Nebraska Notice of Redemption of Preferred Stock is a legal document that outlines the process by which a company can redeem its preferred stock. Preferred stock refers to a class of stock in a company that usually grants certain privileges, such as priority in dividend payments and liquidation distributions, over common stock. This notice establishes the terms and conditions under which the company can exercise its right to redeem the preferred stocks. There are various types of Nebraska Notice of Redemption of Preferred Stock, including: 1. Mandatory Redemption: This type of notice is triggered by specific events or predetermined dates specified in the preferred stock agreement. The company must redeem the preferred stock at a predetermined price or according to a certain formula. 2. Optional Redemption: With this type, the company has the discretion to redeem the preferred stock at any time or within a specified window of opportunity. The redemption terms, including the redemption price and notice requirements, are typically outlined in the preferred stock agreement. 3. Partial Redemption: In certain situations, a company may choose to redeem only a portion of the outstanding preferred stock. This type of notice specifies the number or proportion of shares to be redeemed and the applicable terms. 4. Full Redemption: This notice covers the complete redemption of all outstanding preferred stock. It provides details on the redemption process, including the redemption price, payment method, and the deadline for stockholders to submit their shares for redemption. When filing a Nebraska Notice of Redemption of Preferred Stock, it is crucial to include all relevant information to ensure compliance. Key elements typically mentioned in the document include: a) Company Information: The legal name and address of the company issuing the notice, as well as its organization number, should be clearly stated. b) Stock Details: The unique identification numbers, class, and series of the preferred stock being redeemed must be provided. Additionally, the total number of shares outstanding and the date of issuance should be mentioned. c) Redemption Terms: The notice should clearly state the redemption price per share, either as a specific amount or as a formula based on certain factors defined in the preferred stock agreement. It should also elaborate on any accrued or unpaid dividends up to the redemption date. d) Notice Period: The required time frame in which the stockholders must surrender their shares for redemption should be specified. This includes the date from which the redemption is effective and the last date for submission. e) Payment Instructions: The notice should include instructions on how the stockholders will receive their redemption payment. This may involve specifying acceptable forms of payment, such as checks or electronic transfers, and providing necessary instructions for initiating the process. f) Contact Information: The notice should provide contact details of the company's official representative handling the redemption process. This includes their name, position, phone number, mailing address, and email address, allowing stockholders to seek clarification or guidance. Compliance with Nebraska state regulations and the terms outlined in the preferred stock agreement is crucial when issuing a Notice of Redemption of Preferred Stock. Seeking professional legal advice during the creation and implementation of this notice is highly recommended ensuring accuracy and adherence to applicable laws and regulations.

Nebraska Notice of Redemption of Preferred Stock

Description

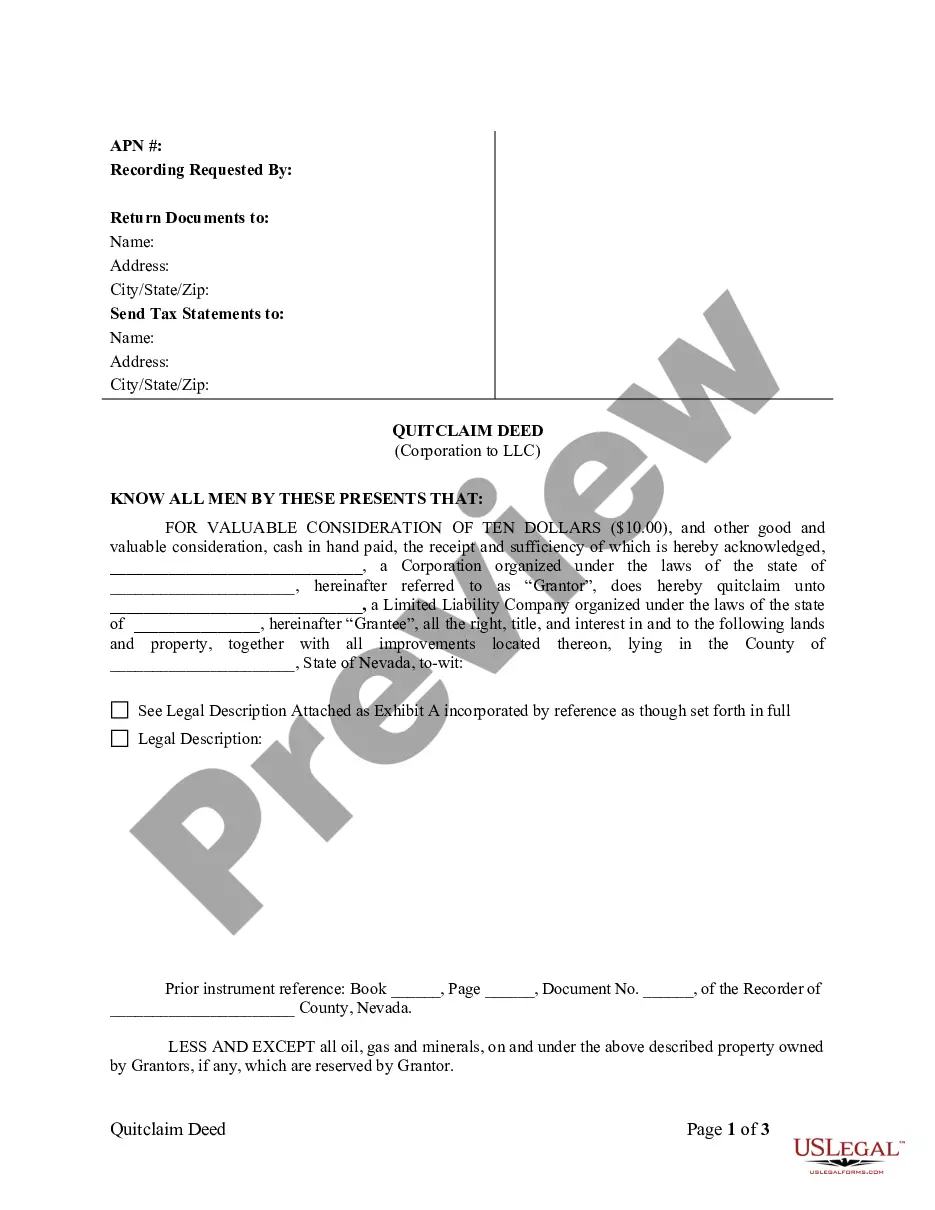

How to fill out Nebraska Notice Of Redemption Of Preferred Stock?

You can invest several hours on-line looking for the authorized record format that meets the federal and state needs you want. US Legal Forms gives thousands of authorized varieties which are reviewed by experts. You can actually down load or printing the Nebraska Notice of Redemption of Preferred Stock from the service.

If you already have a US Legal Forms bank account, you may log in and click on the Down load key. Afterward, you may comprehensive, modify, printing, or indicator the Nebraska Notice of Redemption of Preferred Stock. Every authorized record format you purchase is yours permanently. To have yet another backup of any purchased form, go to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website the very first time, follow the simple recommendations below:

- Initial, ensure that you have selected the right record format to the county/metropolis of your choosing. Read the form explanation to make sure you have selected the right form. If accessible, use the Review key to appear from the record format also.

- If you want to find yet another variation of the form, use the Research discipline to obtain the format that meets your requirements and needs.

- Upon having discovered the format you want, simply click Purchase now to carry on.

- Pick the pricing plan you want, type in your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You should use your credit card or PayPal bank account to cover the authorized form.

- Pick the file format of the record and down load it to the product.

- Make adjustments to the record if needed. You can comprehensive, modify and indicator and printing Nebraska Notice of Redemption of Preferred Stock.

Down load and printing thousands of record templates while using US Legal Forms web site, that provides the largest collection of authorized varieties. Use expert and status-specific templates to take on your small business or specific requirements.

Form popularity

FAQ

Statute. Nebraska recognizes a statutory cause of action for invasion of privacy for the exploitation of a person's ?name, picture, portrait, or personality for advertising or commercial purposes.?

Invasion of privacy; trespass or intrude upon a person's solitude. Any person, firm, or corporation that trespasses or intrudes upon any natural person in his or her place of solitude or seclusion, if the intrusion would be highly offensive to a reasonable person, shall be liable for invasion of privacy.

Annotations. To prove that a defendant has failed, refused, or neglected to provide proper support under this section, the State is not required to prove that a defendant has an ability to pay; however, a defendant may present evidence of inability to pay in order to disprove intent.

Forgery, first degree; penalty. (b) Part of an issue of stock, bonds, bank notes, or other instruments representing interests in or claims against a corporate or other organization or its property. (2) Forgery in the first degree is a Class III felony.

8-1404 Death of decedent; information regarding financial or property interests; furnished; to whom; affidavit; contents; immunity from liability; applicability of section.

(1) A person commits the offense of obstructing a peace officer, when, by using or threatening to use violence, force, physical interference, or obstacle, he or she intentionally obstructs, impairs, or hinders (a) the enforcement of the penal law or the preservation of the peace by a peace officer or judge acting under ...

Criminal possession of a forged instrument; penalty; aggregation allowed; when. (1) Whoever, with knowledge that it is forged and with intent to deceive or harm, possesses any forged instrument covered by section 28-602 or 28-603 commits criminal possession of a forged instrument.

Neb. Rev. Stat. §28-603 defines second-degree forgery as falsely creating, completing, or altering a written document that grants, terminates, or otherwise affects a legal interest or obligation.