaries the Crummy right of withdrawal, a unique feature that allows them to withdraw contributions made to the trust within a limited timeframe. This provision is particularly useful for maximizing tax benefits, ensuring estate planning objectives, and maintaining control over policy proceeds. The beneficiaries of a Nebraska Irrevocable Life Insurance Trust can exercise the Crummy right of withdrawal when contributions are made to the trust. This right of withdrawal must be provided within a specific window, typically 30 days, during which beneficiaries can choose to withdraw the contributed amount. By doing so, they are essentially confirming their status as beneficiaries and affirming their ability to access the funds. The Crummy right of withdrawal plays a crucial role in estate planning strategies, as it allows the trust creator to gift assets to the IIT while maintaining eligibility for the annual gift tax exclusion. The gift tax exclusion permits individuals to make tax-free gifts up to a certain amount each year without incurring gift tax liability. This withdrawal provision ensures that the gift is completed, as the beneficiary can potentially withdraw the contributed amount. If the beneficiary chooses not to exercise the Crummy right of withdrawal, the assets remain in the trust and can be used to pay life insurance premiums or accumulate, safeguarding them from potential future estate taxes. Nebraska Irrevocable Life Insurance Trusts with Crummy Right of Withdrawal can have different variations depending on the specific objectives and needs of the granter. One common variant is the Crummy IIT with a "5 and 5" provision, where beneficiaries can withdraw the greatest of $5,000 or 5% of the contribution. Another variation is the "Limited Withdrawal" approach which restricts beneficiaries from full access to the contributed funds, allowing only partial withdrawals or making them subject to certain conditions specified in the trust document. In summary, Nebraska Irrevocable Life Insurance Trusts with the Crummy right of withdrawal are powerful tools for estate planning and tax efficiency. They permit beneficiaries to access contributed funds while maintaining eligibility for gift tax exclusions. By understanding the nuances and potential variations of this trust structure, individuals can tailor their estate plans to achieve their long-term financial goals effectively.

Nebraska Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

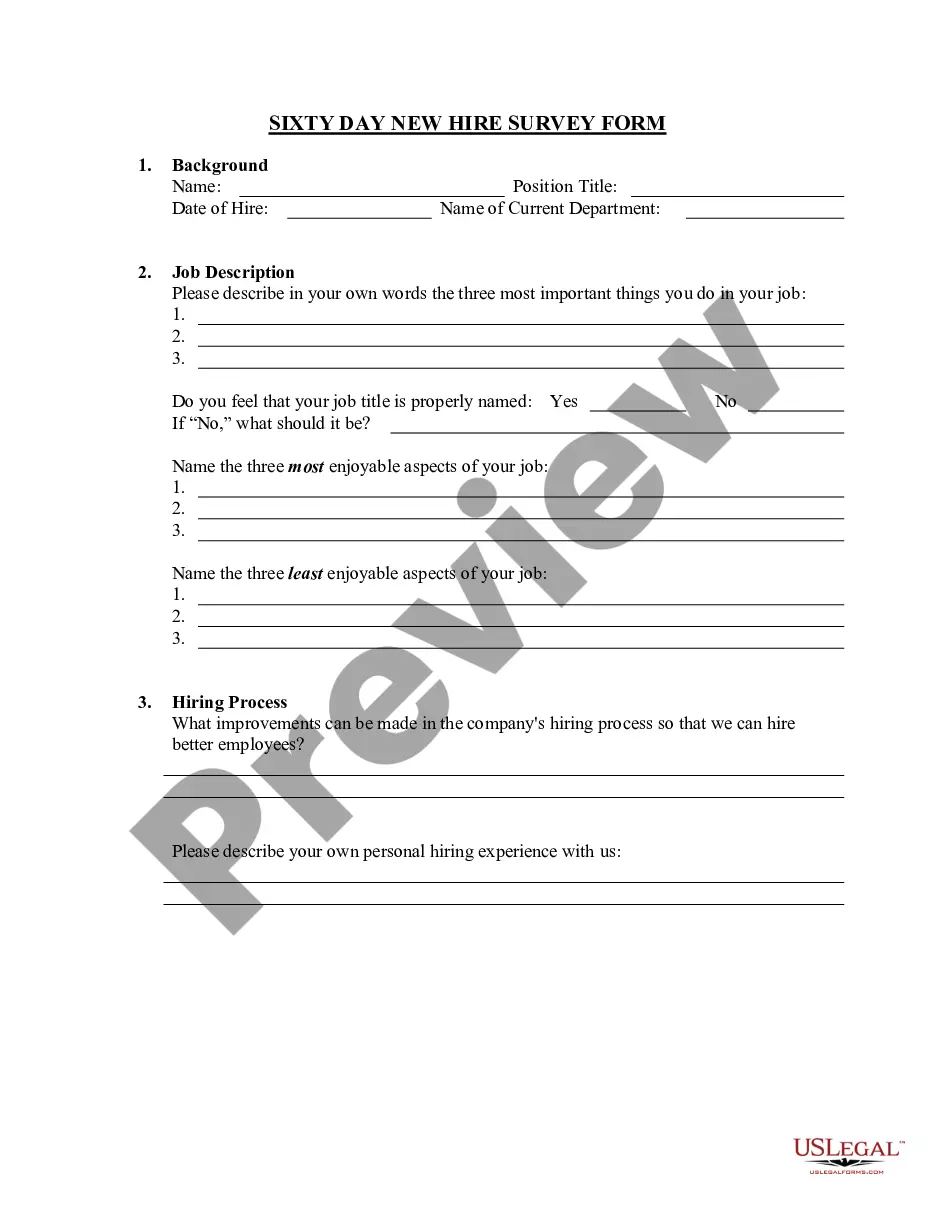

How to fill out Nebraska Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Have you been inside a situation where you need to have paperwork for both company or personal functions virtually every day time? There are a variety of legitimate document layouts accessible on the Internet, but discovering versions you can rely isn`t simple. US Legal Forms offers thousands of develop layouts, much like the Nebraska Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, that happen to be created to fulfill federal and state specifications.

When you are presently informed about US Legal Forms web site and also have a merchant account, basically log in. After that, you can down load the Nebraska Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal web template.

Should you not have an account and need to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is for that right metropolis/area.

- Make use of the Preview option to examine the form.

- Read the information to actually have chosen the correct develop.

- If the develop isn`t what you are looking for, make use of the Look for industry to find the develop that meets your requirements and specifications.

- When you discover the right develop, just click Acquire now.

- Choose the prices prepare you want, submit the desired information to generate your money, and purchase the transaction using your PayPal or charge card.

- Decide on a hassle-free document structure and down load your copy.

Find all the document layouts you possess bought in the My Forms food selection. You may get a extra copy of Nebraska Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal any time, if needed. Just click the necessary develop to down load or print out the document web template.

Use US Legal Forms, probably the most substantial variety of legitimate types, to conserve time as well as avoid errors. The assistance offers skillfully produced legitimate document layouts which can be used for a range of functions. Create a merchant account on US Legal Forms and initiate making your lifestyle a little easier.