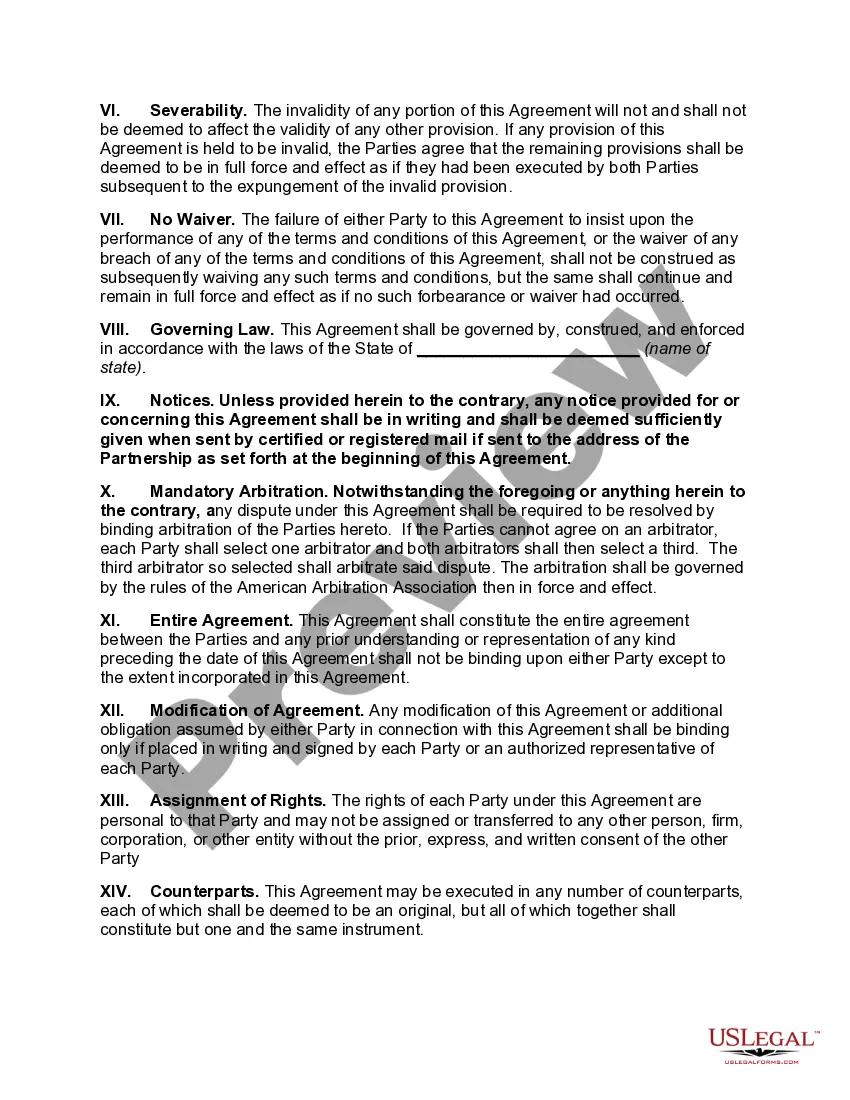

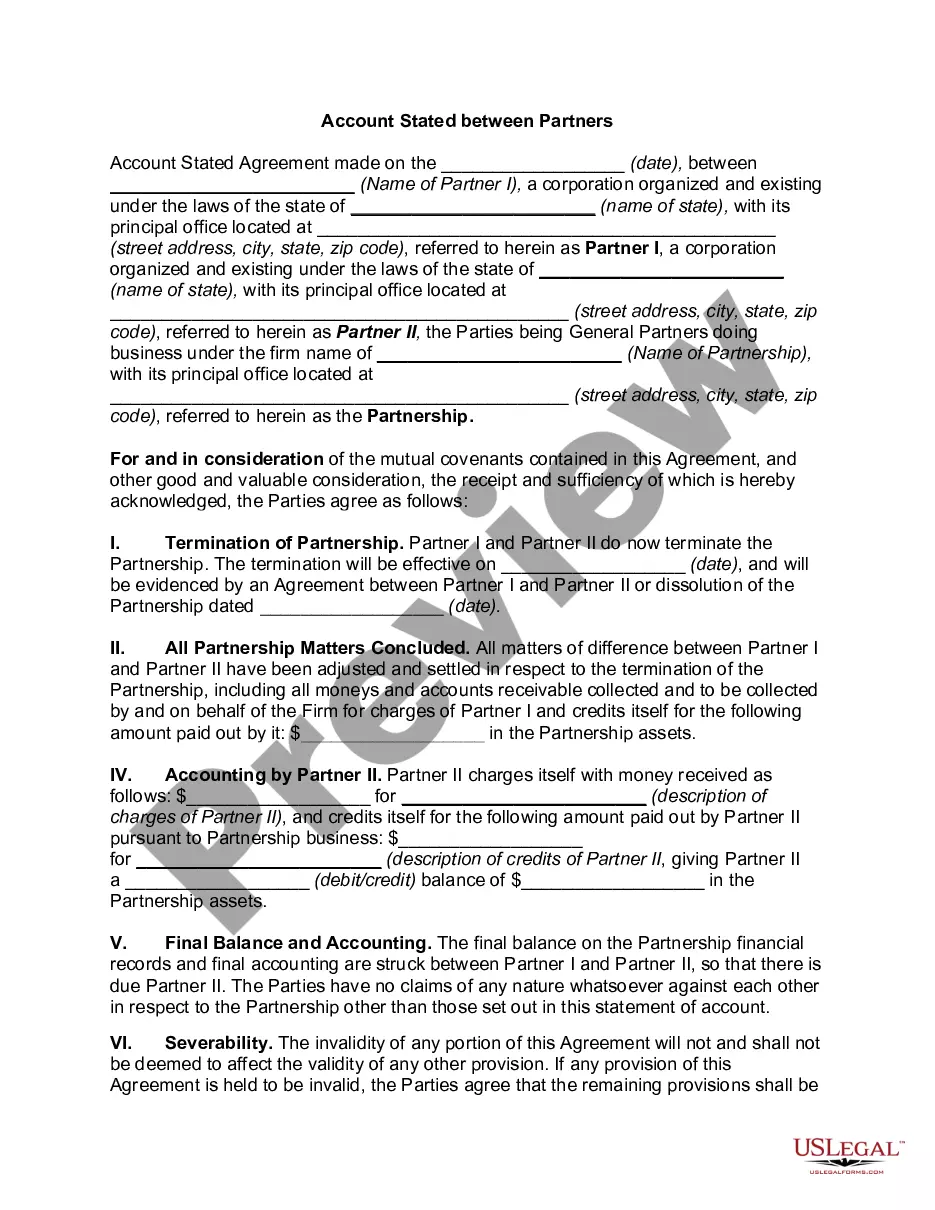

Nebraska Account Stated Between Partners and Termination of Partnership

Description

How to fill out Account Stated Between Partners And Termination Of Partnership?

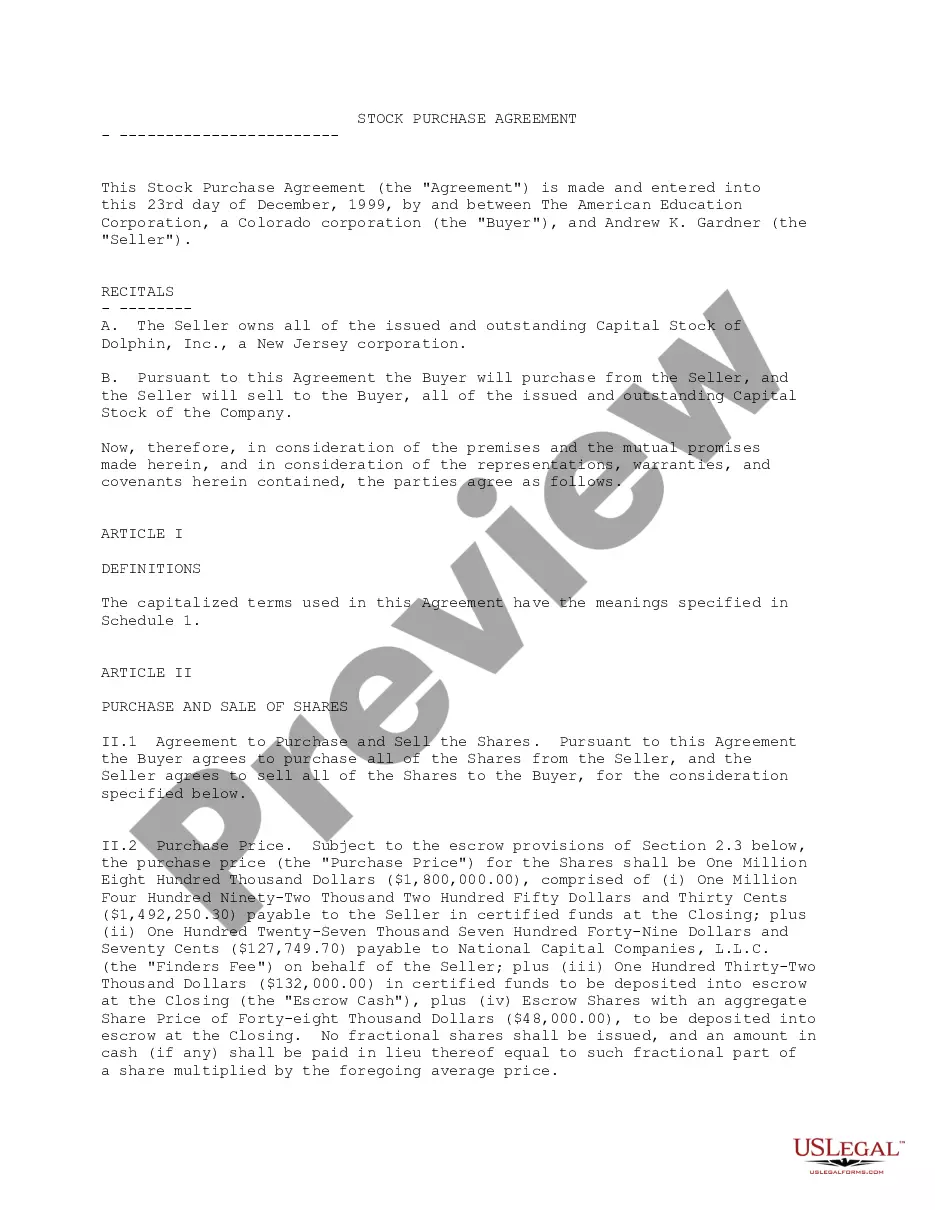

Are you presently in the placement the place you need to have paperwork for either business or person purposes just about every day? There are a lot of authorized file templates available on the Internet, but getting kinds you can rely isn`t effortless. US Legal Forms delivers a large number of form templates, such as the Nebraska Account Stated Between Partners and Termination of Partnership, which are created to satisfy federal and state demands.

If you are already informed about US Legal Forms website and also have a free account, just log in. Next, it is possible to down load the Nebraska Account Stated Between Partners and Termination of Partnership format.

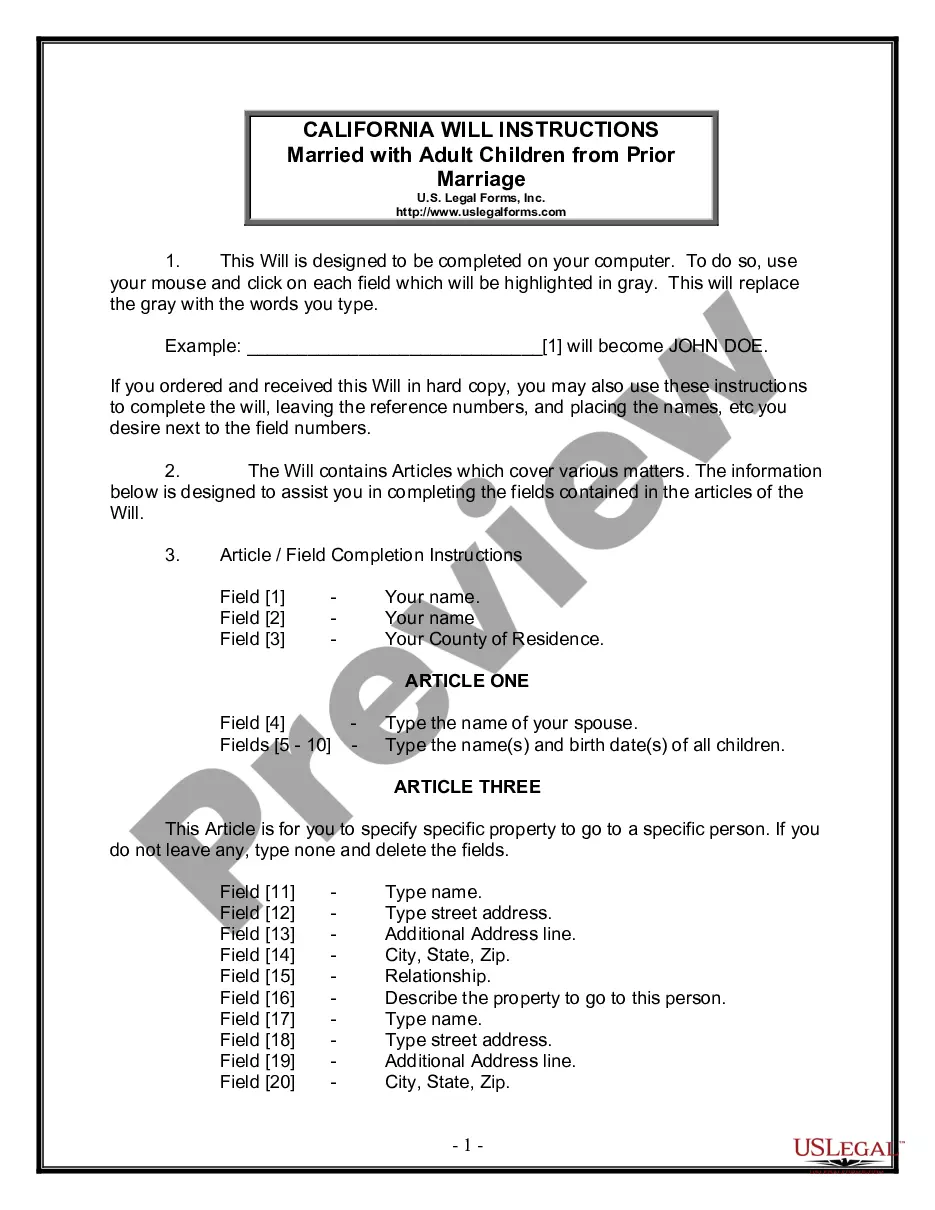

If you do not offer an profile and need to start using US Legal Forms, follow these steps:

- Get the form you require and make sure it is to the appropriate metropolis/state.

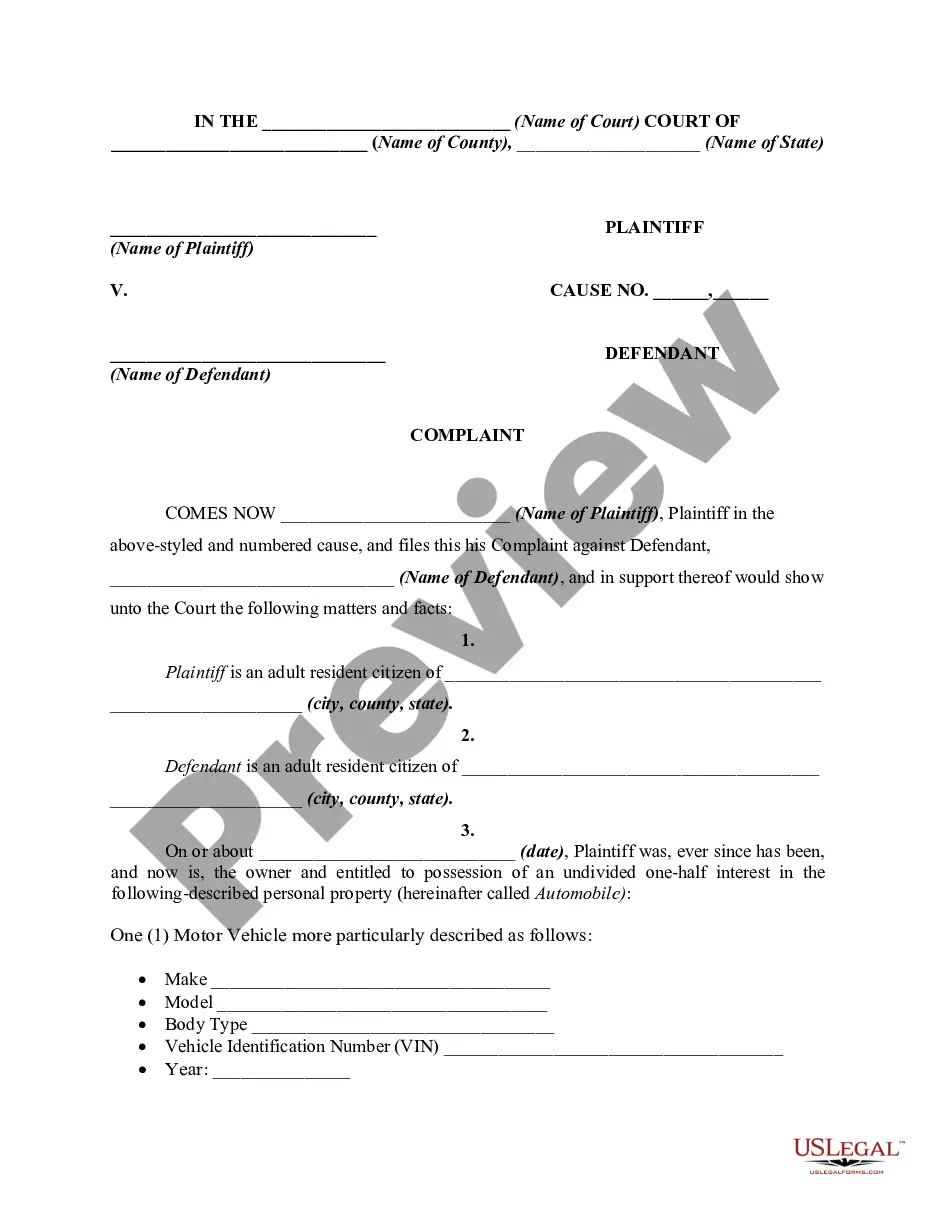

- Utilize the Preview key to review the form.

- See the outline to ensure that you have chosen the appropriate form.

- In the event the form isn`t what you are seeking, use the Lookup field to discover the form that fits your needs and demands.

- If you obtain the appropriate form, click Buy now.

- Pick the pricing prepare you need, complete the specified details to produce your bank account, and buy the transaction using your PayPal or charge card.

- Choose a practical paper file format and down load your duplicate.

Find all the file templates you may have bought in the My Forms menu. You can obtain a additional duplicate of Nebraska Account Stated Between Partners and Termination of Partnership at any time, if possible. Just click on the essential form to down load or produce the file format.

Use US Legal Forms, one of the most considerable variety of authorized types, to save some time and stay away from blunders. The support delivers skillfully created authorized file templates that can be used for a range of purposes. Create a free account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

5 steps to dissolve a partnership. Dissolving a partnership includes reviewing your agreement, discussing the situation with your partner, preparing dissolution papers, closing accounts, and then communicating the change to relevant parties. How to dissolve a partnership | ? articles ? how-to-dissolv... ? articles ? how-to-dissolv...

The easiest and the most hassle-free method to dissolve a partnership firm is by mutual consent or an agreement. A partnership firm may be discontinued with the approval of all the partners or by a contract between the partners. A partnership is formed by a contract and may be terminated using a contract itself. Section 189 - Dissolution of Partnership Firm - IndiaFilings indiafilings.com ? learn ? section-189-dissol... indiafilings.com ? learn ? section-189-dissol...

Sometimes, partners come to a mutual agreement to dissolve the partnership. This can be done without involving any legal formalities. It's important to create a written agreement between the partners that outlines how partnership assets and liabilities will be divided.

Nebraska Criminal Statute of Limitations at a Glance Nebraska has no time limit for the state to file charges of murder, treason, arson, or forgery, but most felonies carry a three-year statute of limitations. There's an 18-month time limit for most misdemeanors.

Rightful dissolution can occur, for example, with the express will of any partner in an at-will partnership, or through the express will of all partners who have not had their interests assigned or had them assigned to a charging order. Termination: Rightful, Wrongful, or Neither, and What are Implications? tremblylaw.com ? termination-rightful-wrongful-... tremblylaw.com ? termination-rightful-wrongful-...