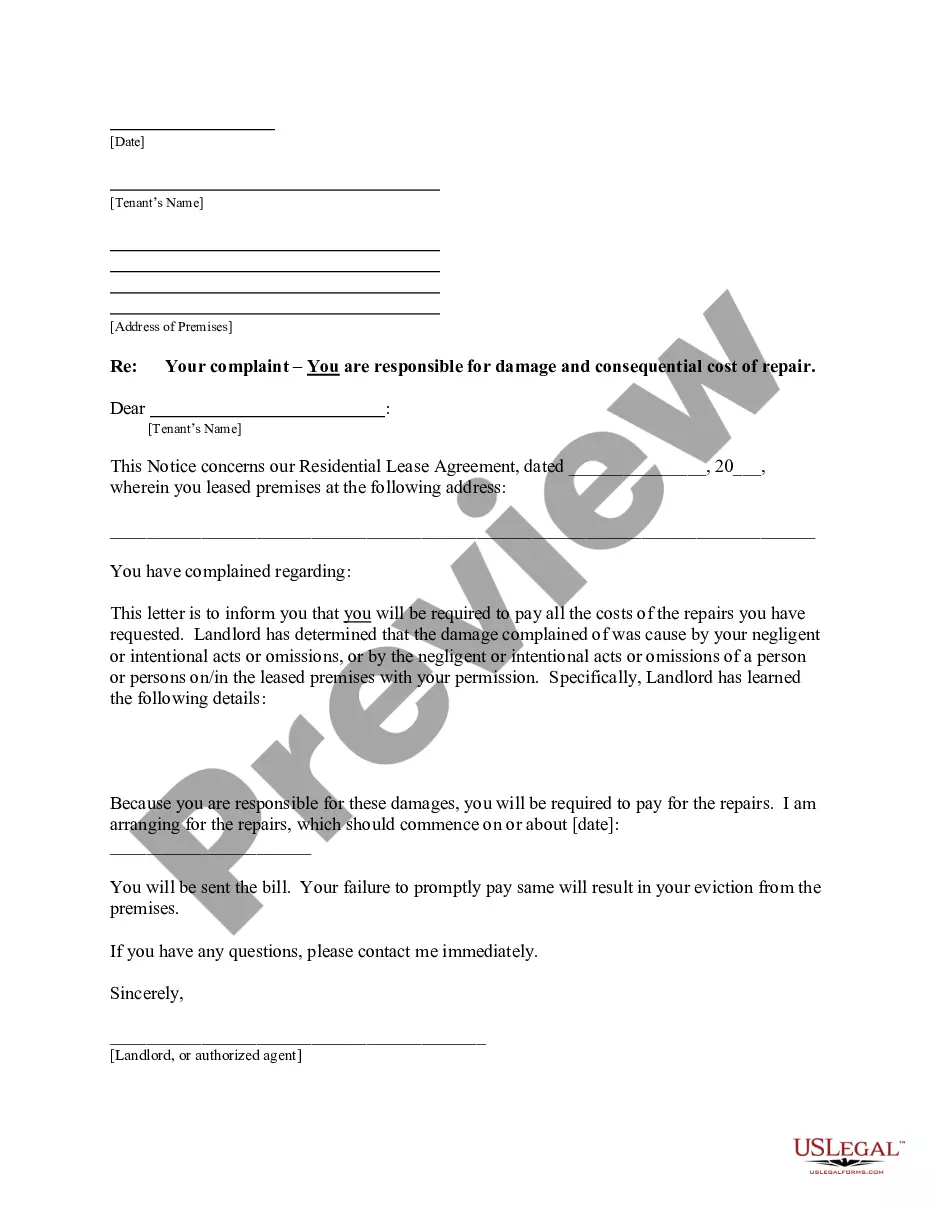

Subject: [Your Name]: Notice of Legal Action Regarding Loan [Loan Reference Number] [Date] [Loan Provider's Name] [Loan Provider's Address] [City, State ZIP] Dear [Loan Provider's Name], RE: NOTICE OF INTENTION TO COMMENCE LEGAL ACTION REGARDING LOAN — [Loan Reference Number] I hope this letter finds you well. This correspondence is to notify you of my intention to pursue legal action regarding the outstanding loan referenced above, as I believe all efforts to resolve this matter amicably have been exhausted. Despite multiple attempts to reach a mutually beneficial resolution, my previous correspondence regarding the repayment of the loan has gone unanswered or received inadequate responses from your end. Hence, the purpose of this letter is to formally demand immediate repayment of the outstanding loan amount. As per the loan agreement signed on [Loan Agreement Date], I borrowed [Loan Amount] from your institution. The terms of the loan agreement state that the loan amount is to be repaid in regular installments over a period of [Loan Term]. I have adhered to this agreement diligently by making timely payments until [Date of Last Payment], which was the last payment processed and verified by my bank statement. To date, the loan balance of [Outstanding Loan Balance] remains unpaid, disregarding my repeated reminders and efforts to resolve the matter. I have enclosed copies of the previous correspondence and relevant supporting documents for your reference. Given the seriousness of this issue, I would like to draw your attention to the potential legal consequences of non-compliance with this letter. Failure to respond within [reasonable time frame, e.g., 14 days] from the receipt of this letter and failure to initiate a satisfactory resolution will result in the immediate initiation of legal action to recover the outstanding loan amount. I want to emphasize that I have exhausted all alternatives to resolve this matter in good faith, but regrettably, it has reached a stage where legal intervention appears inevitable. Under Nebraska state laws and the Uniform Commercial Code (UCC), lenders are obligated to comply with contractual agreements and follow fair practices when it comes to loan obligations. Consequently, I urge you to reconsider and promptly take action to fulfill your obligations in light of the potential legal ramifications that may result from non-compliance. Please be advised that a copy of this letter, along with all relevant enclosures, will be retained for future reference and presented as evidence in a court of law, if necessary. I remain committed to reaching a fair and just resolution outside the legal system, and I hope that this matter can be resolved promptly. I request that you provide a written response and confirmation of receipt of this notice, including the proposed course of action to rectify the situation, no later than [reasonable time frame, e.g., 14 days]. You may contact me at [Your Phone Number] or [Your Email Address] to discuss this matter further, should you wish to resolve it amicably. Thank you for your immediate attention to this matter. I request your full cooperation in resolving this dispute promptly, avoiding the need for costly and time-consuming legal proceedings. Yours sincerely, [Your Name] [Your Address] [City, State ZIP] [Loan Account Number]

Nebraska Sample Letter for Legal Action Concerning Loan

Description

How to fill out Nebraska Sample Letter For Legal Action Concerning Loan?

If you have to complete, download, or print legitimate file web templates, use US Legal Forms, the greatest variety of legitimate types, that can be found on the Internet. Use the site`s basic and handy look for to discover the papers you want. Various web templates for organization and individual reasons are sorted by groups and claims, or search phrases. Use US Legal Forms to discover the Nebraska Sample Letter for Legal Action Concerning Loan with a couple of clicks.

When you are presently a US Legal Forms buyer, log in in your bank account and click on the Acquire switch to have the Nebraska Sample Letter for Legal Action Concerning Loan. You can even access types you previously acquired from the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the form for your appropriate city/region.

- Step 2. Utilize the Review choice to look over the form`s information. Don`t forget about to read the information.

- Step 3. When you are unsatisfied together with the kind, take advantage of the Look for discipline on top of the display screen to get other versions from the legitimate kind format.

- Step 4. Once you have found the form you want, select the Buy now switch. Choose the pricing strategy you favor and add your credentials to register for an bank account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Find the format from the legitimate kind and download it in your system.

- Step 7. Total, revise and print or signal the Nebraska Sample Letter for Legal Action Concerning Loan.

Each and every legitimate file format you get is the one you have forever. You possess acces to every kind you acquired inside your acccount. Go through the My Forms portion and pick a kind to print or download yet again.

Contend and download, and print the Nebraska Sample Letter for Legal Action Concerning Loan with US Legal Forms. There are millions of professional and status-distinct types you can use for your personal organization or individual needs.

Form popularity

FAQ

A demand letter is a document that you give to the person that you think owes you money. Within the letter, you set out why you are entitled to the payment and demand it. You'd be surprised how often a simple demand letter can work without you having to go to court.

Here are the steps to suing for non-payment of services:Send a Final Demand for Payment. Before taking any formal legal action, it's a good idea to send a final demand for payment to the client.Assess How Much You're Owed.Get Legal Advice.Consider Small Claims Court.Consider A Civil Lawsuit.28-Mar-2019

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

If your client refuses to pay after a reasonable amount of time and collection effort, you can take him to small claims court. Usually, the fees for small claims cases are fairly low, and you can present your case without a lawyer. However, small claims courts limit the amount for which you can sue.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

How to write a demand letterEstablish facts. Don't assume everyone knows the facts.Refer to evidence. If there's evidence (like a contract), you don't need to include it, but you should refer to it.Make a demand. Be specific as to what you want.Set a deadline and establish method of payment.Offer a consequence.

Fostering open communication with your customers can save you from hefty legal fees and court dates in the end.Contact the customer.Assess interest or late fees on unpaid invoices.Send a formal debt collection letter.Call a collection agency.Take legal action for nonpayment of invoices.Pay attention to your staff.