Nebraska Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website.

The service offers a large selection of templates, such as the Nebraska Agreement for Acquiring Stake of Retiring Law Partner, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Nebraska Agreement for Acquiring Stake of Retiring Law Partner. Use your account to browse through the legal forms you may have purchased previously. Proceed to the My documents section of your account and retrieve an additional copy of the document you need.

Complete, modify, print, and sign the obtained Nebraska Agreement for Acquiring Stake of Retiring Law Partner. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted paperwork that meets state requirements.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

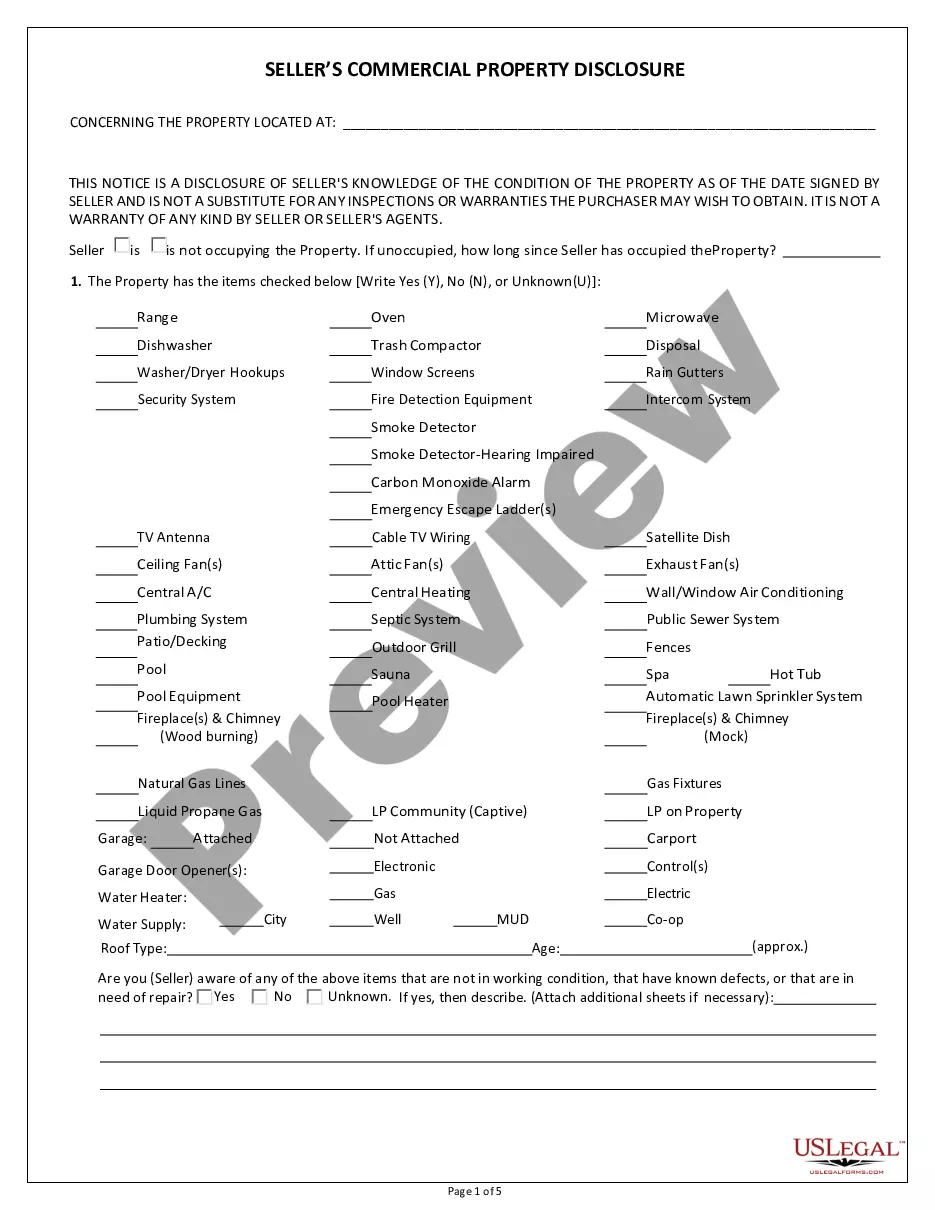

- First, ensure that you have selected the correct form for your jurisdiction. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident the form is correct, click the Buy now button to acquire the form.

- Choose the pricing plan you want and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Solution. The amount due to a retiring partner is settled as per the terms of partnership agreement or otherwise mutually agreed upon either in lumpsum or in instalments.

General Reserve Account Dr. Profit and Loss Account Dr. Alternatively, instead of transferring the entire reserve or profit, only the share of the Retiring Partner may be transferred to the Retiring Partner's Capital Account.

Four methods of payment to retiring partnerLump sum payment of the amount (paid immediately) Retiring Partner's Capital A/c Dr.Transfer of amount due, to his loan account.Part payment of the claim.Payment of retiring partner's loan by annual installments.

When senior partners leave a firm, they sell their equity back to the firm. Unlike most medical practices, which often sell to other doctors, law firms like to retain the partnership structure, so they usually buy back the shares or equity of the departing partner.

Whether they retire early or not, many partners still want to work in some capacity after they retire. What retirement means in this context is a partner gives up his or her equity in the firm and becomes an employee. Typically, retired partners are paid for their personal productivity and for new clients.

Company name, status, and duration.Liability of the partners.Number of owners/control of the business.Capital.Management, decision-making and binding the partnership.Dissolution.Death and disability.Transfer of partnership interests.More items...?

With the admission of a new partner, the partnership firm is reconstituted and a new agreement is entered into to carry on the business of the firm. 2. Right to share the profits of the partnership firm.

Give the journal entry for closing the retiring partner's capital account when his share is paid to him. Give the journal entry for closing the retiring partner's capital account when his share is paid to him privately by the remaining partners.

Retirement of a PartnerFinal Payment to Retiring Partner.Revaluation and Reserves.Treatment of Partners Loan.Calculation of Gaining Ratio.Joint Life Policy Accounting Treatment.

According to the Partnership Act 1932, a new partner can be admitted into the firmonly with the consent of all the existing partners unless otherwise agreed upon. For the right to acquire share in the assets and profits of the partnership firm, the partner brings an agreed amount of capital either in cash or in kind.