Description: The Nebraska Security Agreement in Personal Property Fixtures plays a vital role in securing a commercial loan. This agreement ensures that the lender has a legal claim over the borrower's personal property fixtures, providing an additional layer of collateral for the loan. In Nebraska, there are two primary types of security agreements related to personal property fixtures commonly used in securing commercial loans: 1. General Security Agreement: Also known as a blanket security agreement, this type of agreement grants the lender a security interest in all the borrower's personal property and fixtures, present and future. By securing various types of collateral, including equipment, inventory, and machinery, the lender gains a comprehensive claim on the borrower's assets, providing a stronger sense of security in case of default. 2. Specific Security Agreement: Unlike a general security agreement, a specific security agreement focuses on a particular asset or group of assets. This agreement precisely identifies and describes the specific personal property fixtures that will serve as collateral for the commercial loan. It might encompass fixtures like refrigeration units, lighting fixtures, HVAC systems, or any other property fixture deemed important in the borrower's commercial operation. To create a valid Nebraska Security Agreement in Personal Property Fixtures, specific keywords and elements need to be included: 1. Identification of the parties involved: The agreement should clearly state the names and contact details of both the borrower (debtor) and the lender (secured party), along with any relevant information such as addresses, legal entities, and business names. 2. Detailed description of the collateral: The agreement should provide a comprehensive inventory and description of the personal property fixtures being used as collateral. This includes itemizing fixtures, providing serial numbers, model references, and any additional identifying information. 3. Perfection of security interest: To ensure the lender's claim is legally enforceable, the security agreement requires proper recording or filing through the appropriate governmental agencies. This step is crucial in protecting the lender's interest against competing claims from other creditors. 4. Terms and conditions: The agreement should outline the specific terms and conditions governing the commercial loan, including the loan amount, interest rate, repayment schedule, and any relevant provisions such as default conditions, remedies, and rights. 5. Signature and execution: To make the agreement legally binding, both the borrower and the lender must sign and date the document. It is advisable to have the agreement notarized to enhance its authenticity. By implementing a Nebraska Security Agreement in Personal Property Fixtures, lenders can mitigate the risks associated with commercial loans. Having a properly formalized and recorded agreement safeguards their interests in cases of default or bankruptcy while providing borrowers with the necessary capital to support their commercial ventures.

Nebraska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Nebraska Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

If you wish to comprehensive, obtain, or printing authorized document templates, use US Legal Forms, the most important variety of authorized varieties, which can be found on the web. Make use of the site`s easy and convenient lookup to get the files you require. A variety of templates for organization and individual functions are sorted by types and says, or key phrases. Use US Legal Forms to get the Nebraska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan in just a number of mouse clicks.

When you are previously a US Legal Forms customer, log in to the bank account and then click the Acquire option to get the Nebraska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. You can also entry varieties you formerly downloaded from the My Forms tab of your respective bank account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the form for your right area/country.

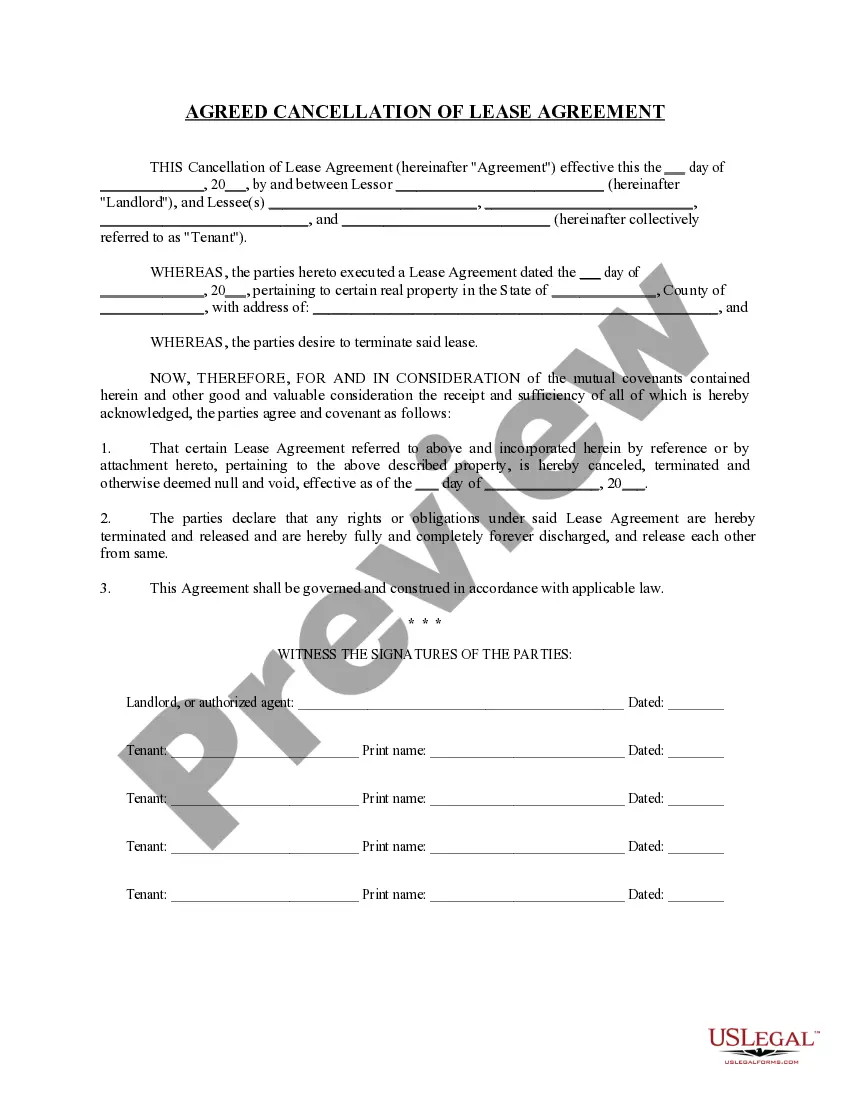

- Step 2. Make use of the Preview choice to check out the form`s content material. Don`t neglect to see the explanation.

- Step 3. When you are unsatisfied using the type, make use of the Research industry at the top of the display screen to locate other types in the authorized type format.

- Step 4. After you have discovered the form you require, select the Buy now option. Opt for the prices program you favor and put your accreditations to register to have an bank account.

- Step 5. Process the deal. You can utilize your bank card or PayPal bank account to perform the deal.

- Step 6. Choose the formatting in the authorized type and obtain it in your product.

- Step 7. Comprehensive, modify and printing or sign the Nebraska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Each and every authorized document format you buy is the one you have forever. You might have acces to each and every type you downloaded inside your acccount. Select the My Forms segment and select a type to printing or obtain yet again.

Be competitive and obtain, and printing the Nebraska Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan with US Legal Forms. There are millions of skilled and status-specific varieties you can use for your personal organization or individual requirements.