Nebraska Sales Consulting Agreement with Independent Contractor

Description

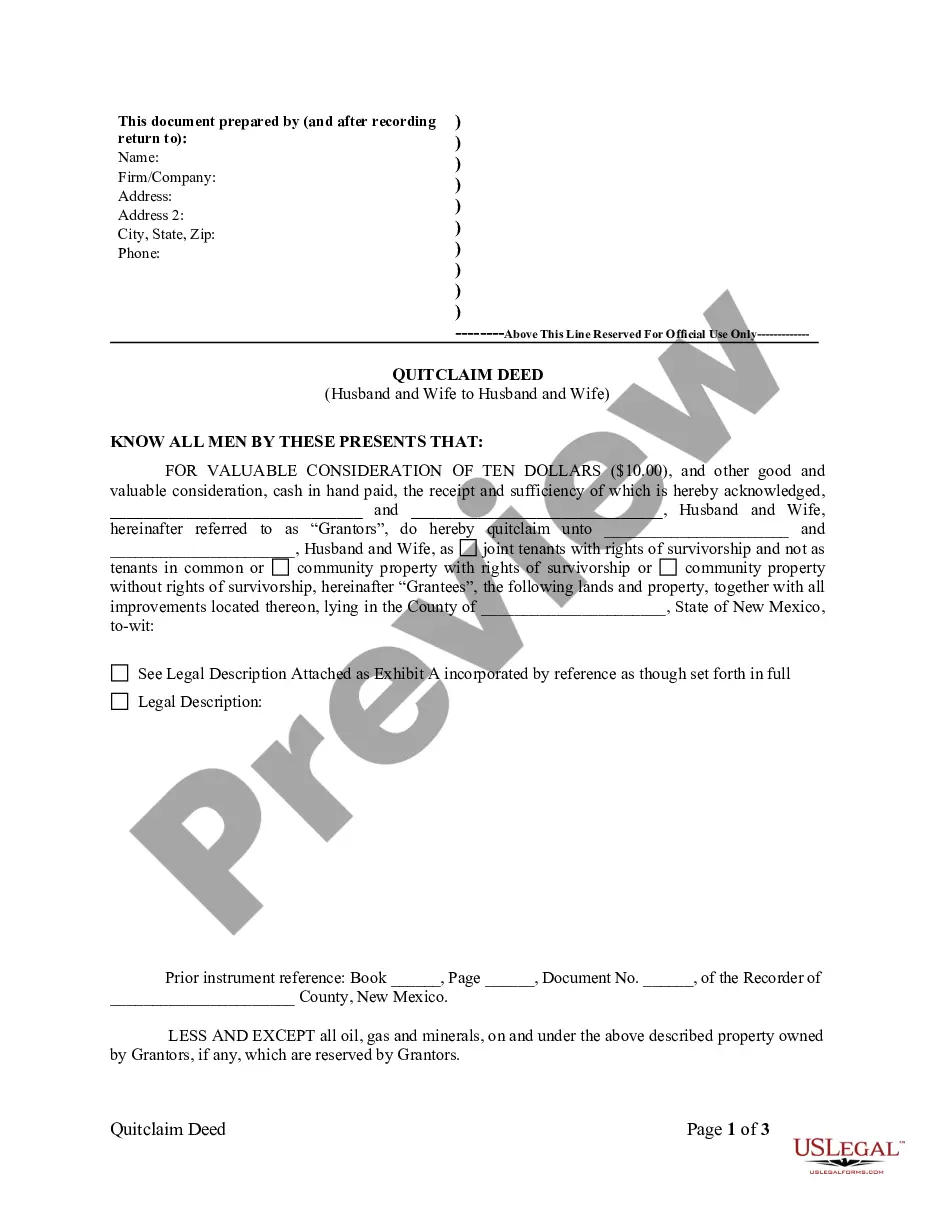

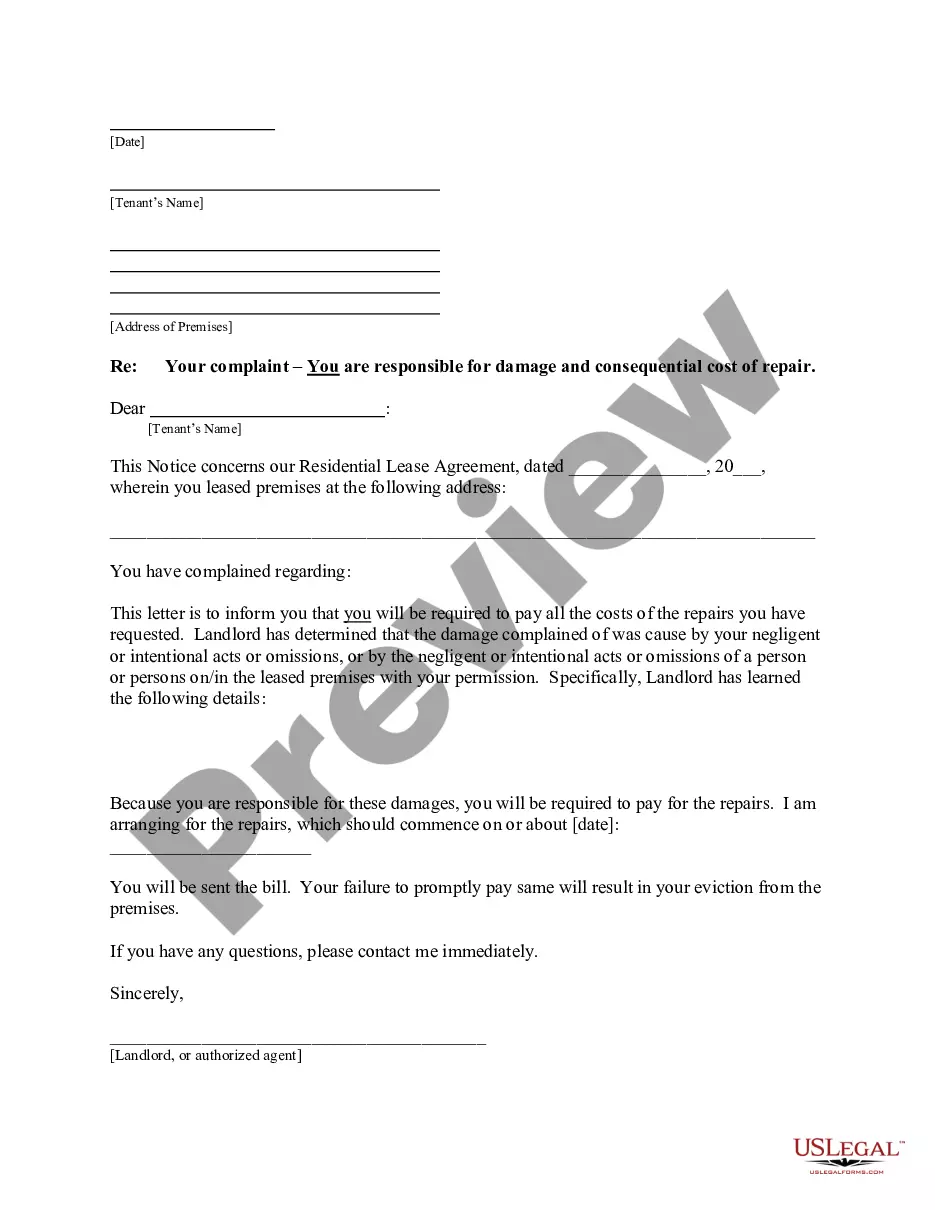

How to fill out Sales Consulting Agreement With Independent Contractor?

If you have to complete, download, or print lawful record templates, use US Legal Forms, the greatest variety of lawful forms, that can be found on-line. Make use of the site`s simple and easy convenient research to obtain the paperwork you require. Different templates for company and person functions are categorized by categories and claims, or keywords. Use US Legal Forms to obtain the Nebraska Sales Consulting Agreement with Independent Contractor within a few mouse clicks.

When you are currently a US Legal Forms client, log in to the profile and click on the Acquire key to get the Nebraska Sales Consulting Agreement with Independent Contractor. You may also accessibility forms you in the past delivered electronically within the My Forms tab of the profile.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the appropriate city/nation.

- Step 2. Utilize the Preview choice to check out the form`s content. Never neglect to read the explanation.

- Step 3. When you are unsatisfied together with the form, use the Lookup field on top of the display to locate other models of your lawful form web template.

- Step 4. When you have identified the shape you require, click the Purchase now key. Select the rates program you choose and add your credentials to register on an profile.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Choose the structure of your lawful form and download it on your product.

- Step 7. Comprehensive, change and print or sign the Nebraska Sales Consulting Agreement with Independent Contractor.

Each and every lawful record web template you buy is the one you have eternally. You might have acces to each form you delivered electronically in your acccount. Click the My Forms area and choose a form to print or download once more.

Contend and download, and print the Nebraska Sales Consulting Agreement with Independent Contractor with US Legal Forms. There are many specialist and express-certain forms you may use to your company or person demands.

Form popularity

FAQ

You may have noticed already that consulting is a type of service. So, put simply, a consultancy agreement is a type of services agreement, specifically tailored between an outside consultant who provides business strategy advice to a client (the business owner).

A consulting agreement is a legally binding document that affirms a client's request for assistance from a consultant. It's a contract detailing the terms of service between a consultant operating as an independent contractor and a client.

Contracts play an essential role in the relationships that consultants have their clients. These legally binding documents tell a client what work you will perform, how long you expect the project to take, what compensation you expect, and more.

What should you include in a consulting contract?Receitals and Background. The recital clause is the opening section of the consulting agreement.Scope of Services.Ownership of Intellectual Property.Compensation, Expenses, and Schedules.Dispute Resolution.Termination of Services.Methods of Communication.Confidentiality.More items...?04-Jan-2021

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Your consulting agreement should include:the commercial details of the specific project, including exactly what services you will provide;a clause outlining when and how much you should be paid;how you and your client will deal with pre-existing and new intellectual property;a dispute resolution process; and.More items...?

Protect yourself: Put your guidelines in writing -- and stick by them. Have a very clear discussion laying out your professional boundaries and ask your client to do the same. Come to an understanding about working hours and response times and agree on how you will schedule calls, meetings, and Skype sessions.

Here is the full list of the components to include in the document:Names of the parties involved.List of all the services the consultant will provide.List of the client's required contributions.Payment and compensation details.Deadlines and timeline details.Details about contract termination.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.30-Apr-2014