Nebraska Sample Letter for Employee Automobile Expense Allowance

Description

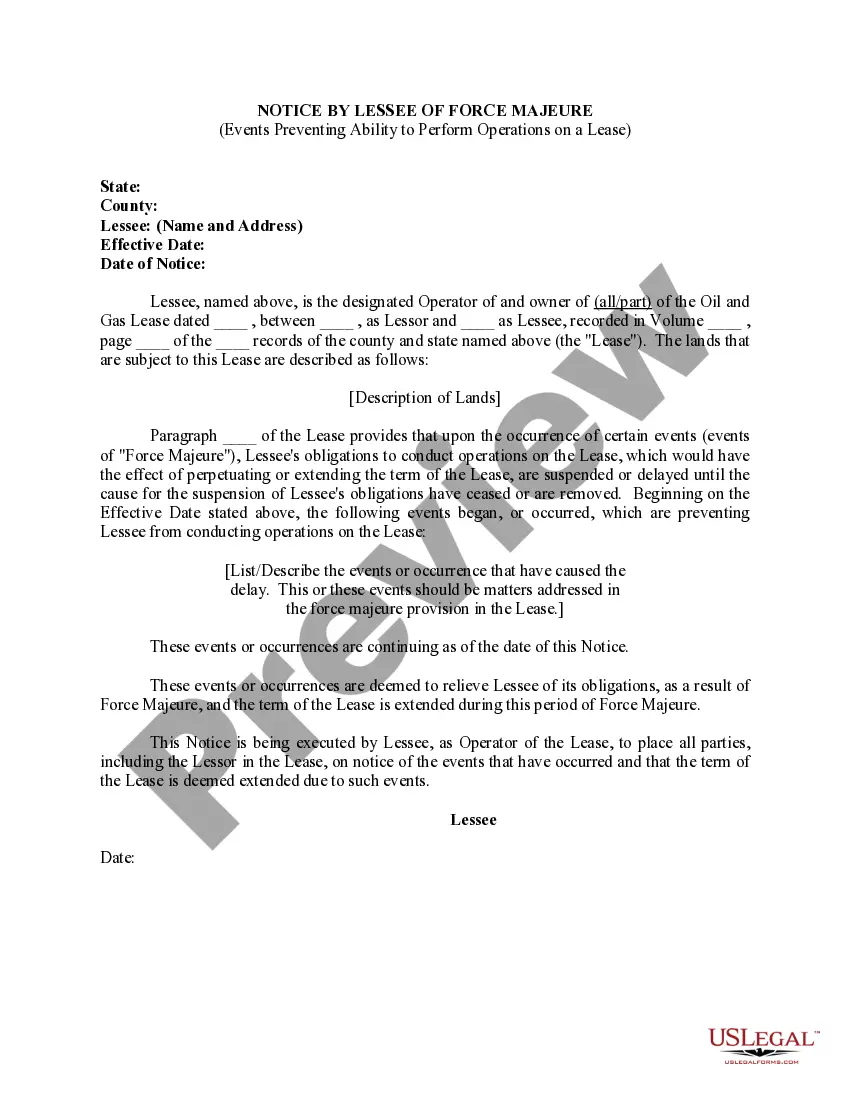

How to fill out Sample Letter For Employee Automobile Expense Allowance?

Selecting the ideal legal document format can be a challenge. Clearly, there are numerous templates accessible online, but how will you locate the legal version you require? Utilize the US Legal Forms site.

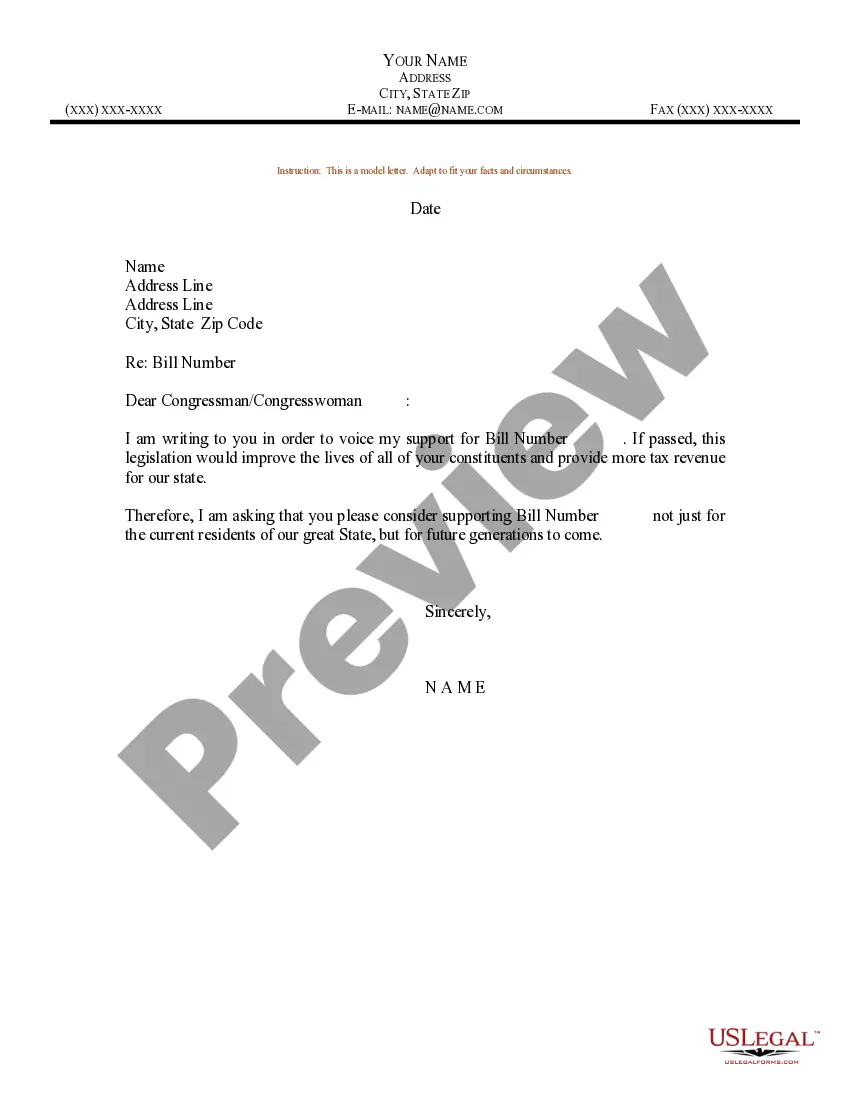

This service provides thousands of templates, including the Nebraska Sample Letter for Employee Automobile Expense Allowance, that you can employ for both business and personal needs. Each form is reviewed by experts and meets state and federal standards.

If you’re already registered, Log In to your account and click on the Download button to acquire the Nebraska Sample Letter for Employee Automobile Expense Allowance. You can use your account to search through the legal forms you have previously acquired.

Select the file format and download the legal document to your device. Complete, edit, print, and sign the Nebraska Sample Letter for Employee Automobile Expense Allowance. US Legal Forms is the largest library of legal templates where you can find various document formats. Use the service to download professionally crafted papers that adhere to state standards.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the appropriate form for your jurisdiction.

- You can preview the form using the Review button and read the form description to make sure it’s suitable for you.

- If the form does not meet your expectations, use the Search field to find the correct form.

- Once you are confident that the form is correct, click on the Download now button to obtain it.

- Choose the payment plan you want and enter the necessary information. Create your account and pay for the order with your PayPal account or Visa or Mastercard.

Form popularity

FAQ

It's calculated by dividing the value/purchase price of the car in multiples of R 85 000 (this changes almost every year). So let's say the employee's car cost R 100 000 - the fixed cost would be R 50 924, fuel R 1.018 per km and the maintenance R 0.412 per km.

You can pay employees who use their cars for work by providing a car allowance, paying them for a trip in advance or reimbursing them afterward. To meet IRS standards for an employee-expense plan, the money can only go for legitimate work trips.

Because a standard car allowance is a non-accountable plan, it should be taxed fully as W-2 income. The employer should withhold federal income taxes, FICA/Medicare taxes, and (if applicable) state income taxes on the full allowance amount. The car allowance should be taxed at the employee's income bracket.

A car allowance is a set amount that you give to your employees to cover a period of time. This car allowance is intended to cover typical costs of owning a vehicle, such as maintenance, wear-and-tear, insurance, fuel and depreciation.

It's a sum of money you add to the employee's annual salary for the purpose of allowing them to buy or lease a vehicle. The staff member will have to source and buy the vehicle by themselves. They're also responsible for maintaining and insuring the car, as well as monitoring expenses.

Because a standard car allowance is a non-accountable plan, it should be taxed fully as W-2 income. The employer should withhold federal income taxes, FICA/Medicare taxes, and (if applicable) state income taxes on the full allowance amount. The car allowance should be taxed at the employee's income bracket.

A standard vehicle allowance is a monthly compensation for the costs of using a motor vehicle for work. This payment is typically part of a paycheck. It's up to the employee whether to put that money toward a car payment or to use it to defray gas expense, wear and tear, and other car costs.

A car allowance is what an employer gives employees for the business use of their personal vehicle. A car allowance is a set amount over a given time. It's meant to cover the costs of using your own car. A car allowance covers things like fuel, wear-and-tear, tires and more.