Nebraska Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Selecting the finest official document template can be a challenge. Clearly, there are many templates accessible online, but how do you obtain the official form you require? Utilize the US Legal Forms website. The service offers a multitude of templates, such as the Nebraska Private Annuity Agreement, suitable for both professional and personal purposes.

All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the Nebraska Private Annuity Agreement. Use your account to browse the official forms you have previously obtained. Proceed to the My documents section of your account and get another copy of the document you need.

Complete, modify, and print as well as sign the acquired Nebraska Private Annuity Agreement. US Legal Forms is the largest repository of official documents from which you can find numerous file templates. Utilize the service to obtain correctly designed documents that comply with state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

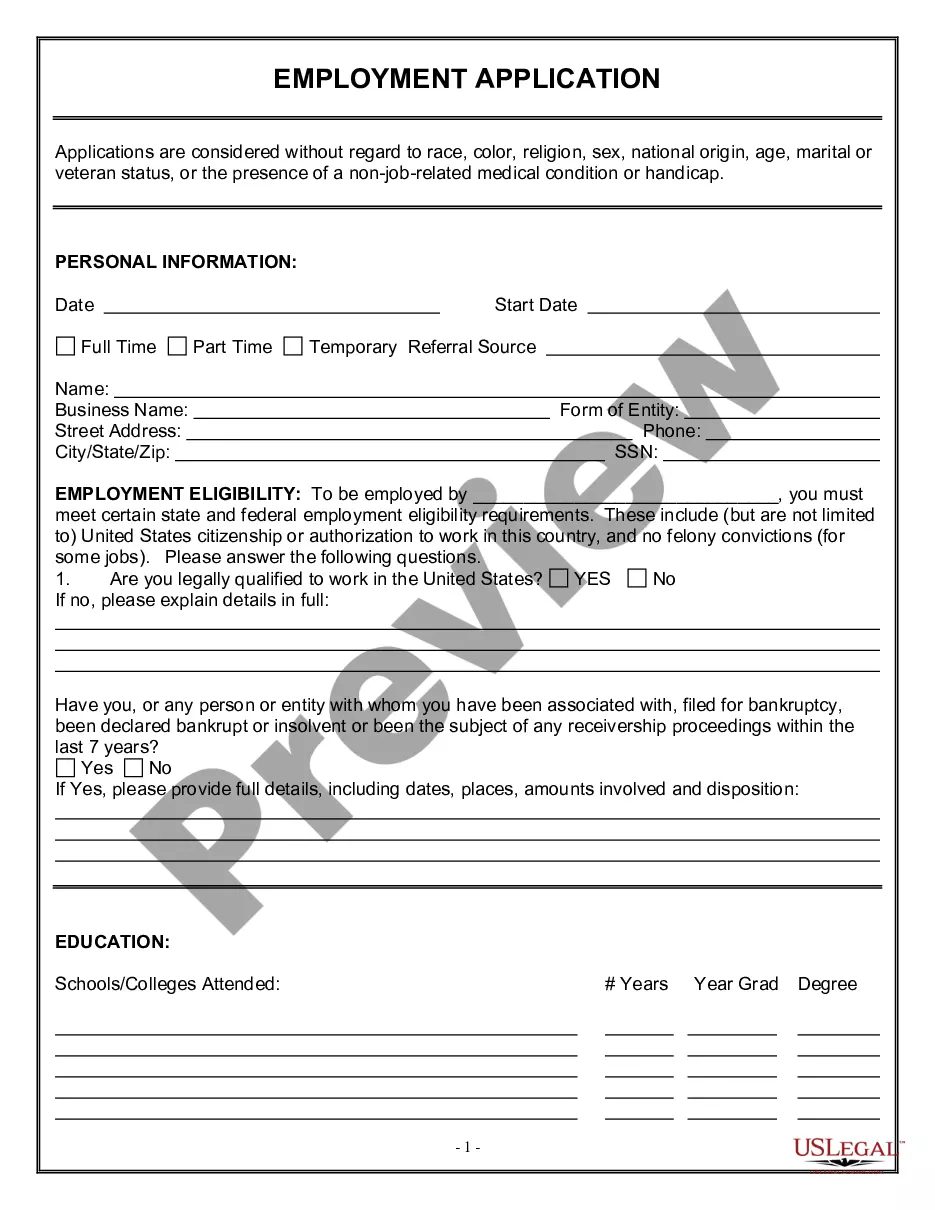

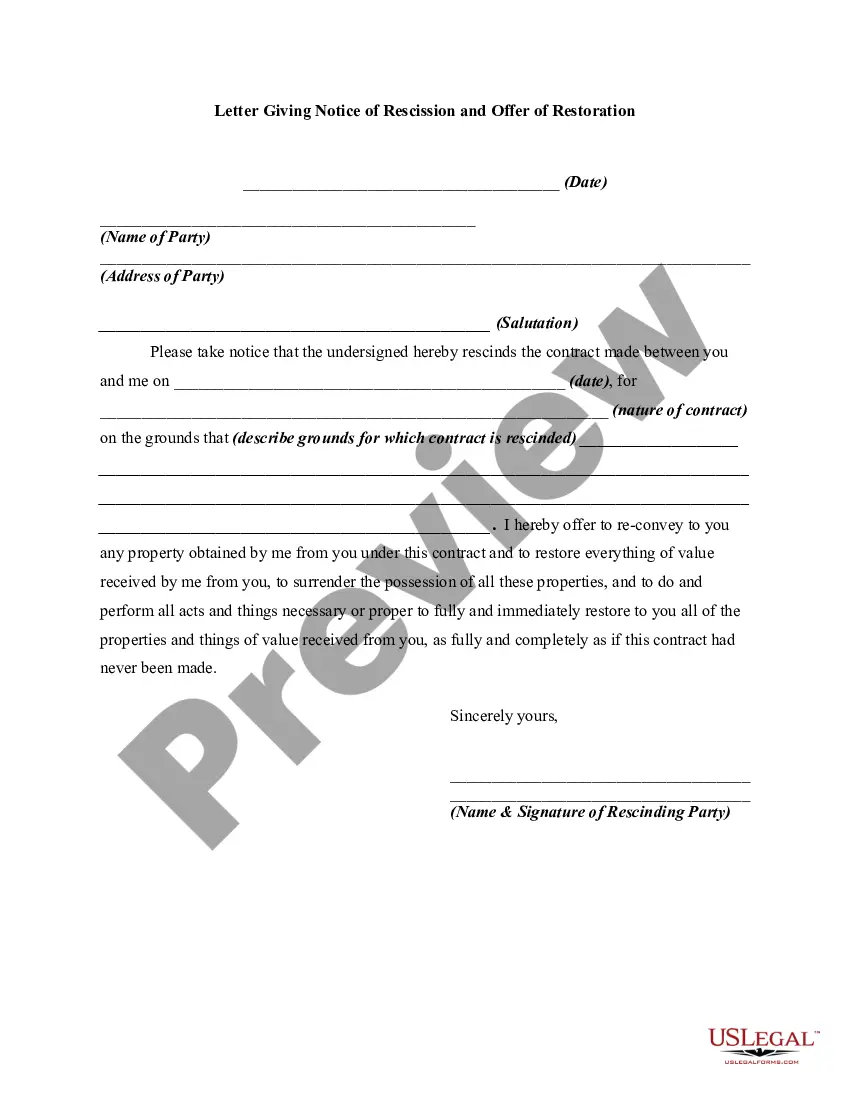

- First, make sure you have selected the appropriate form for your city/state. You can review the form using the Preview button and read the form description to ensure it is indeed the correct one for you.

- If the form does not meet your requirements, use the Search field to find the right form.

- Once you are confident that the form is suitable, click the Purchase now button to obtain the form.

- Choose the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card.

- Select the file format and download the official document template to your device.

Form popularity

FAQ

The monthly payout for a $100,000 annuity can vary based on several factors, including your age, the type of annuity purchased, and the terms of the Nebraska Private Annuity Agreement. Generally, fixed annuities may provide a stable monthly income, while variable annuities may fluctuate based on market performance. To get an accurate estimate, it is advisable to consult with a financial expert who can provide a tailored calculation. This way, you can plan accordingly for your financial future.

Thus, annuity payments to an annuitant who was outliving his life expectancy is taxed as ordinary income. Additionally, the annuity payment must be based on IRS actuarial tables and cannot be related in any way to the amount of income earned by the asset; otherwise, the asset will be included in the annuitant's estate.

For estate tax purposes, the value of property sold for a private annuity is removed from the Annuitant's gross estate.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

Insuring the life of the transferee is an available option; however, any connection of the life insurance policy to the private annuity will be deemed as a secured transaction.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

The owner of the annuity is the person who pays the initial premium to the insurance company and has the authority to make withdrawals, change the beneficiaries named in the contract and terminate the annuity. The annuitant is the person whose life determines the annuity payouts.