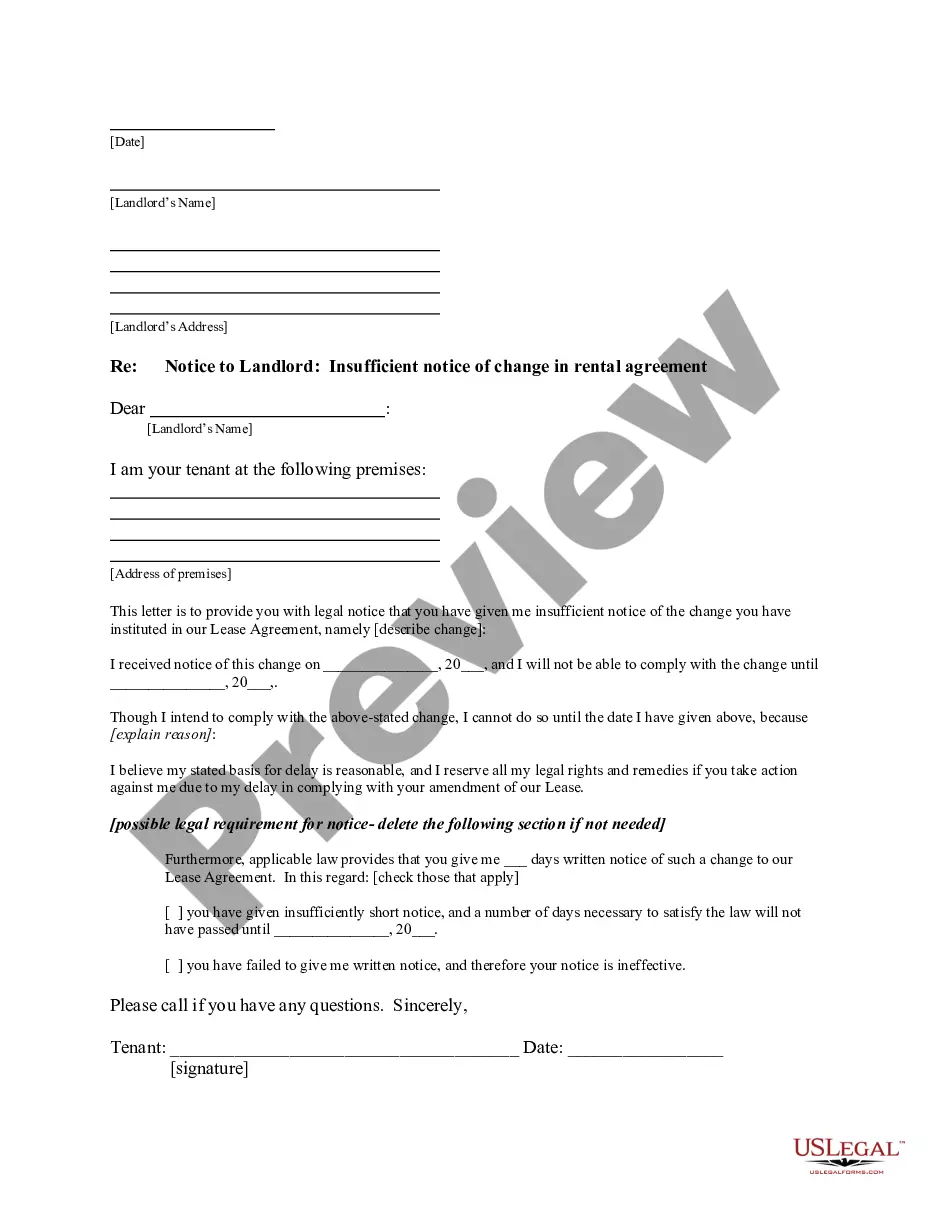

Nebraska Sample Letter for Review of Form 1210

Description

How to fill out Sample Letter For Review Of Form 1210?

Choosing the best legal document web template can be quite a struggle. Of course, there are plenty of web templates available on the net, but how would you discover the legal kind you need? Make use of the US Legal Forms web site. The support provides thousands of web templates, for example the Nebraska Sample Letter for Review of Form 1210, which can be used for business and private requirements. Every one of the types are examined by pros and meet up with state and federal requirements.

Should you be already signed up, log in in your accounts and click the Obtain key to get the Nebraska Sample Letter for Review of Form 1210. Make use of your accounts to appear with the legal types you have ordered in the past. Go to the My Forms tab of your accounts and obtain yet another backup in the document you need.

Should you be a whole new customer of US Legal Forms, listed here are easy guidelines so that you can comply with:

- Very first, make sure you have selected the proper kind for your town/state. You may examine the shape while using Review key and look at the shape description to make certain it will be the best for you.

- If the kind does not meet up with your needs, utilize the Seach discipline to discover the proper kind.

- Once you are positive that the shape would work, go through the Acquire now key to get the kind.

- Choose the costs prepare you need and enter in the essential information and facts. Build your accounts and pay for an order using your PayPal accounts or credit card.

- Pick the data file formatting and download the legal document web template in your product.

- Full, change and produce and signal the acquired Nebraska Sample Letter for Review of Form 1210.

US Legal Forms will be the most significant library of legal types that you will find numerous document web templates. Make use of the service to download professionally-made files that comply with express requirements.