A Nebraska Qualified Domestic Trust Agreement is a legal tool specifically designed to benefit non-U.S. citizen spouses who inherit assets from their U.S. citizen spouses. By establishing a Qualified Domestic Trust (DOT) in Nebraska, the non-U.S. citizen spouse can ensure that their inherited assets are not subject to excessive estate taxes. The DOT agreement allows the non-U.S. citizen spouse to postpone paying estate taxes until the assets are distributed from the trust, rather than immediately upon inheritance. This can be particularly beneficial when the value of the inherited assets exceeds the estate tax exemption limit. To qualify as a DOT in Nebraska, the trust must meet certain requirements outlined by both federal and state law. These requirements typically include designating a U.S. trustee, who could be an individual or a financial institution, to oversee the trust's administration and ensure compliance with tax regulations. Additionally, the trust must contain specific provisions stated in the DOT agreement, such as limiting distributions to the non-U.S. citizen spouse to only income earned by the trust, unless prior approval is obtained from the Internal Revenue Service (IRS). Nebraska recognizes and adheres to the federal regulations for Dots, making it consistent with DOT provisions across the United States. The trust agreement should be drafted in accordance with both federal and Nebraska state laws to ensure its validity. While there are no specific types of Nebraska Qualified Domestic Trust Agreements, the terms and conditions of the trust can be customized to suit the unique needs and preferences of each individual. The trust agreement can be structured to provide flexibility and asset protection, ensuring that the non-U.S. citizen spouse has access to income generated by the trust while preserving the principal for future generations. In conclusion, a Nebraska Qualified Domestic Trust Agreement is a powerful estate planning tool designed to alleviate the estate tax burden for non-U.S. citizen spouses inheriting assets from U.S. citizen spouses. By complying with the federal and Nebraska state requirements, the DOT agreement provides a strategic framework to effectively manage and distribute assets, ensuring long-term financial security for the non-U.S. citizen spouse and their beneficiaries.

Nebraska Qualified Domestic Trust Agreement

Description

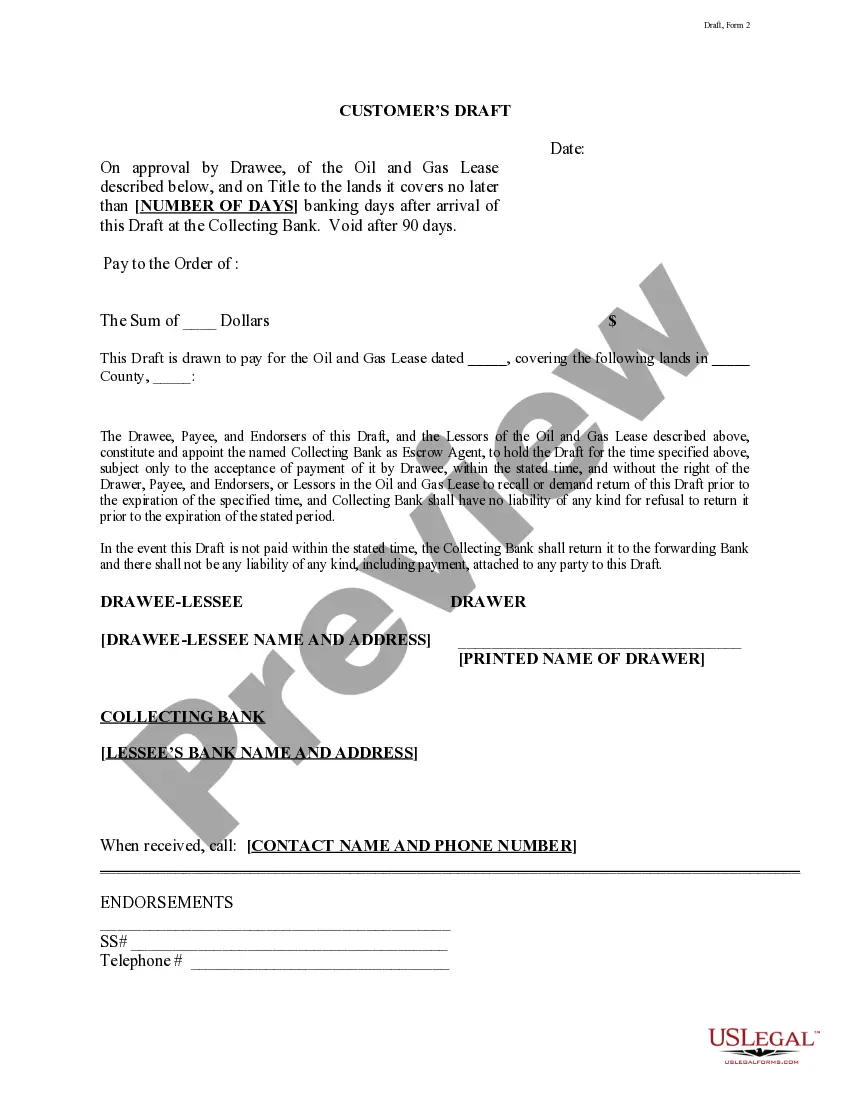

How to fill out Nebraska Qualified Domestic Trust Agreement?

US Legal Forms - one of many greatest libraries of authorized forms in the USA - provides a wide range of authorized papers templates you may download or print out. Utilizing the site, you may get 1000s of forms for organization and personal functions, categorized by classes, claims, or key phrases.You will find the newest models of forms such as the Nebraska Qualified Domestic Trust Agreement in seconds.

If you already possess a membership, log in and download Nebraska Qualified Domestic Trust Agreement from the US Legal Forms collection. The Acquire key can look on every form you view. You have access to all previously acquired forms from the My Forms tab of your profile.

If you want to use US Legal Forms the first time, here are easy instructions to help you get started:

- Be sure to have picked the correct form for your city/region. Click the Preview key to check the form`s articles. See the form outline to ensure that you have chosen the appropriate form.

- If the form doesn`t suit your requirements, take advantage of the Research discipline at the top of the screen to obtain the the one that does.

- Should you be satisfied with the form, validate your choice by clicking on the Buy now key. Then, opt for the pricing strategy you want and provide your references to sign up on an profile.

- Method the financial transaction. Use your bank card or PayPal profile to accomplish the financial transaction.

- Pick the structure and download the form in your system.

- Make modifications. Fill out, revise and print out and signal the acquired Nebraska Qualified Domestic Trust Agreement.

Each template you included with your money lacks an expiry particular date and it is the one you have permanently. So, if you would like download or print out another duplicate, just visit the My Forms section and click about the form you require.

Get access to the Nebraska Qualified Domestic Trust Agreement with US Legal Forms, probably the most considerable collection of authorized papers templates. Use 1000s of professional and state-certain templates that meet up with your company or personal requires and requirements.