A Nebraska Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement is a legal instrument designed to provide financial security and tax advantages for children. This unique trust arrangement offers various benefits and allows for efficient estate planning. The Nebraska Qualified Subchapter-S Trust allows individuals to transfer assets into a trust while still enjoying the tax benefits associated with the Subchapter-S corporation status. By utilizing this trust structure, parents or guardians can protect their children's future financial well-being and minimize their tax liability. A Crummy Trust Agreement refers to a specific provision within the trust that provides beneficiaries — typicallchildrenre— - with the ability to withdraw contributions made to the trust within a specific timeframe, usually 30 days. This withdrawal right can help qualify the trust for the annual gift tax exclusion. There can be different types of Nebraska Qualified Subchapter-S Trusts for the Benefit of a Child with a Crummy Trust Agreement, depending on the specific needs and goals of the trust creator. Some possible variations include: 1. Irrevocable Nebraska Qualified Subchapter-S Trust for the Benefit of a Child with Crummy Trust Agreement: This trust arrangement offers the most significant asset protection and tax advantages. It ensures that the assets transferred into the trust are protected from creditors and potential future estate taxes. 2. Revocable Nebraska Qualified Subchapter-S Trust for the Benefit of a Child with Crummy Trust Agreement: This trust structure allows for greater flexibility and control. The trust creator retains the ability to modify, amend, or revoke the trust agreement, providing more freedom to make changes as circumstances evolve. 3. Testamentary Nebraska Qualified Subchapter-S Trust for the Benefit of a Child with Crummy Trust Agreement: This trust is established through a will and comes into effect upon the trust creator's death. It allows for the seamless transfer of assets to the trust, ensuring the child's financial security while enjoying the tax advantages provided by the trust structure. 4. Special Needs Nebraska Qualified Subchapter-S Trust for the Benefit of a Child with Crummy Trust Agreement: This trust is specifically designed to provide ongoing financial support for children with special needs while preserving their eligibility for government benefits. It allows for the management and distribution of funds in a way that supplements, rather than supplants, existing public aid programs. Overall, a Nebraska Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement serves as a powerful tool in estate planning, allowing individuals to secure their children's financial future while minimizing taxes. By carefully considering their unique circumstances and goals, trust creators can tailor the trust to best suit their needs.

Nebraska Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Nebraska Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

US Legal Forms - among the greatest libraries of lawful forms in America - provides a wide range of lawful papers themes you can acquire or produce. Using the website, you may get a huge number of forms for enterprise and personal reasons, sorted by classes, says, or search phrases.You can find the latest types of forms just like the Nebraska Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement in seconds.

If you already have a registration, log in and acquire Nebraska Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement from your US Legal Forms catalogue. The Down load button will show up on each and every type you view. You get access to all earlier downloaded forms inside the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, listed below are easy guidelines to get you began:

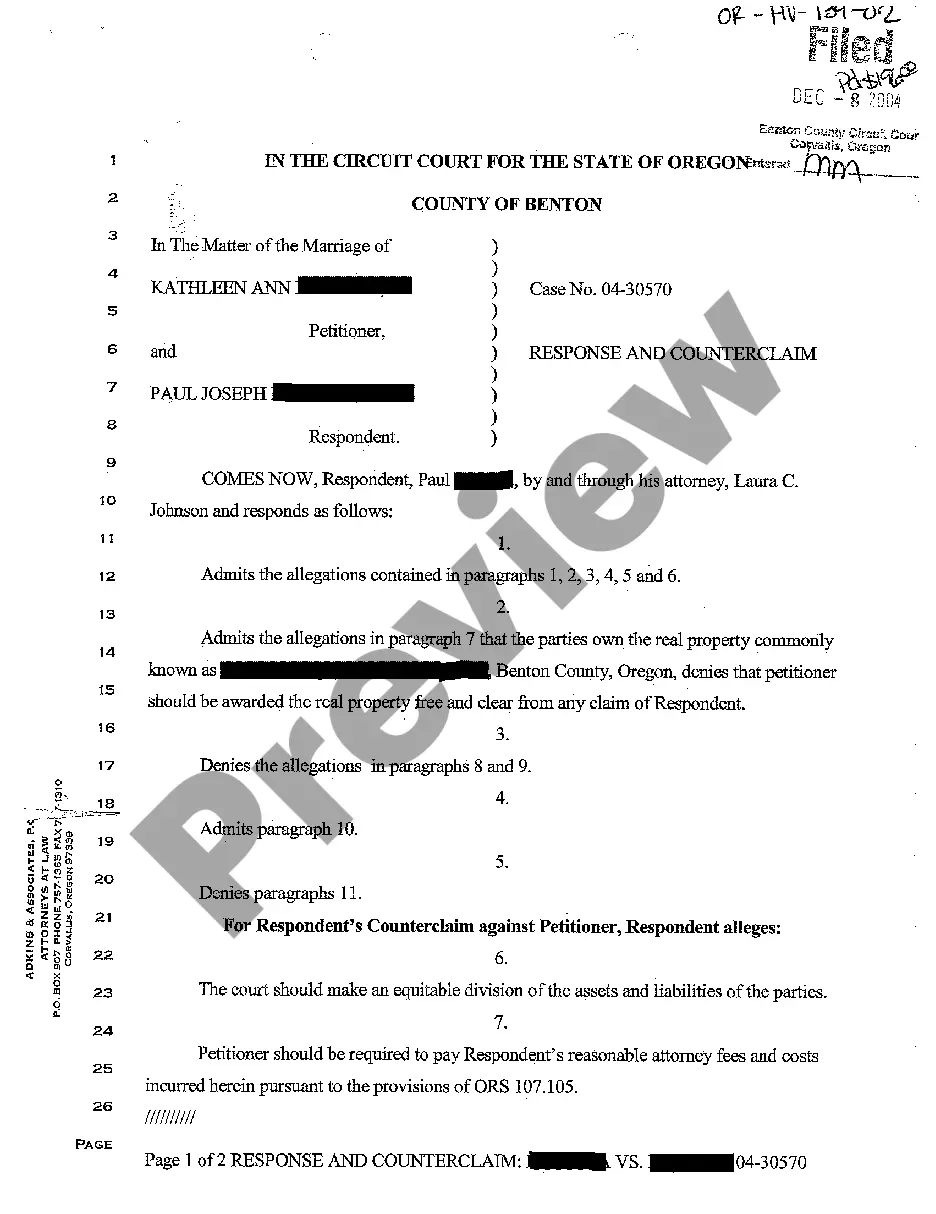

- Make sure you have picked out the correct type for your city/state. Click on the Preview button to examine the form`s articles. Browse the type description to actually have chosen the proper type.

- In the event the type does not suit your demands, take advantage of the Search discipline towards the top of the screen to get the one that does.

- In case you are pleased with the shape, verify your choice by clicking on the Acquire now button. Then, choose the pricing strategy you like and supply your qualifications to sign up for an account.

- Method the transaction. Use your credit card or PayPal account to finish the transaction.

- Select the formatting and acquire the shape on your gadget.

- Make changes. Load, revise and produce and indicator the downloaded Nebraska Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

Each format you included in your account lacks an expiry time which is yours permanently. So, if you would like acquire or produce an additional version, just check out the My Forms segment and click on around the type you want.

Obtain access to the Nebraska Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement with US Legal Forms, by far the most considerable catalogue of lawful papers themes. Use a huge number of expert and condition-specific themes that meet up with your business or personal demands and demands.