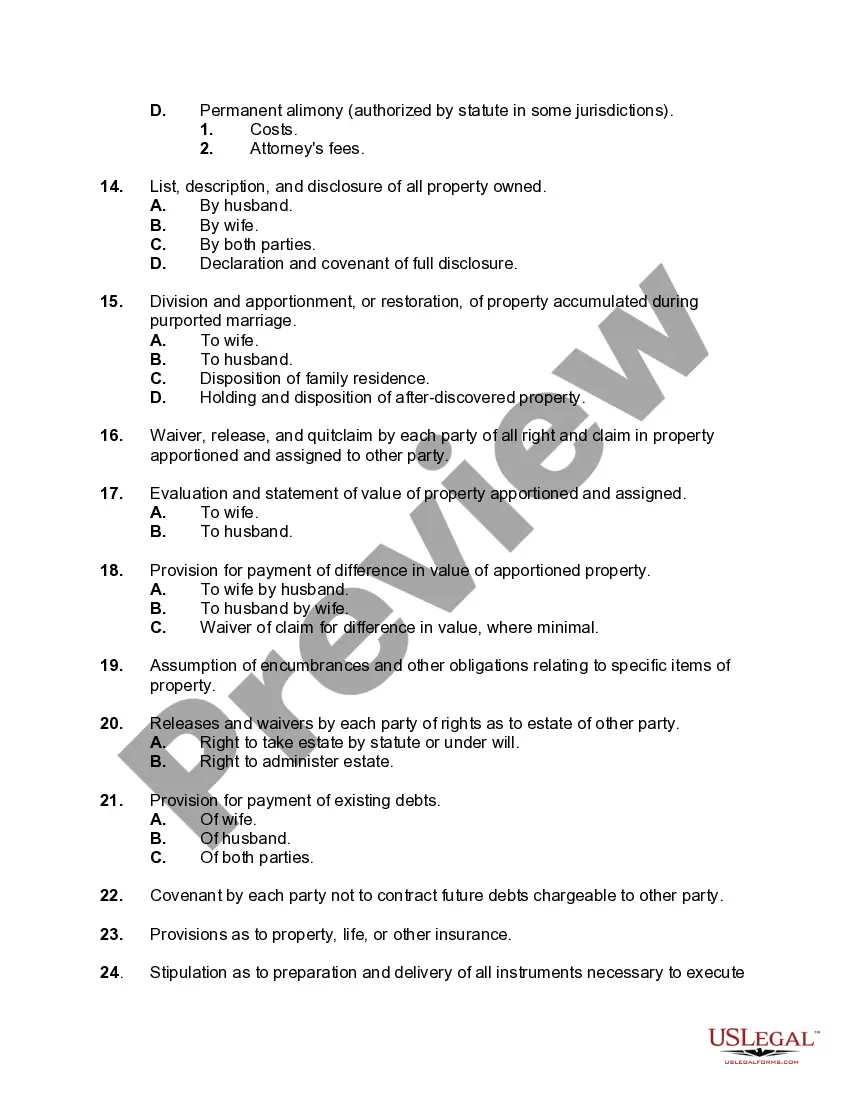

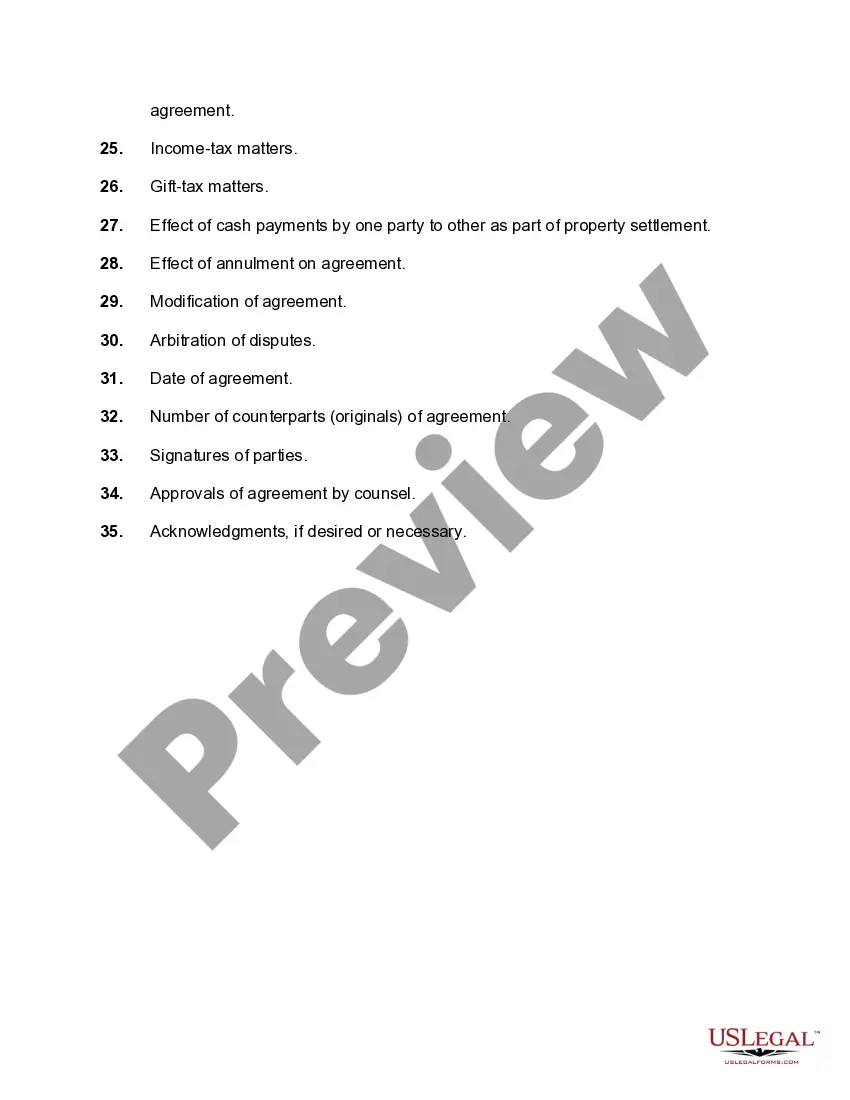

Nebraska Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage: When going through a divorce or annulment in Nebraska, it is essential to carefully consider the division or restoration of property. Nebraska's law provides guidelines and considerations for creating a comprehensive agreement. Here is a detailed description of what to include in your checklist: 1. Identifying and listing all marital property: Begin by compiling a comprehensive list of all the property and assets acquired during the marriage. This includes real estate, vehicles, financial accounts, investments, retirement savings, personal belongings, and any other significant assets. 2. Determining property ownership: Clarify the ownership of each item on the list. Differentiate between marital property, which is jointly owned, and separate property, which belongs to each spouse individually. In Nebraska, assets acquired during the marriage are generally considered marital property, while assets owned before the marriage or acquired by gift or inheritance are often considered separate property. 3. Valuing marital property: Accurately assess the value of each marital asset to ensure a fair division. This may involve obtaining professional appraisals for real estate, vehicles, valuable collectibles, or businesses. As the value of certain assets may fluctuate over time, current evaluations are vital for an equitable distribution. 4. Classifying and valuing debts: Alongside property, debts accumulated during the marriage should also be considered. Compile a list of all outstanding debts, such as mortgages, loans, credit card balances, or vehicle financing. Determine the responsibility for each debt and its corresponding value. 5. Equitable division: Nebraska follows the principle of equitable distribution, meaning marital property is divided fairly but not necessarily equally. When drafting an agreement, consider various factors that influence the division's fairness, including the spouses' financial circumstances, contributions to the marriage, earning capacities, age, health, and other relevant factors. 6. Custody and support considerations: If children are involved, address custody and child support arrangements within the agreement. Detail the custody schedule, decision-making authority, and how expenses related to the children will be covered. Compliance with Nebraska child support guidelines is crucial for court approval. 7. Alimony (spousal support): If one spouse requires financial assistance from the other following the annulment, consider including terms for spousal support within the agreement. Factors such as the duration of the marriage, earning capacities, age, health, and contributions to the marriage are relevant when determining whether and how much alimony should be awarded. 8. Tax implications: Understand and consider the potential tax consequences of the property division. Certain assets, such as retirement accounts, may have tax liabilities upon withdrawal or transfer. Different types of Nebraska Checklists may include: — Checklist for equitable division of property in an annulment — Checklist for restoring property to its original owner in an annulment — Checklist for financial agreements in an annulment proceeding — Checklist for division of marital assets and debts in an annulment — Checklist for addressing child custody and support in an annulment.

Nebraska Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Nebraska Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

Finding the right authorized file template can be quite a have difficulties. Needless to say, there are plenty of themes available on the net, but how do you find the authorized type you want? Use the US Legal Forms site. The support offers a huge number of themes, including the Nebraska Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, which you can use for enterprise and private demands. Every one of the types are examined by experts and satisfy federal and state needs.

When you are presently authorized, log in to your bank account and click on the Obtain switch to get the Nebraska Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage. Use your bank account to look from the authorized types you possess purchased formerly. Visit the My Forms tab of your respective bank account and have another version of the file you want.

When you are a whole new customer of US Legal Forms, listed here are straightforward recommendations for you to follow:

- First, ensure you have chosen the right type for the town/state. You may check out the shape while using Review switch and study the shape description to ensure this is the right one for you.

- In case the type fails to satisfy your expectations, take advantage of the Seach industry to get the appropriate type.

- Once you are positive that the shape is proper, click on the Get now switch to get the type.

- Choose the prices prepare you want and enter the needed information and facts. Make your bank account and pay for the transaction with your PayPal bank account or charge card.

- Pick the submit formatting and obtain the authorized file template to your product.

- Total, modify and print out and indicator the obtained Nebraska Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage.

US Legal Forms is definitely the biggest collection of authorized types where you can find a variety of file themes. Use the company to obtain expertly-produced files that follow state needs.