Nebraska Product Sales Order Form

Description

How to fill out Product Sales Order Form?

US Legal Forms - a significant source of legal documents in the USA - provides a range of legal paperwork categories that can be downloaded or printed.

Through the website, you can discover thousands of forms for commercial and personal uses, sorted by categories, states, or keywords.

You can obtain the latest documents like the Nebraska Sales Order Form in moments.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

If you are satisfied with the form, verify your choice by clicking the Acquire now button. Then, select the pricing plan you want and provide your information to create an account.

- If you already have a monthly subscription, Log In and download the Nebraska Sales Order Form from the US Legal Forms library.

- The Download option will be available on each form you view.

- You have access to all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to start.

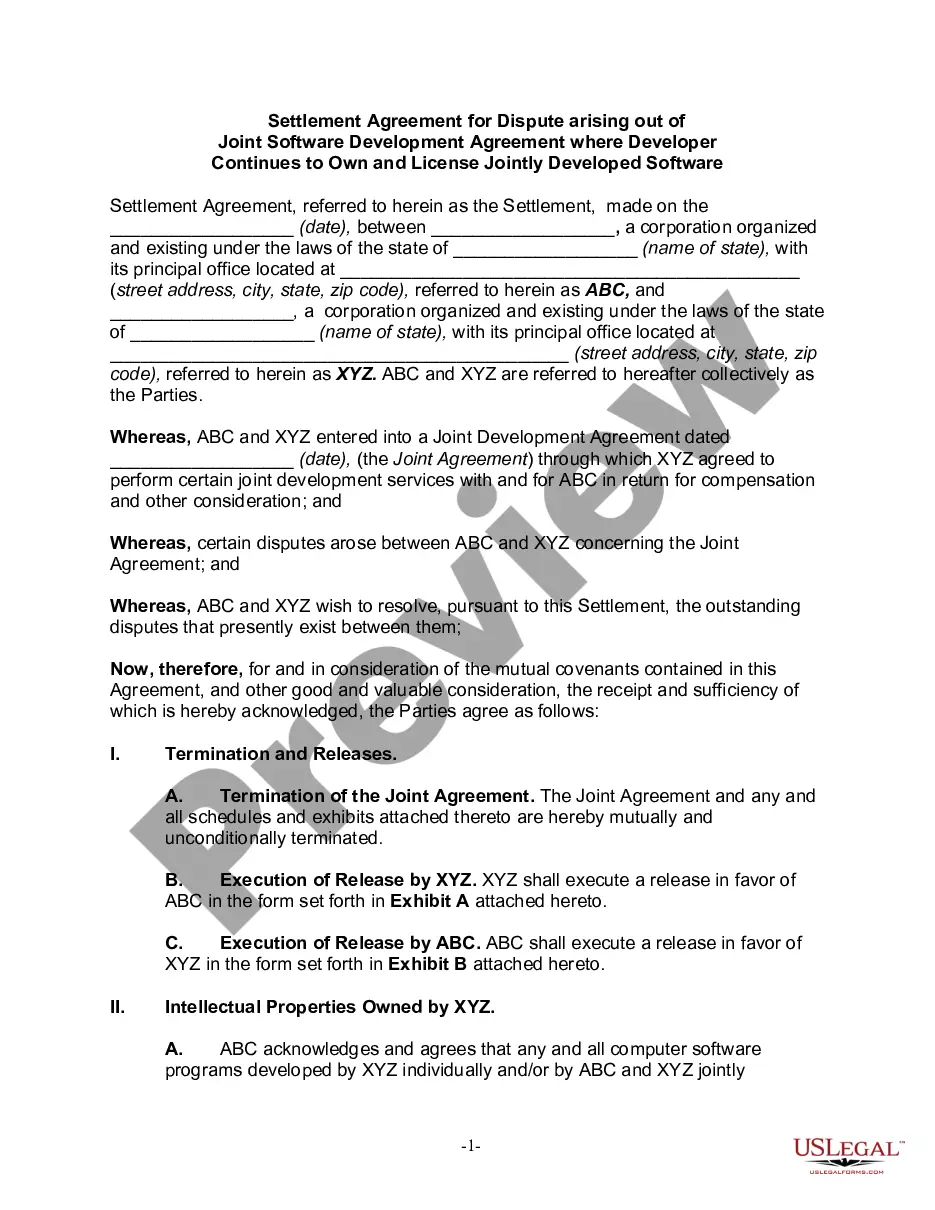

- Ensure you have chosen the correct form for your city/state. Use the Preview option to review the form's contents.

- Examine the form's description to confirm you have selected the appropriate one.

Form popularity

FAQ

To obtain a Nebraska sales tax ID number, you need to register your business with the Nebraska Department of Revenue. This can typically be done online by completing the necessary application forms. After processing your application, you will receive your unique sales tax ID number, which you should include on your Nebraska Product Sales Order Form for all taxable transactions.

The non-resident income tax form for Nebraska is Form 1040N. This form is specifically designed for individuals who earn income in Nebraska but reside in another state. Completing Form 1040N appropriately is crucial for non-residents utilizing the Nebraska Product Sales Order Form for business transactions.

Form 13, Section A, is to be issued by persons or organizations making purchases of property or taxable services in the normal course of their business for the purpose of resale either in the form or condition in which it was purchased, or as an ingredient or component part of other property.

Form 1040N - Individual Income Tax Return.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the

Form 13, Section B, may be completed and issued by governmental units or organizations that are exempt from paying Nebraska sales and use taxes. See this list in the Nebraska Sales Tax Exemptions Chart. Most nonprofit organizations are not exempt from paying sales and use tax.

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

FORM. 17. Section A Purchasing Agent Appointment. Name and Address of Contractor. Name and Address of Exempt Governmental Unit or Exempt Organization.

Nebraska Sales Tax on Cars: The state of NE, like most other states, has a sales tax on car purchases. The Nebraska sales tax on cars is 5%. Money from this sales tax goes towards a whole host of state-funded projects and programs. Registration Fee: The cost to register your car in the state of NE is $15.

6. Form. Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales.