The Nebraska Master Finance Lease Agreement is a legal document that outlines the terms and conditions between a lessor (financier) and a lessee (business or individual) for the financing of equipment or real estate in the state of Nebraska. This agreement allows the lessee to use the asset for an extended period, typically ranging from 12 to 60 months, in exchange for regular lease payments. Key elements included in the Nebraska Master Finance Lease Agreement include: 1. Parties Involved: The agreement identifies the lessor and lessee, highlighting their legal names, addresses, and contact details. 2. Description of Assets: A comprehensive list of the equipment or real estate being leased is provided, including details such as brand, model, quantity, and any relevant specifications. 3. Lease Terms: This section outlines the duration of the lease, including the lease commencement and termination dates. Additionally, it specifies the lease payment schedule, which may be monthly, quarterly, or annually, and discloses any penalties for late payments. 4. Purchase Option: The agreement often includes a purchase option, giving the lessee the right to buy the leased asset at the end of the lease term at a predetermined price or at fair market value. 5. Maintenance and Repairs: The responsibility for maintaining and repairing the asset is defined, indicating whether it falls under the lessor's or lessee's responsibility. It may also include details on warranty coverage and insurance requirements. 6. Default and Remedies: This section highlights the actions that may be taken if either party breaches the terms of the agreement. It may include penalties, termination rights, and the course of action in case of default. 7. Indemnification and Liability: The agreement addresses issues of indemnification, stating that the lessee agrees to defend, indemnify, and hold harmless the lessor from any claims, damages, or losses arising from the use or possession of the leased asset. Types of Nebraska Master Finance Lease Agreements: 1. Equipment Finance Lease Agreement: This agreement focuses on financing various types of equipment, such as machinery, vehicles, technology, or medical equipment. 2. Real Estate Finance Lease Agreement: This type of agreement is used for financing commercial real estate properties, including office spaces, warehouses, or retail spaces. 3. Vendor Finance Lease Agreement: This agreement is facilitated between a lessor and a vendor/supplier, allowing the vendor to offer financing options to their customers through lease arrangements. 4. Sale and Leaseback Agreement: In this agreement, the lessee sells an owned asset to the lessor and simultaneously enters into a lease agreement to continue using the asset. These various types of Nebraska Master Finance Lease Agreements cater to specific industries, enabling businesses to acquire the necessary assets while preserving their capital and cash flow. It is essential to consult with legal and financial professionals to ensure compliance with Nebraska laws and to customize the agreement according to individual needs and circumstances.

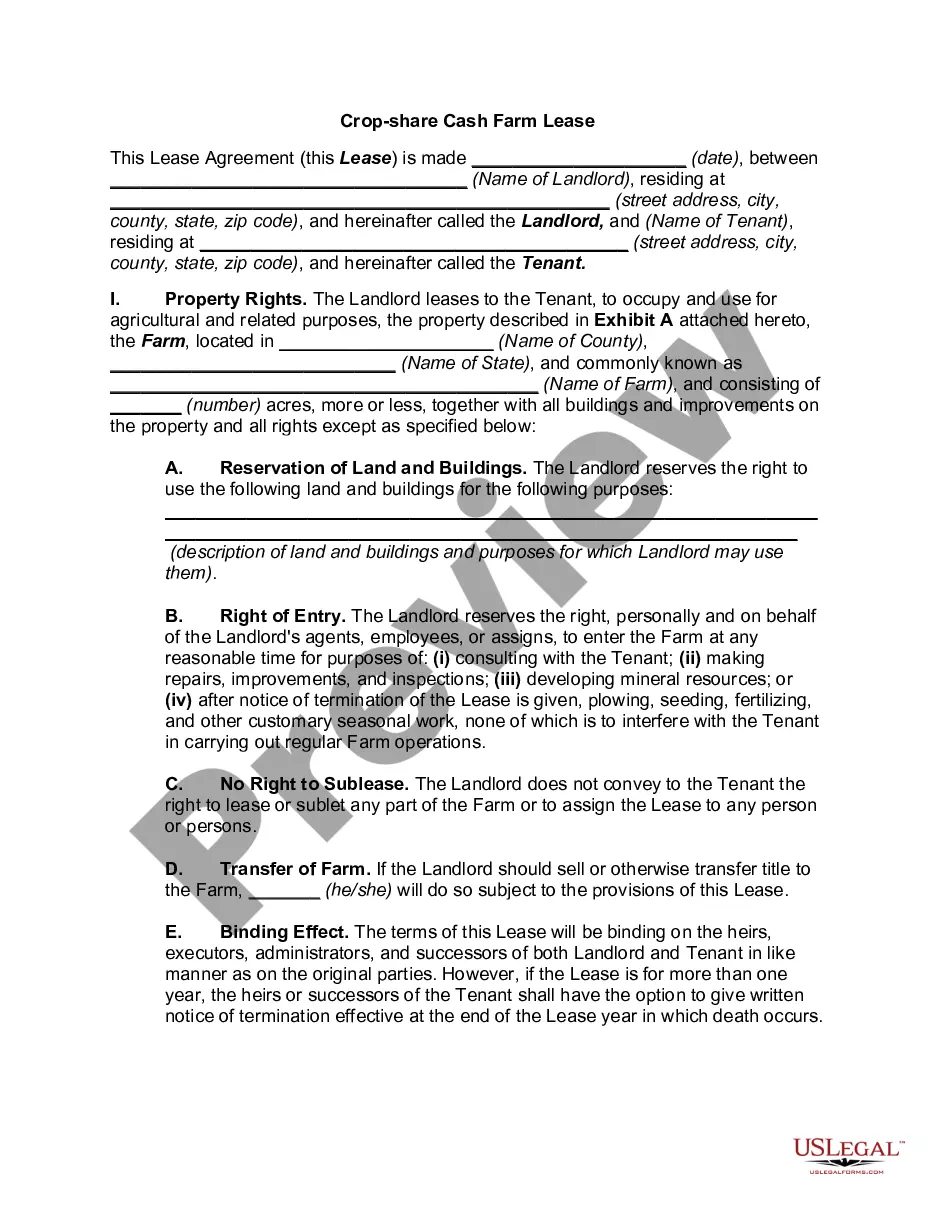

Nebraska Master Finance Lease Agreement

Description

How to fill out Nebraska Master Finance Lease Agreement?

Choosing the right authorized record web template can be a have difficulties. Naturally, there are tons of themes available on the Internet, but how do you discover the authorized form you require? Use the US Legal Forms web site. The support offers a large number of themes, like the Nebraska Master Finance Lease Agreement, which can be used for business and private requirements. All of the types are inspected by specialists and meet up with federal and state requirements.

In case you are presently listed, log in in your accounts and click on the Down load key to obtain the Nebraska Master Finance Lease Agreement. Make use of accounts to appear from the authorized types you may have ordered earlier. Go to the My Forms tab of your accounts and get yet another duplicate in the record you require.

In case you are a new customer of US Legal Forms, listed below are basic instructions that you should stick to:

- First, make certain you have chosen the appropriate form for your personal town/county. You can examine the shape while using Review key and look at the shape description to make certain it will be the right one for you.

- When the form is not going to meet up with your expectations, use the Seach industry to obtain the correct form.

- Once you are sure that the shape would work, go through the Acquire now key to obtain the form.

- Opt for the rates strategy you need and enter in the needed details. Design your accounts and purchase the order utilizing your PayPal accounts or credit card.

- Select the document formatting and acquire the authorized record web template in your device.

- Comprehensive, change and printing and sign the obtained Nebraska Master Finance Lease Agreement.

US Legal Forms is the largest catalogue of authorized types where you can discover different record themes. Use the company to acquire skillfully-created paperwork that stick to state requirements.