Nebraska Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Selecting the finest sanctioned document format can be a challenge. Of course, there are numerous templates accessible online, but how do you acquire the authorized document you seek.

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Nebraska Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, suitable for both business and personal needs.

All documents are reviewed by experts and meet both state and federal regulations.

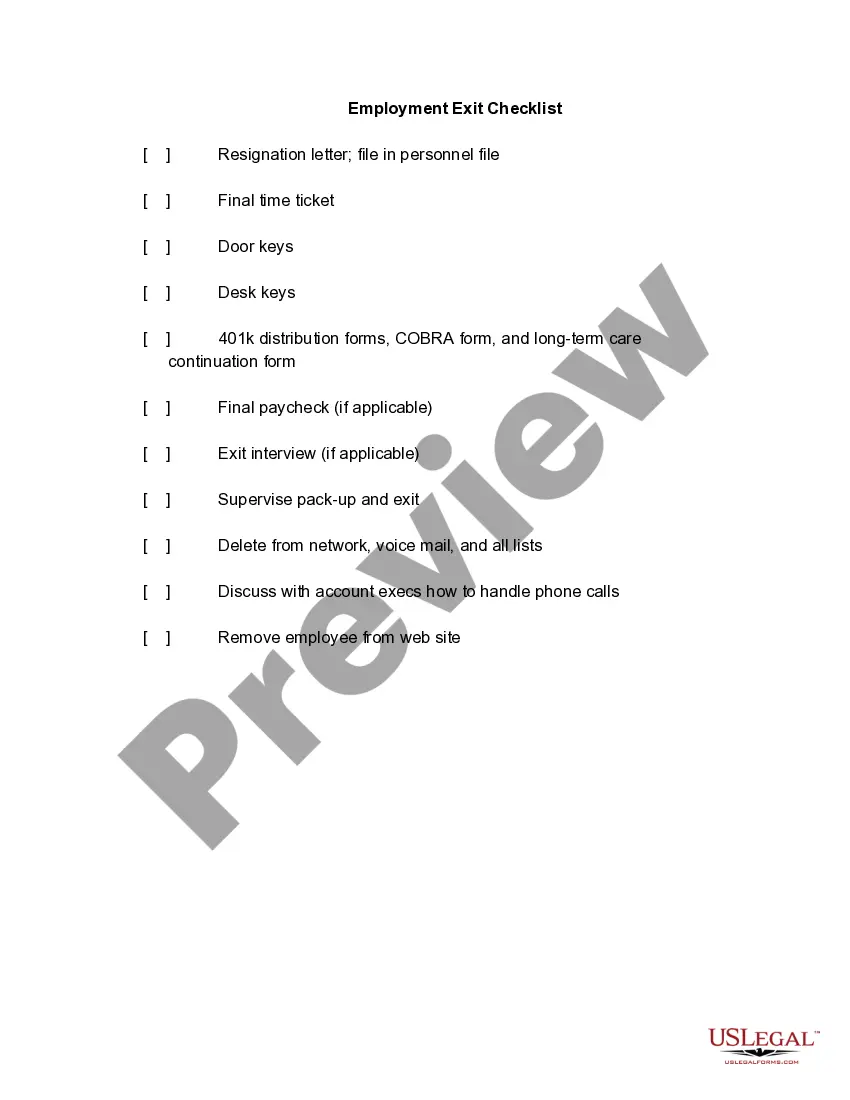

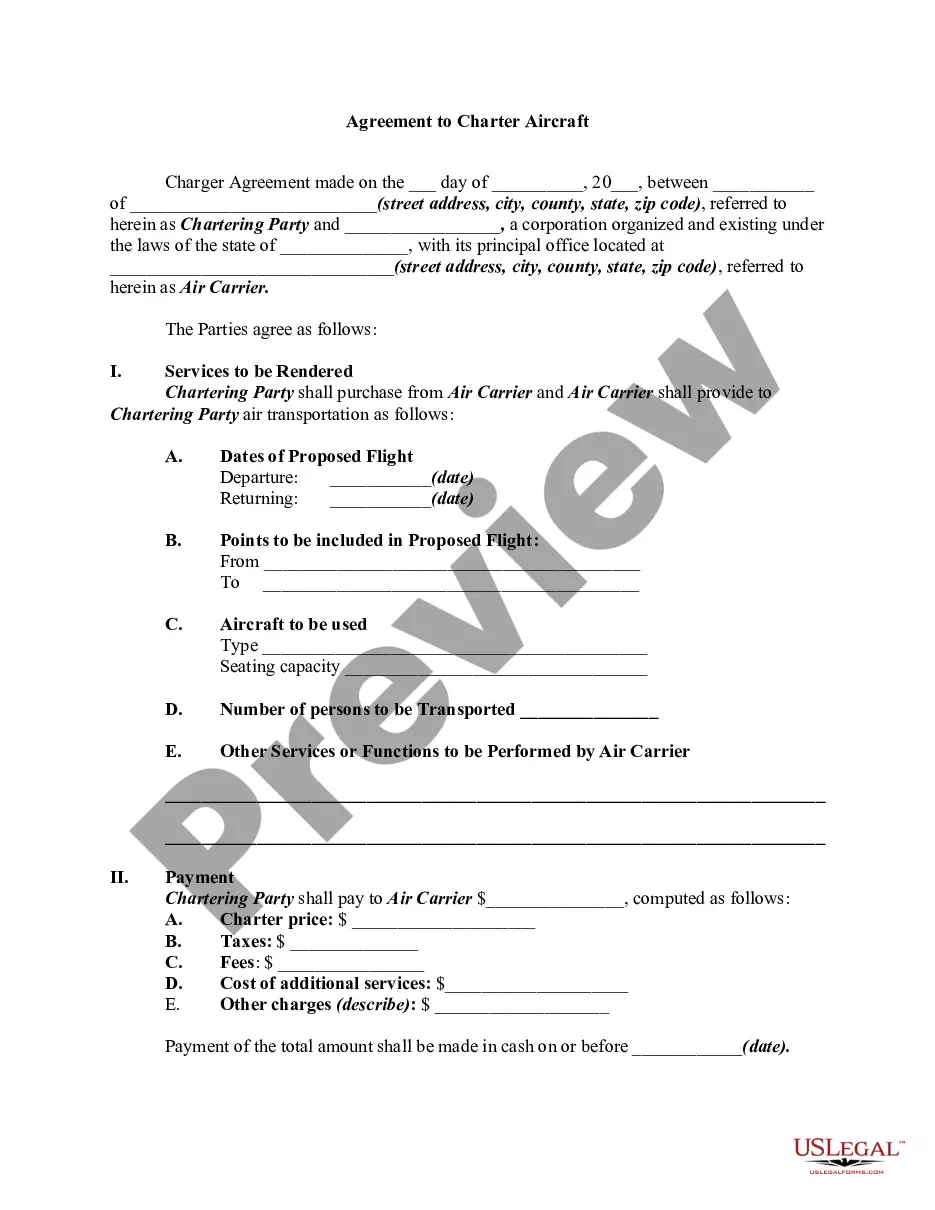

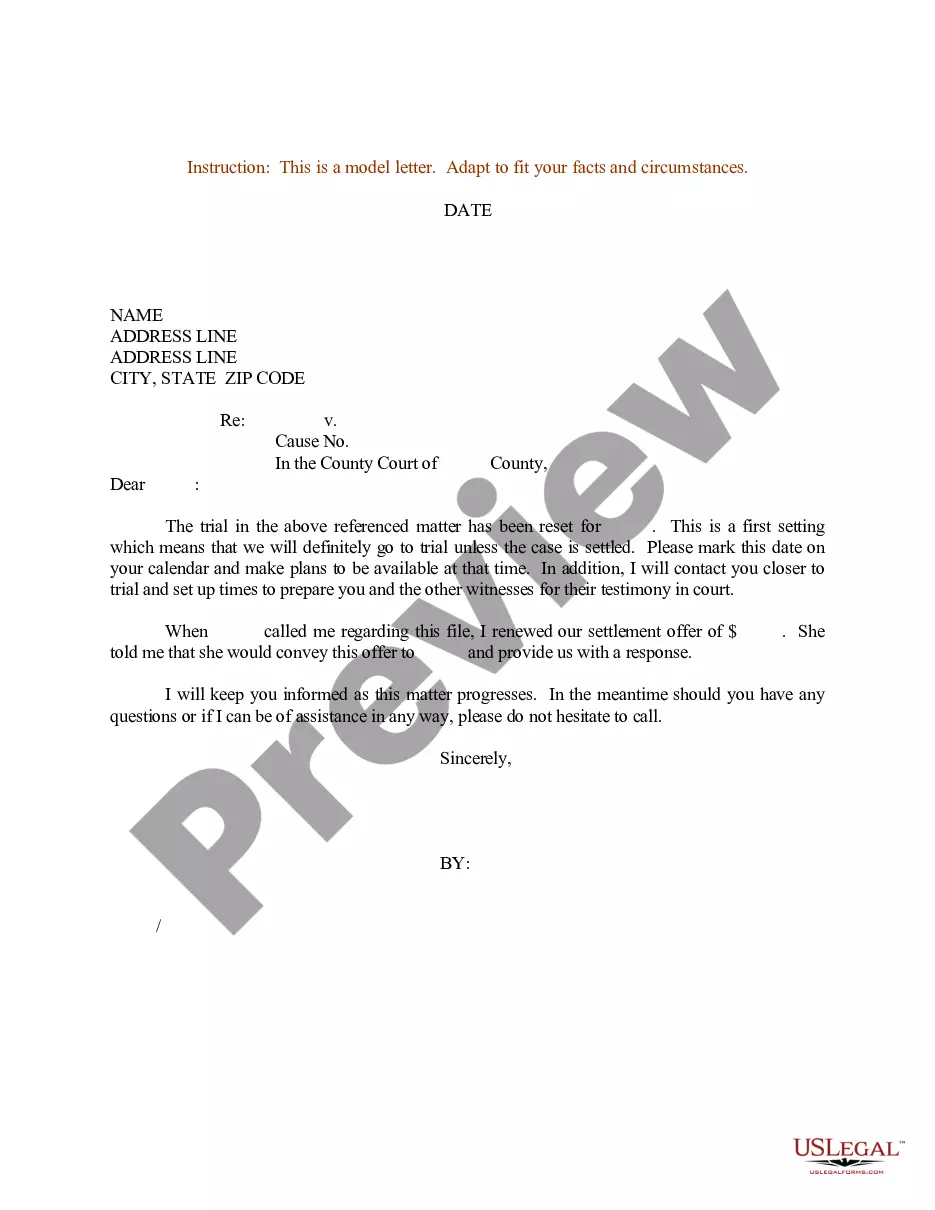

If the document does not meet your needs, utilize the Search field to find the appropriate form. Once you're certain that the document is suitable, click the Buy now button to procure the document. Select the pricing plan you prefer and provide the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document to your device. Finally, complete, modify, and print the Nebraska Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Use the service to download expertly crafted paperwork that complies with state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Nebraska Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

- Use your account to review the legal documents you may have purchased in the past.

- Visit the My documents tab of your account to obtain another copy of the document you desire.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct document for your locality/region.

- You can preview the document using the Preview button and read the document description to confirm its suitability.

Form popularity

FAQ

The 10% rule stipulates that the present value of the charitable remainder interest must be at least 10% of the total contribution to the trust. This rule ensures that a significant portion of the trust goes towards charitable purposes, aligning with the tax benefits associated with establishing such a trust. When considering charitable remainder trusts under Nebraska Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, understanding this rule can guide your planning.

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Charitable trusts are created in the same manner as private express trusts, with several key exceptions: the trust must be created for a charitable purpose, the beneficiaries to the trust must be indefinite, and the trust may be perpetual.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.