Nebraska Notice to Seller — Confirmation of Sale to Merchant is a legal document that serves as an acknowledgement and agreement between a seller and a merchant regarding the sale of goods in Nebraska. This notice provides important details about the transaction, ensuring transparency and protection for both parties involved. Keywords: Nebraska, Notice to Seller, Confirmation of Sale, Merchant, legal document, acknowledgement, agreement, goods, transaction, transparency, protection. Types of Nebraska Notice to Seller — Confirmation of Sale to Merchant: 1. General Nebraska Notice to Seller — Confirmation of Sale to Merchant: This is the standard form used in Nebraska for confirming the sale between a seller and a merchant. It includes essential information about the goods sold, sales terms and conditions, payment details, and delivery arrangements, assuring both parties of the transaction's specific terms. 2. Nebraska Notice to Seller — Confirmation of Sale to Merchant (Conditional): This type of notice is used when the sale to a merchant is subject to certain conditions, such as the approval of financing, inspections, or other contingencies. It allows the seller and merchant to outline the specific conditions that must be met for the sale to proceed. 3. Nebraska Notice to Seller — Confirmation of Sale to Merchant (Bulk Sales): In cases where a merchant purchases goods in bulk from a seller, this type of notice is utilized. It includes additional information required by Nebraska law for bulk sales, such as details about the inventory being sold, any liens or encumbrances, and compliance with legal requirements. 4. Nebraska Notice to Seller — Confirmation of Sale to Merchant (Consignment): When a seller consigns goods to a merchant for sale on their behalf, this notice is used. It outlines the consignment agreement terms, including the responsibilities of both parties, sale proceeds distribution, liability, and return of unsold items. 5. Nebraska Notice to Seller — Confirmation of Sale to Merchant (Installment): In cases where the sale between a seller and a merchant is structured as an installment sale with payment in multiple installments, this notice type is used. It includes specific details about the payment schedule, interest rates, any late fees, and conditions for default or prepayment. Please note that these are general types of Nebraska Notice to Seller — Confirmation of Sale to Merchant, and specific situations may require customized forms to accurately reflect the details and conditions of the sale transaction.

Nebraska Notice to Seller - Confirmation of Sale to Merchant

Description

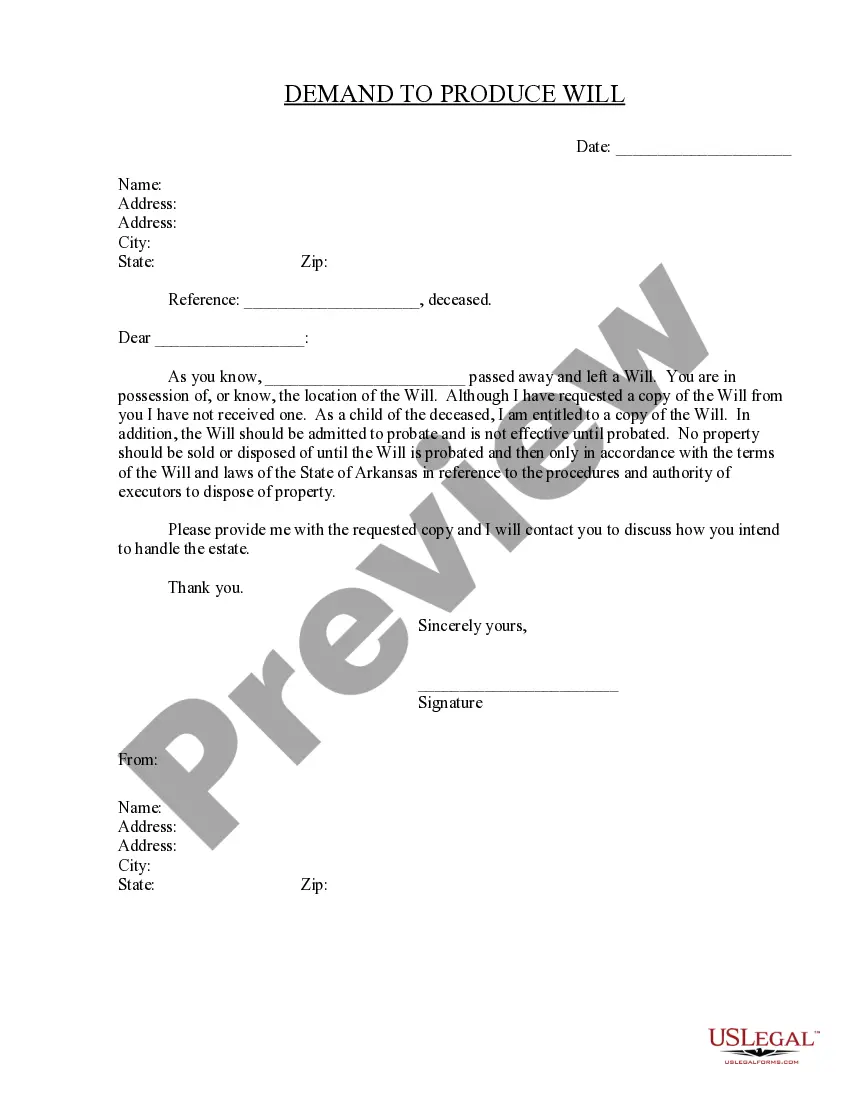

How to fill out Nebraska Notice To Seller - Confirmation Of Sale To Merchant?

If you need to total, acquire, or printing authorized file themes, use US Legal Forms, the greatest assortment of authorized kinds, which can be found online. Take advantage of the site`s easy and practical lookup to find the files you need. Various themes for enterprise and personal purposes are sorted by classes and states, or keywords. Use US Legal Forms to find the Nebraska Notice to Seller - Confirmation of Sale to Merchant in just a few clicks.

If you are already a US Legal Forms buyer, log in in your profile and then click the Down load option to get the Nebraska Notice to Seller - Confirmation of Sale to Merchant. You can even gain access to kinds you formerly acquired inside the My Forms tab of your profile.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape to the right metropolis/region.

- Step 2. Make use of the Preview choice to examine the form`s articles. Don`t neglect to read the information.

- Step 3. If you are unhappy together with the form, use the Search industry towards the top of the monitor to find other variations in the authorized form format.

- Step 4. When you have located the shape you need, click on the Acquire now option. Pick the prices strategy you prefer and add your qualifications to sign up on an profile.

- Step 5. Process the purchase. You can use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Select the structure in the authorized form and acquire it on your own device.

- Step 7. Total, revise and printing or signal the Nebraska Notice to Seller - Confirmation of Sale to Merchant.

Every authorized file format you buy is your own permanently. You have acces to every form you acquired in your acccount. Go through the My Forms segment and pick a form to printing or acquire once more.

Remain competitive and acquire, and printing the Nebraska Notice to Seller - Confirmation of Sale to Merchant with US Legal Forms. There are millions of professional and state-particular kinds you may use for your enterprise or personal requirements.

Form popularity

FAQ

Summary. The Uniform Commercial Code (UCC) is a comprehensive set of laws governing all commercial transactions in the United States. It is not a federal law, but a uniformly adopted state law. Uniformity of law is essential in this area for the interstate transaction of business.

Yes. If the contract involves the sale of goods for $500 or more, then the contract must be in writing to be enforceable. Under the statute of frauds, a contract that involves the sale of goods will be required to be made in writing in order to be enforceable if the price of those goods is over $500.

Do all contracts have to be in writing? Typically, unless it is required by law, contracts do not have to be in writing to be legally acceptable.

The "merchant's exception" provision of U.C.C. § 2-201(2) breaks down. into six discrete elements: 1) the sale must be between merchants; 2) the confir- mation must have been "received" by the other merchant; 3) the confirmation. must be received "within a reasonable time;" 4) the merchant receiving the con-

Merchant's Exception (UCC 2-201 (2)): If you and your Buyer are both merchants, and you sent him something in writing memorializing the oral agreement (some courts consider detailed invoices sufficient), and he did not object, the oral contract is enforceable.

Contracts that cannot be performed within one year must be in writing. However, any contract with an indefinite duration does not need to be in writing. Regardless of how long it takes to perform the duties of the contract, if it has an indefinite duration, it does not fall under the Statue of Frauds.

Generally speaking, the UCC requires that any contract for the sale of goods with a price of $500 or more must be in writing.

Most contracts can be either written or oral and still be legally enforceable, but some agreements must be in writing in order to be binding. However, oral contracts are very difficult to enforce because there's no clear record of the offer, consideration, and acceptance.

UCC 1-103(b) states that the principles of law and equity can be used to supplant the interpretation of UCC unless they were specifically excluded or displaced.

UCC 1-308 states: A party that with explicit reservation of rights performs or promises performance or assents to performance in a manner demanded or offered by the other party does not thereby prejudice the rights reserved. Such words as without prejudice, under protest, or the like are sufficient.