Nebraska Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

Locating the appropriate authorized document template can pose a challenge. Clearly, there is an abundance of templates accessible online, but how do you identify the authorized template you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Nebraska Declaration of Gift with Signed Acceptance by Donee, suitable for business and personal purposes. All templates are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Nebraska Declaration of Gift with Signed Acceptance by Donee. Use your account to browse through the authorized templates you have accessed previously. Navigate to the My documents section of your account to download another copy of the document you need.

US Legal Forms is the largest repository of authorized templates where you can find numerous document designs. Leverage the service to download professionally crafted papers that adhere to state requirements.

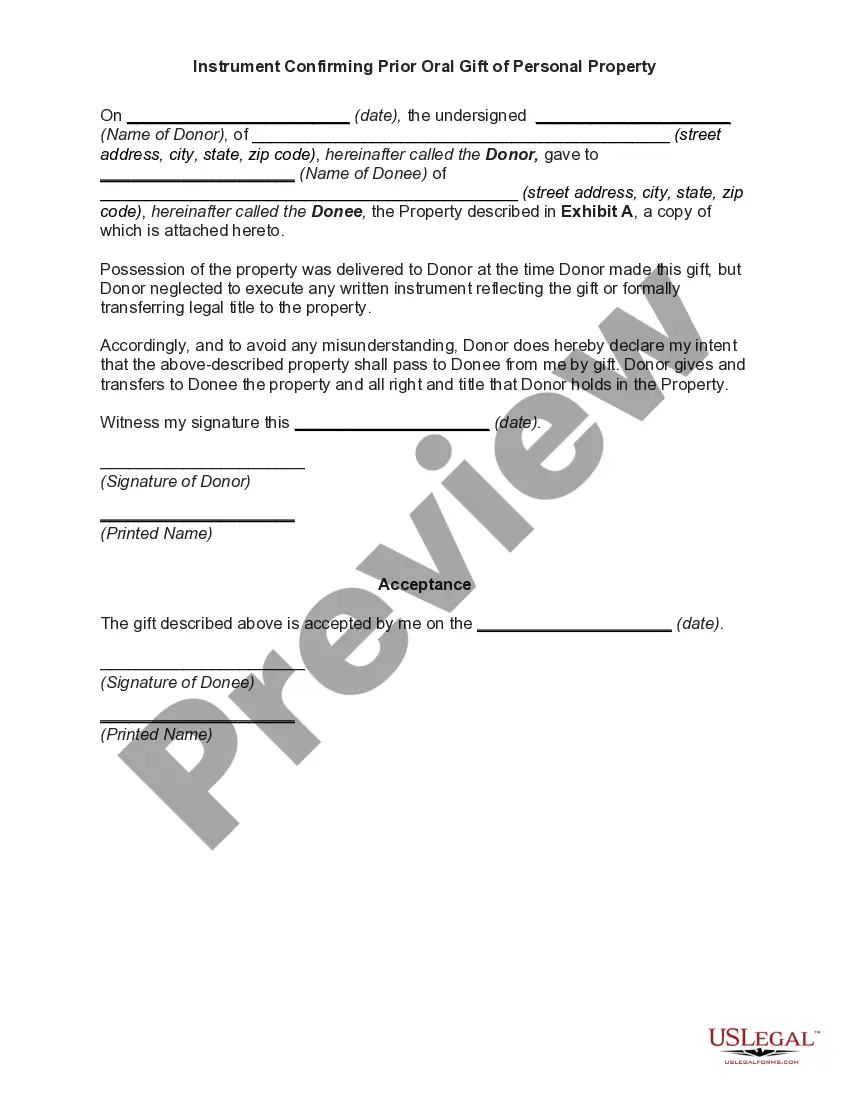

- First, ensure you have chosen the correct template for your city/county. You can preview the document using the Review button and read the document description to confirm it's the right fit for you.

- If the template does not meet your needs, utilize the Search section to locate the appropriate document.

- Once you are confident that the document is suitable, click the Purchase now button to acquire the template.

- Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the authorized template to your device.

- Complete, modify, print, and sign the Nebraska Declaration of Gift with Signed Acceptance by Donee.

Form popularity

FAQ

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the

Gifted Vehicles: Transfer or registration of vehicle received as gift. The car title has to include the word gift instead of the purchase price, and form REG 256 has to be completed. If you truly received a vehicle as a gift, you're not required to pay taxes on it in California.

Do you have to pay taxes on a gifted car in Nebraska? You won't need to pay taxes for any vehicle received as a gift in Nebraska.

A Certificate of Title must be obtained by the buyer within 30 days of the date of purchase. Application for title is made with an Application for Certificate of Title and presented to a County Treasurer along with the appropriate $10.00 titling fee. The County Treasurer then issues a title to the new owner.

If you gift a car, you may be responsible for paying gift tax on it. While the requirements differ every year, for 2019, a gift tax is necessary if the fair market value of the car is more than $15,000 for a single person or $30,000 for a married couple. The gift tax can be anywhere from 18% to 40%.

6. Form. Amended Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales.

Does a bill of sale have to be notarized in Nebraska? Yes. Both the buyer and the seller need to sign the bill of sale in the presence of a notary.

The state income tax table can be found inside the Nebraska Form 1040N instructions booklet. The Nebraska Form 1040N instructions and the most commonly filed individual income tax forms are listed below on this page. Preparation of your Nebraska income tax forms begins with the completion of your federal tax forms.

Nebraska requires a simple proof of identity and address and your driver's license will suffice. You will need proof of ownership of the vehicle and a completed application for a title. If you need help with how to fill out transfer of title form, you may contact your local Dept. of Motor Vehicle office.

In the state of Nebraska, you are required to present specific documentation and payment to initiate a vehicle title transfer. In this state, you must have a vehicle title, vehicle inspection form, and other documentation, in addition to fees that must be paid during an NE vehicle title transfer.