Nebraska Sample Letter for Foreclosed Home of Estate

Description

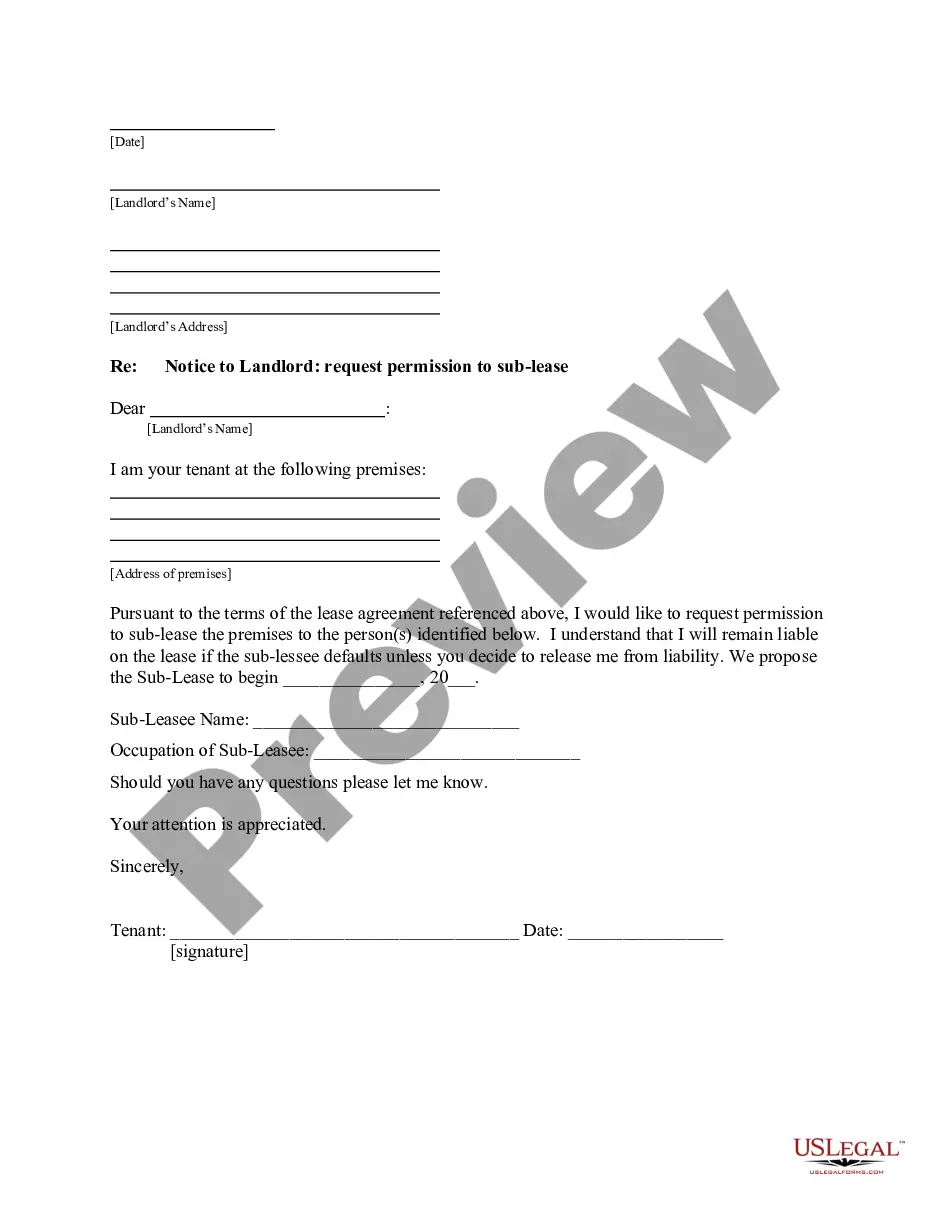

How to fill out Sample Letter For Foreclosed Home Of Estate?

US Legal Forms - one of the greatest libraries of lawful kinds in the United States - delivers an array of lawful document themes you are able to acquire or print. Making use of the web site, you can find 1000s of kinds for enterprise and specific functions, categorized by categories, claims, or key phrases.You can get the most up-to-date models of kinds such as the Nebraska Sample Letter for Foreclosed Home of Estate within minutes.

If you already possess a registration, log in and acquire Nebraska Sample Letter for Foreclosed Home of Estate in the US Legal Forms collection. The Acquire button will appear on every single kind you look at. You have access to all previously delivered electronically kinds in the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, listed below are simple recommendations to obtain started out:

- Make sure you have picked the proper kind for the city/region. Go through the Preview button to examine the form`s information. Browse the kind information to ensure that you have selected the right kind.

- If the kind doesn`t satisfy your needs, utilize the Search discipline on top of the screen to get the one which does.

- When you are pleased with the form, affirm your option by simply clicking the Purchase now button. Then, pick the costs prepare you favor and offer your references to register on an accounts.

- Approach the financial transaction. Make use of your charge card or PayPal accounts to accomplish the financial transaction.

- Choose the format and acquire the form on your gadget.

- Make alterations. Complete, change and print and sign the delivered electronically Nebraska Sample Letter for Foreclosed Home of Estate.

Every template you put into your account lacks an expiry day and is also the one you have forever. So, if you would like acquire or print another version, just visit the My Forms portion and click on around the kind you will need.

Gain access to the Nebraska Sample Letter for Foreclosed Home of Estate with US Legal Forms, probably the most considerable collection of lawful document themes. Use 1000s of skilled and condition-distinct themes that meet your small business or specific requirements and needs.

Form popularity

FAQ

Most Nebraska foreclosures are non-judicial under power of sale in trust or deed, so the civil courts are not involved in the process. Instead, the mortgage holder has to give borrowers notice before any sale of the property can take place.

No Redemption Period After a Foreclosure Sale in Nebraska Some states have a law that gives a foreclosed homeowner time after the foreclosure sale to redeem the property. Under Nebraska law, though, foreclosed homeowners don't get a right of redemption after a nonjudicial foreclosure. The Foreclosure Process and Laws in Nebraska - AllLaw alllaw.com ? articles ? nolo ? nebraska-forec... alllaw.com ? articles ? nolo ? nebraska-forec...

The Nebraska Foreclosure Protection Act protects homeowners from the fraudulent activities of individuals and entities that prey on vulnerable consumers. An individual or company legitimately doing business under the Act will: Require fees for services only after ? the services have been provided.

120 days Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a few exceptions. (12 C.F.R. § 1024.41). This 120-day period provides most homeowners ample opportunity to submit a loss mitigation application to the servicer. Nebraska Foreclosure Laws and Procedures - Nolo Nolo ? legal-encyclopedia ? nebraska... Nolo ? legal-encyclopedia ? nebraska...

Deed of Trust Foreclosure in Nebraska A Notice of Default is filed with the Register of Deeds in the County where your home is located. A copy of the Notice of Default, stamped with the date it was filed with the Register of Deeds, is sent to you by registered or certified mail within ten days after it is filed. Housing - Legal Aid of Nebraska Legal Aid of Nebraska ? ... ? Resources Legal Aid of Nebraska ? ... ? Resources

A deed in lieu of foreclosure is a legal agreement between a homeowner/borrower and a mortgage lender. As the borrower, you agree to give your home's legal title to the lender in exchange for being released from your mortgage debt.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency. Foreclosure: How to Write a Hardship Letter - City of Bloomington MN bloomingtonmn.gov ? sites ? default ? files bloomingtonmn.gov ? sites ? default ? files

Filing a bankruptcy or a lawsuit could stop a foreclosure sale. Talk to a lawyer about your situation to see what is best for you. The most common way to stop a foreclosure is to refinance or modify your mortgage loan to make it more affordable.