Nebraska Qualified Domestic Trust Agreement

Description

How to fill out Qualified Domestic Trust Agreement?

US Legal Forms - one of many greatest libraries of authorized forms in the USA - provides a wide range of authorized papers templates you may download or print out. Utilizing the site, you may get 1000s of forms for organization and personal functions, categorized by classes, claims, or key phrases.You will find the newest models of forms such as the Nebraska Qualified Domestic Trust Agreement in seconds.

If you already possess a membership, log in and download Nebraska Qualified Domestic Trust Agreement from the US Legal Forms collection. The Acquire key can look on every form you view. You have access to all previously acquired forms from the My Forms tab of your profile.

If you want to use US Legal Forms the first time, here are easy instructions to help you get started:

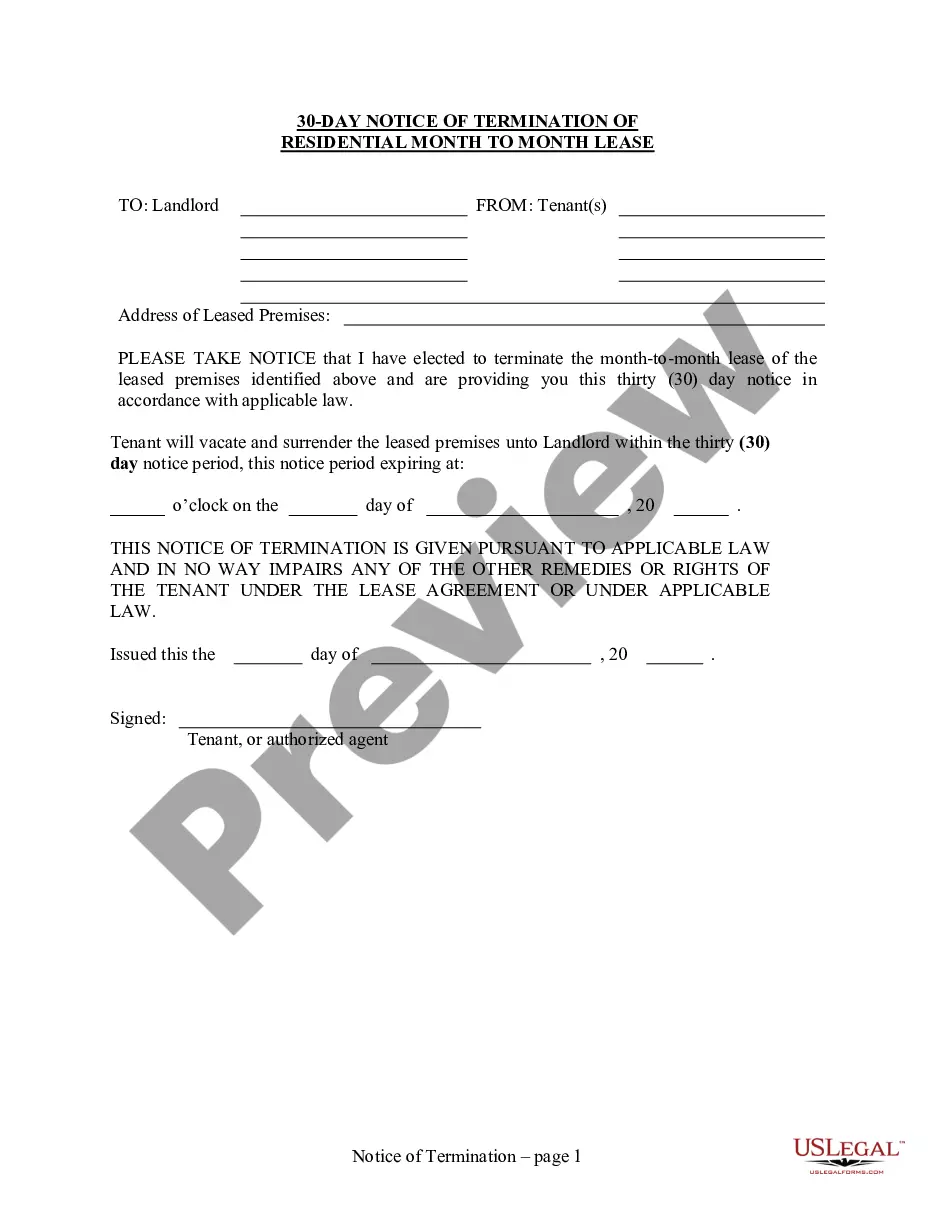

- Be sure to have picked the correct form for your city/region. Click the Preview key to check the form`s articles. See the form outline to ensure that you have chosen the appropriate form.

- If the form doesn`t suit your requirements, take advantage of the Research discipline at the top of the screen to obtain the the one that does.

- Should you be satisfied with the form, validate your choice by clicking on the Buy now key. Then, opt for the pricing strategy you want and provide your references to sign up on an profile.

- Method the financial transaction. Use your bank card or PayPal profile to accomplish the financial transaction.

- Pick the structure and download the form in your system.

- Make modifications. Fill out, revise and print out and signal the acquired Nebraska Qualified Domestic Trust Agreement.

Each template you included with your money lacks an expiry particular date and it is the one you have permanently. So, if you would like download or print out another duplicate, just visit the My Forms section and click about the form you require.

Get access to the Nebraska Qualified Domestic Trust Agreement with US Legal Forms, probably the most considerable collection of authorized papers templates. Use 1000s of professional and state-certain templates that meet up with your company or personal requires and requirements.