Nebraska Unrestricted Charitable Contribution of Cash

Description

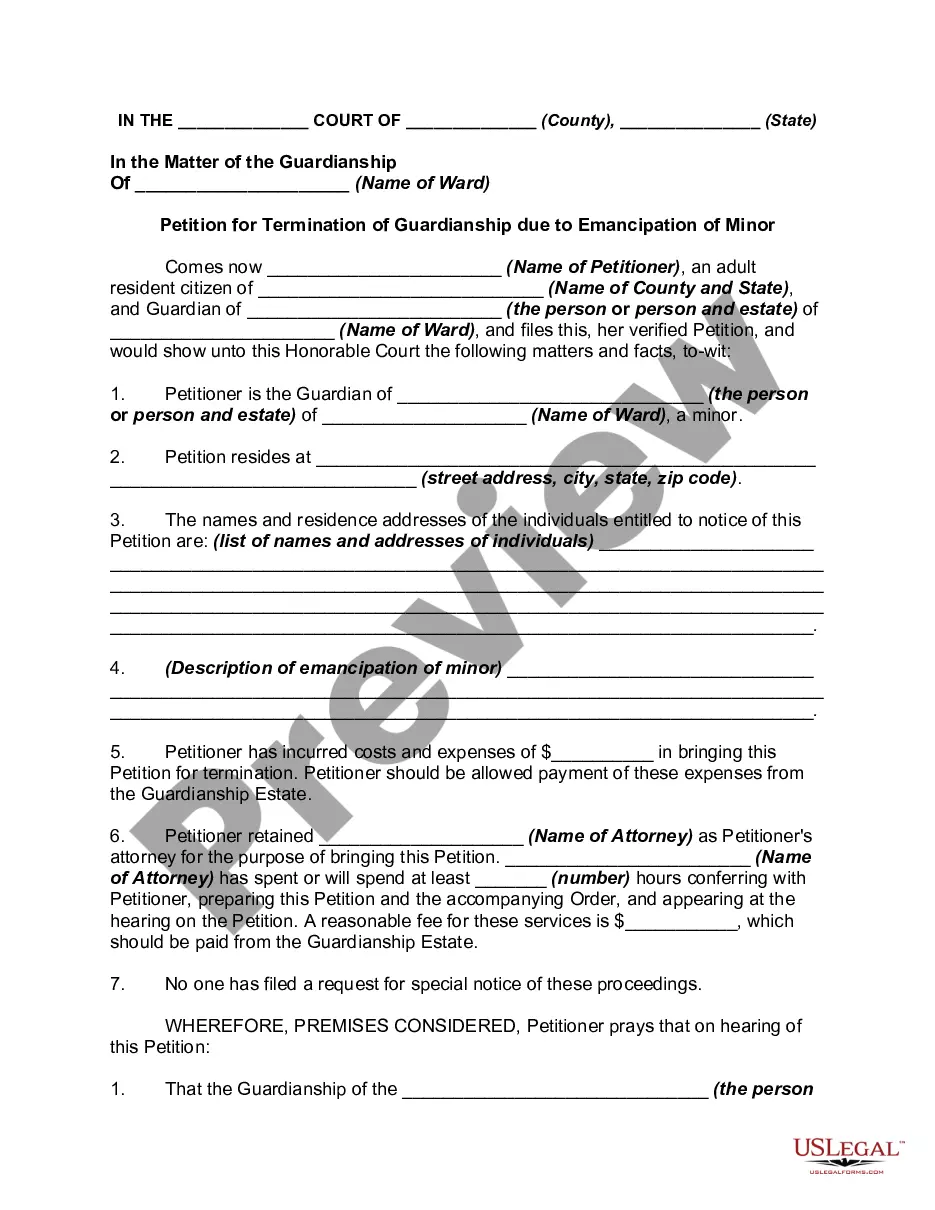

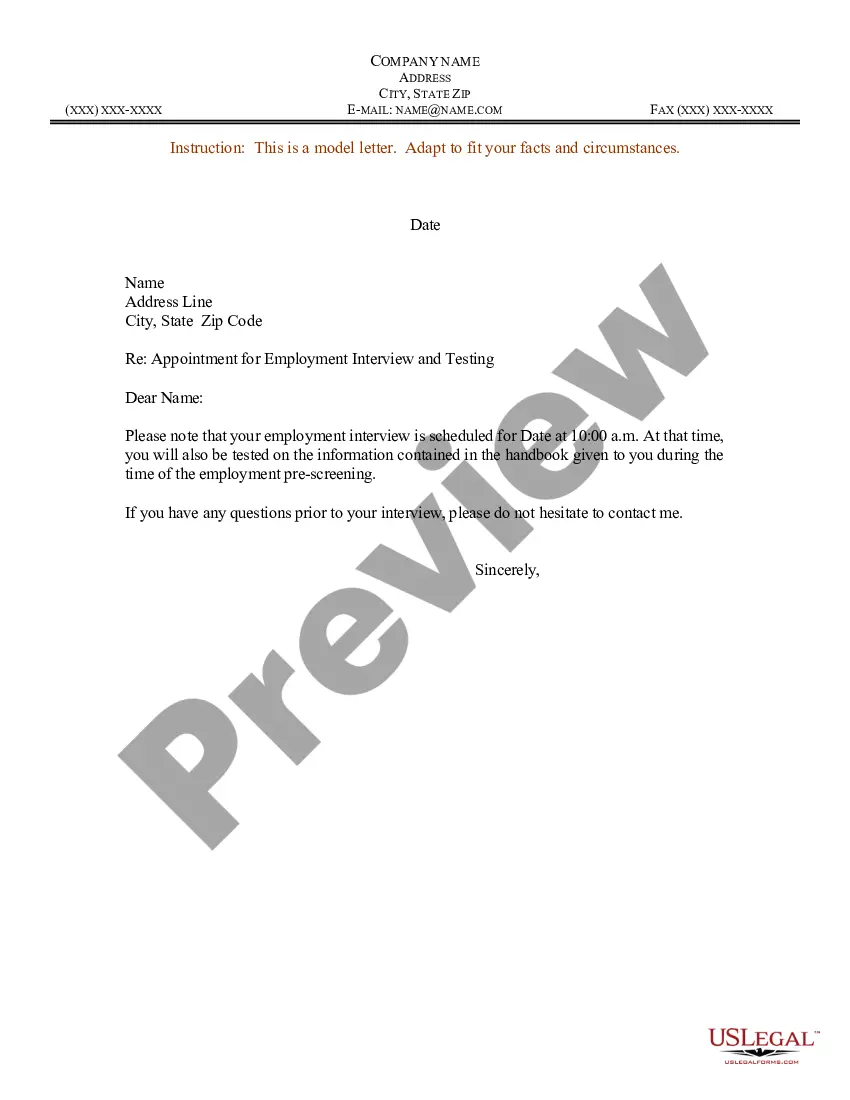

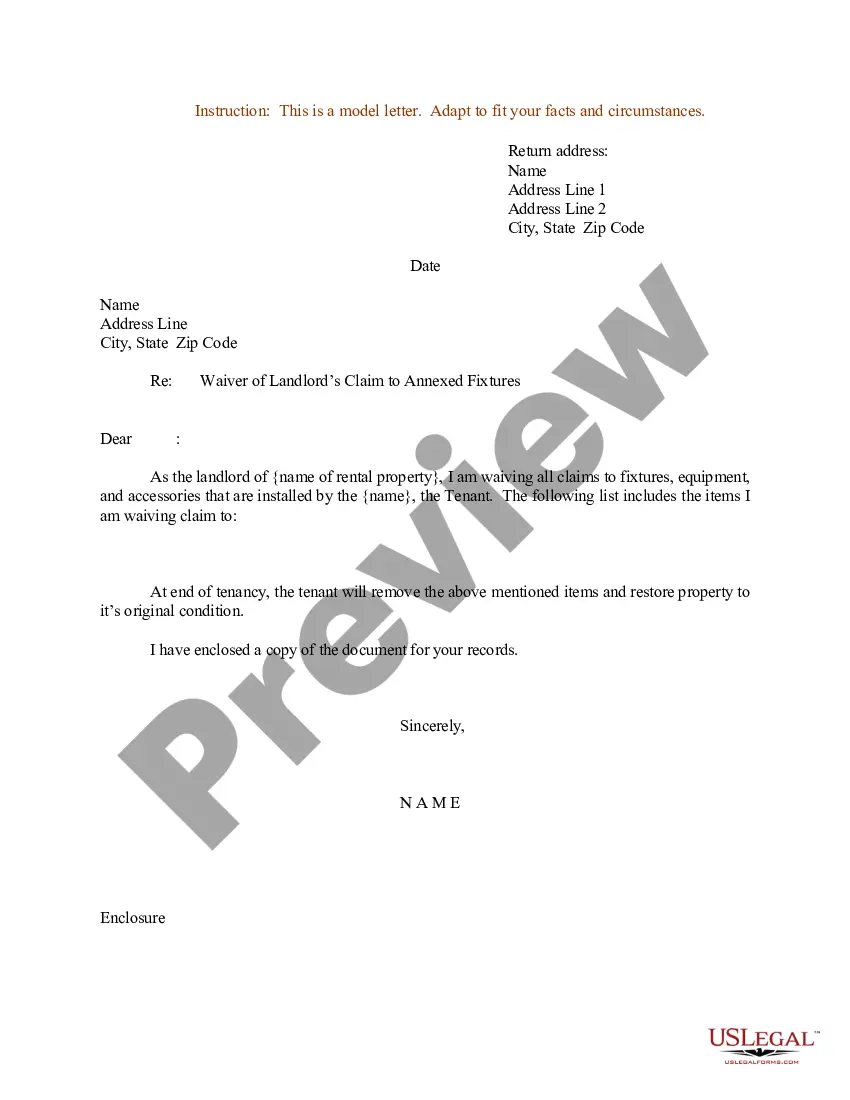

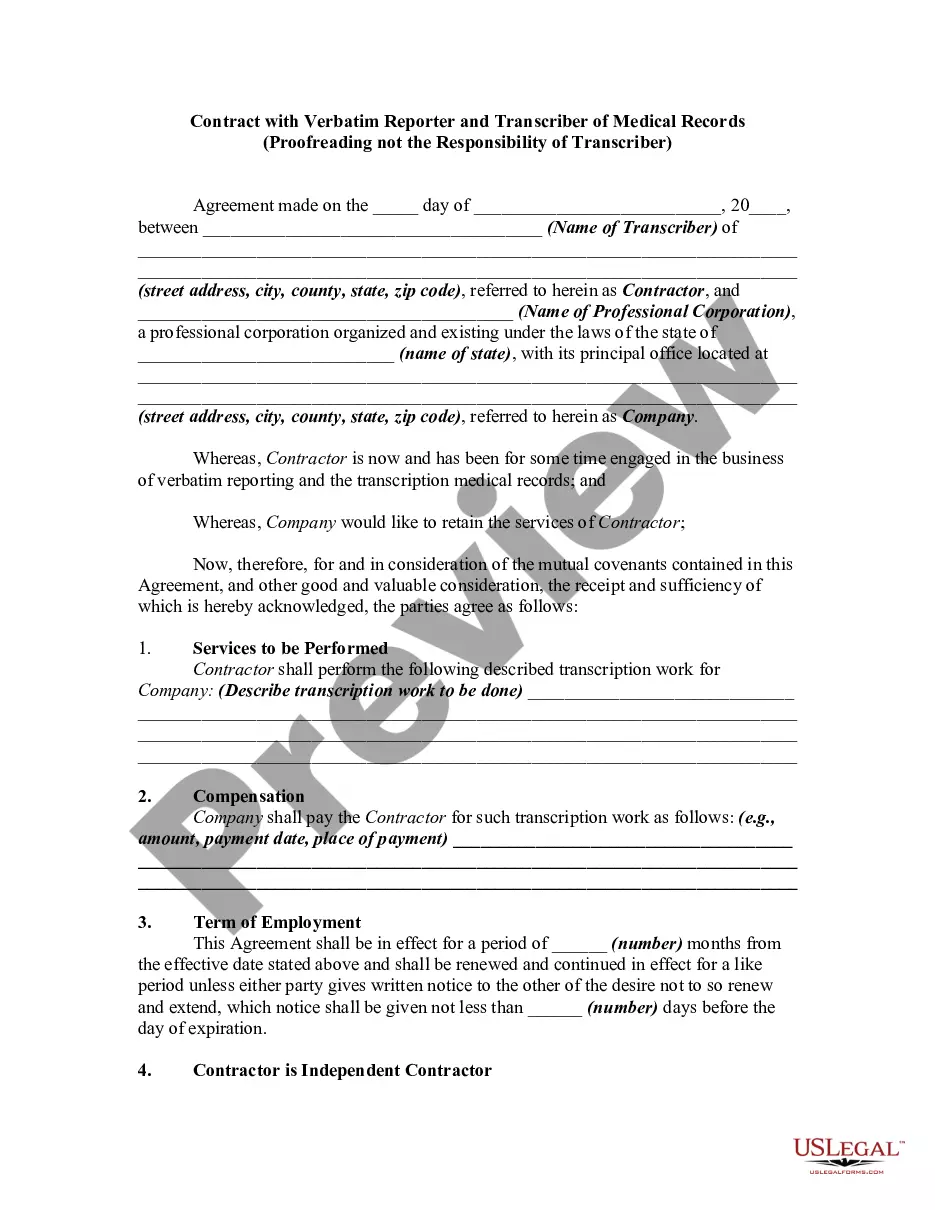

How to fill out Unrestricted Charitable Contribution Of Cash?

You can spend several hours online seeking the legal document template that satisfies the state and federal requirements you have.

US Legal Forms offers hundreds of legal documents that have been reviewed by experts.

It is easy to download or print the Nebraska Unrestricted Charitable Contribution of Cash from our platform.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Nebraska Unrestricted Charitable Contribution of Cash.

- Every legal document template you purchase is your property indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the form details to confirm you have selected the appropriate document.

Form popularity

FAQ

You can deduct up to $300 if you're single or married filing separately (or $600 if you're married filing jointly) for cash contributions made to qualifying charitieseven if you don't itemize.

To be eligible, donations have to be made in cash or via check, credit card or debit card. (The IRS says "amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with their volunteer services to a qualifying charitable organization" count, as well.)

Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes (AGI) for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI.

Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax Exempt Organization Search uses deductibility status codes to identify these limitations.

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize.

The adjusted gross income (AGI) limit for cash contributions to qualifying public charities remains increased for individual donors. For cash contributions made in 2021, you can elect to deduct up to 100 percent of your AGI (formerly 60 percent prior to the CARES Act).

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.