Nebraska LLC Operating Agreement for Rental Property

Description

How to fill out LLC Operating Agreement For Rental Property?

Are you currently in a situation where you need documentation for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding forms you can rely on is not straightforward.

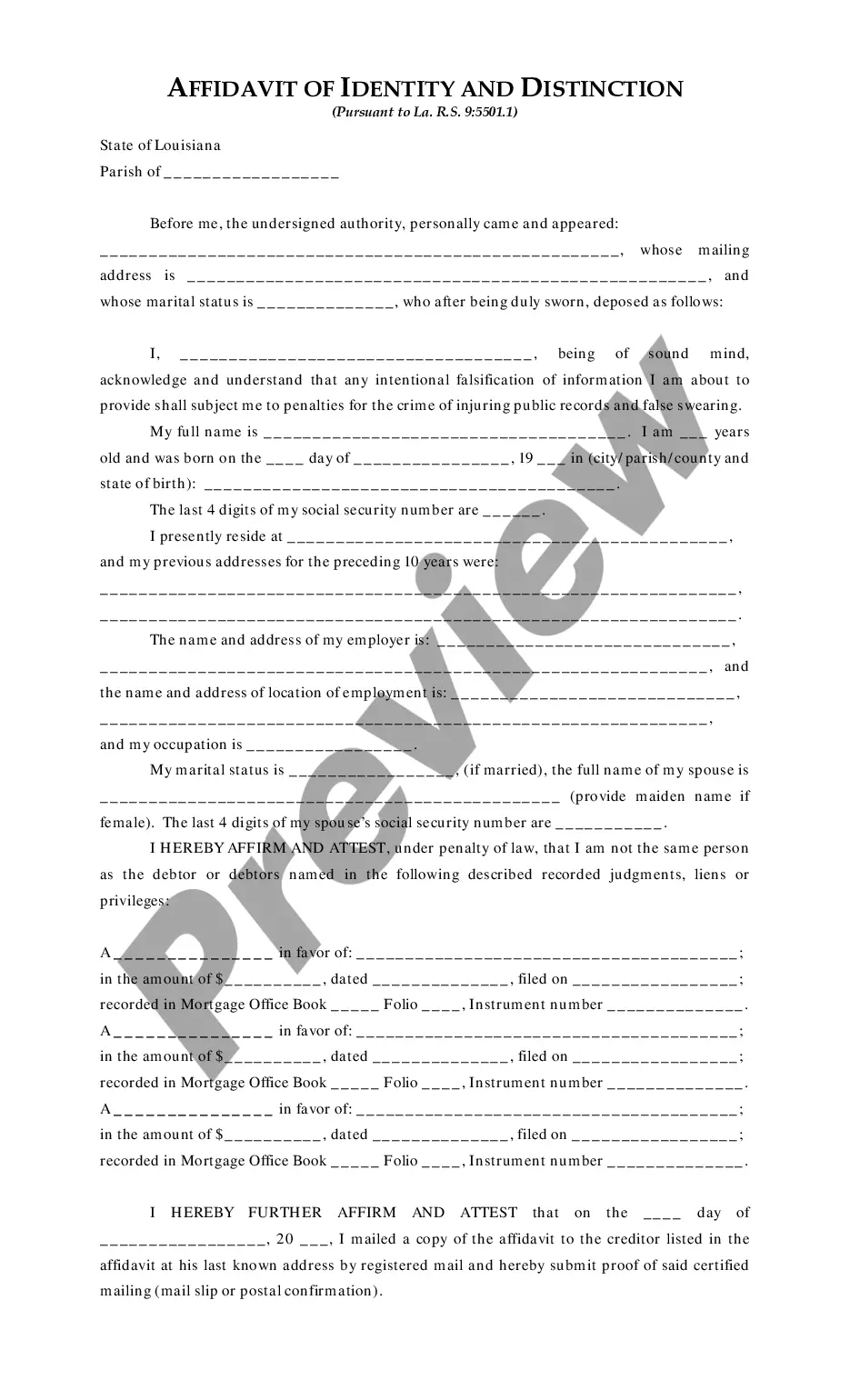

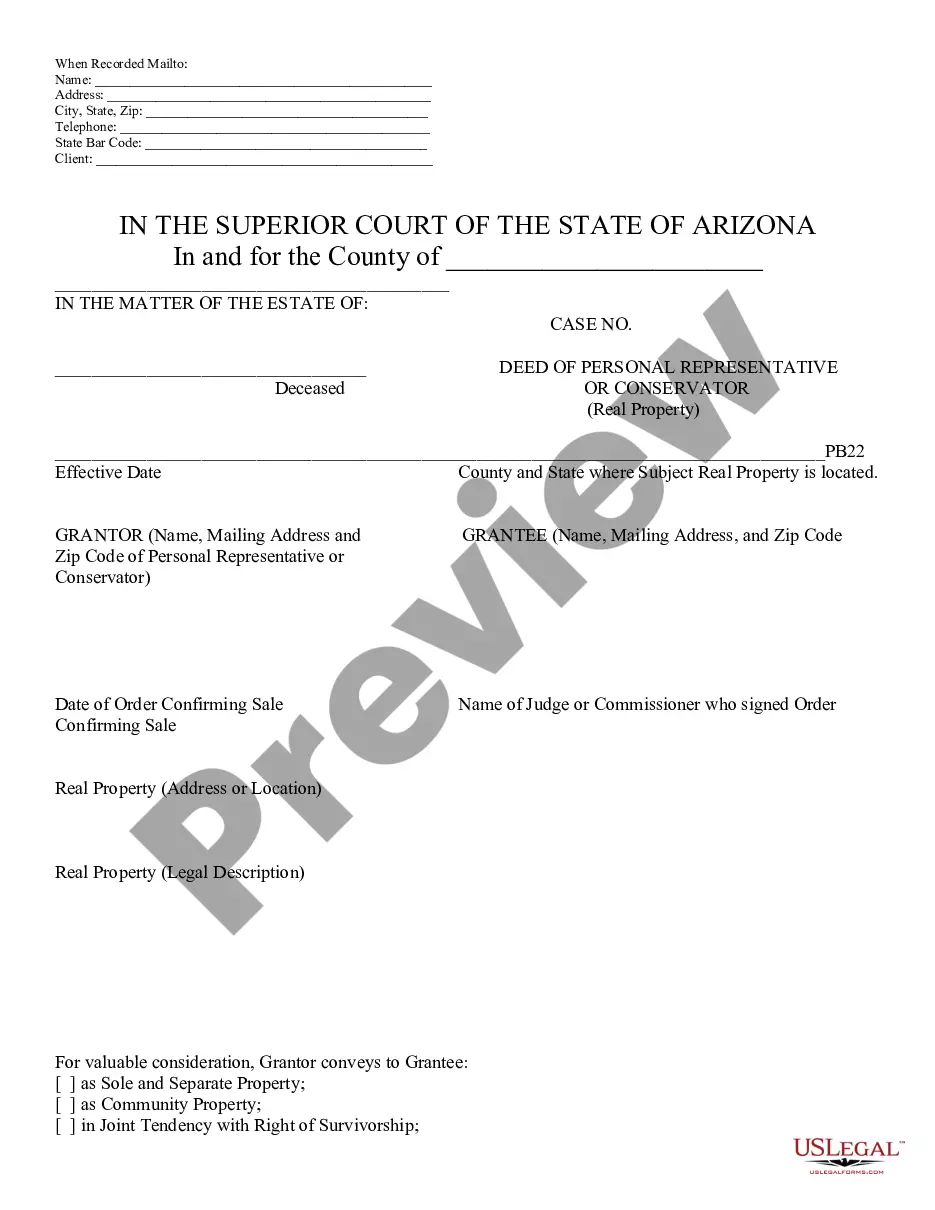

US Legal Forms offers a multitude of form templates, including the Nebraska LLC Operating Agreement for Rental Property, which are created to comply with federal and state regulations.

When you locate the correct form, simply click Buy now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Nebraska LLC Operating Agreement for Rental Property template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is suitable for your specific area.

- Use the Preview button to review the form.

- Read the description to make sure you have chosen the correct form.

- If the form isn’t what you’re looking for, utilize the Search box to find the form that fits your needs.

Form popularity

FAQ

Is an operating agreement required in Nebraska? No, Nebraska's statutes don't require LLCs to have an operating agreement. However, you'll need an operating agreement for some essential tasks, like opening a business bank account.

To file a Nebraska LLC amendment, submit the proper form, in duplicate. Domestic LLCs organized before January 1, 2011: File the Amended Certificate of Organization. The certificate must be amended when there is a change in the name, purpose, capital, or duration of the LLC.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

One thing that the new Act did not do was add a requirement that LLC operating agreements must be in writing to be enforceable. Under the new Act, as with the old law, an LLC operating agreement may be written or oral.