Nebraska Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

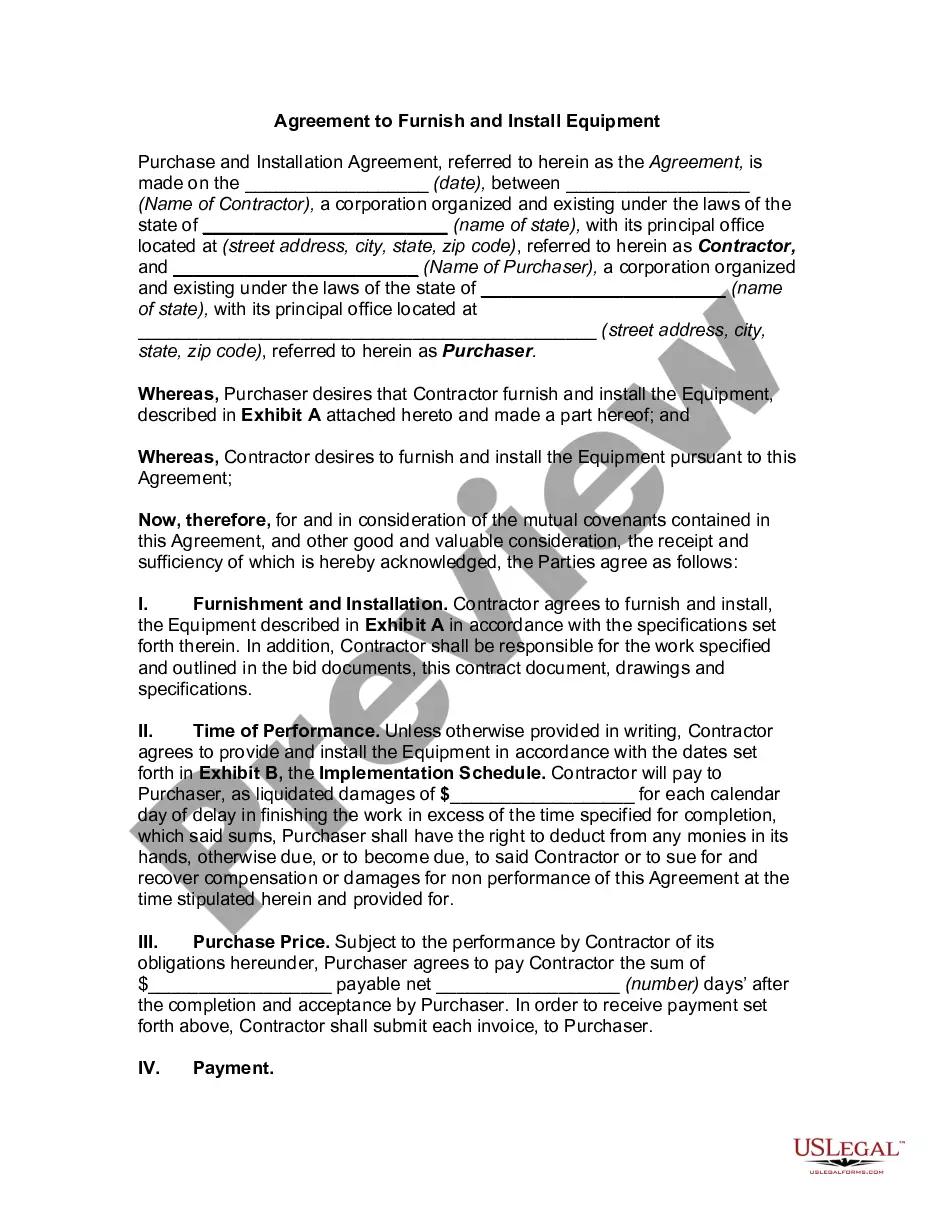

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Are you currently in a position where you require documentation for various business or personal reasons almost daily.

There are numerous legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of form templates, including the Nebraska Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, designed to meet state and federal regulations.

Once you find the appropriate form, click on Get now.

Select a payment plan you prefer, fill in the required information to set up your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Nebraska Liquidation of Partnership with Sale of Assets and Assumption of Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/area.

- Use the Preview button to examine the form.

- Review the details to ensure you have selected the correct document.

- If the form isn’t what you are seeking, use the Search area to find the form that meets your needs.

Form popularity

FAQ

Yes, when a partnership is dissolved, its assets must be liquidated to settle outstanding liabilities. This process is a fundamental aspect of the Nebraska Liquidation of Partnership with Sale of Assets and Assumption of Liabilities. Liquidation ensures that all financial obligations are satisfied before any remaining assets are distributed to the partners. Therefore, navigating this process carefully is crucial for a successful dissolution.

If the partnership realized a loss, credit the income section and debit each partner's capital account based on his or her share of the loss. Credit each partner's drawing account and debit each partner's capital account for the balance in that same partner's drawing account.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Definition: Partnership liquidation is the process of closing the partnership and distributing its assets. Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Liquidation of Partnership Property Provided the liquidation terminates your entire interest in the partnership, your tax basis in the distributed property is equal to your adjusted basis in the partnership interest minus the cash distributed to you.