Nebraska Unrestricted Charitable Contribution of Cash refers to a type of donation made by individuals or organizations to nonprofit organizations registered in Nebraska. This form of contribution involves donating money without any restrictions on how the funds should be used by the recipient organization. The Nebraska Unrestricted Charitable Contribution of Cash offers flexibility for the organization to allocate the funds according to their most pressing needs, supporting various initiatives and programs. By making an Unrestricted Charitable Contribution of Cash in Nebraska, donors provide crucial support to nonprofit organizations to further their missions, implement projects, and deliver essential services to the community. These monetary donations play a significant role in enhancing the sustainability and impact of charitable organizations throughout the state. With an Unrestricted Charitable Contribution of Cash, donors can help a diverse range of causes such as education, healthcare, environment, poverty alleviation, arts and culture, social services, and more. By not imposing restrictions on how the funds are used, donors allow nonprofit organizations to effectively address emerging needs and invest in areas that require immediate attention. Types of Nebraska Unrestricted Charitable Contribution of Cash: 1. Individual Donations: Any person residing in Nebraska can make an unrestricted cash contribution to a qualified nonprofit organization of their choice. By giving back to the local community through an unrestricted donation, individuals can support causes they are passionate about and contribute to the overall wellbeing of their fellow Nebraskans. 2. Corporate Philanthropy: Companies and businesses in Nebraska are also encouraged to make unrestricted charitable contributions of cash to support nonprofit organizations. This form of corporate philanthropy allows businesses to align their values with community needs while promoting social responsibility. 3. Endowments and Foundations: Endowments and foundations established in Nebraska can designate a portion of their funds as unrestricted charitable contributions. This enables such entities to provide sustained financial support to nonprofit organizations, bolstering their capacity to foster positive change in the community. 4. Estate Planning: Individuals can include provisions for Nebraska Unrestricted Charitable Contributions of Cash in their estate planning. This ensures that even after their lifetime, their support for various causes and nonprofits continues through unrestricted financial contributions. In conclusion, the Nebraska Unrestricted Charitable Contribution of Cash is a significant philanthropic tool that offers flexibility and vital support to nonprofit organizations in the state. By making unrestricted cash contributions, individuals, businesses, foundations, and those engaged in estate planning can empower organizations to make a more significant impact and address immediate needs in the Nebraska community.

Nebraska Unrestricted Charitable Contribution of Cash

Description

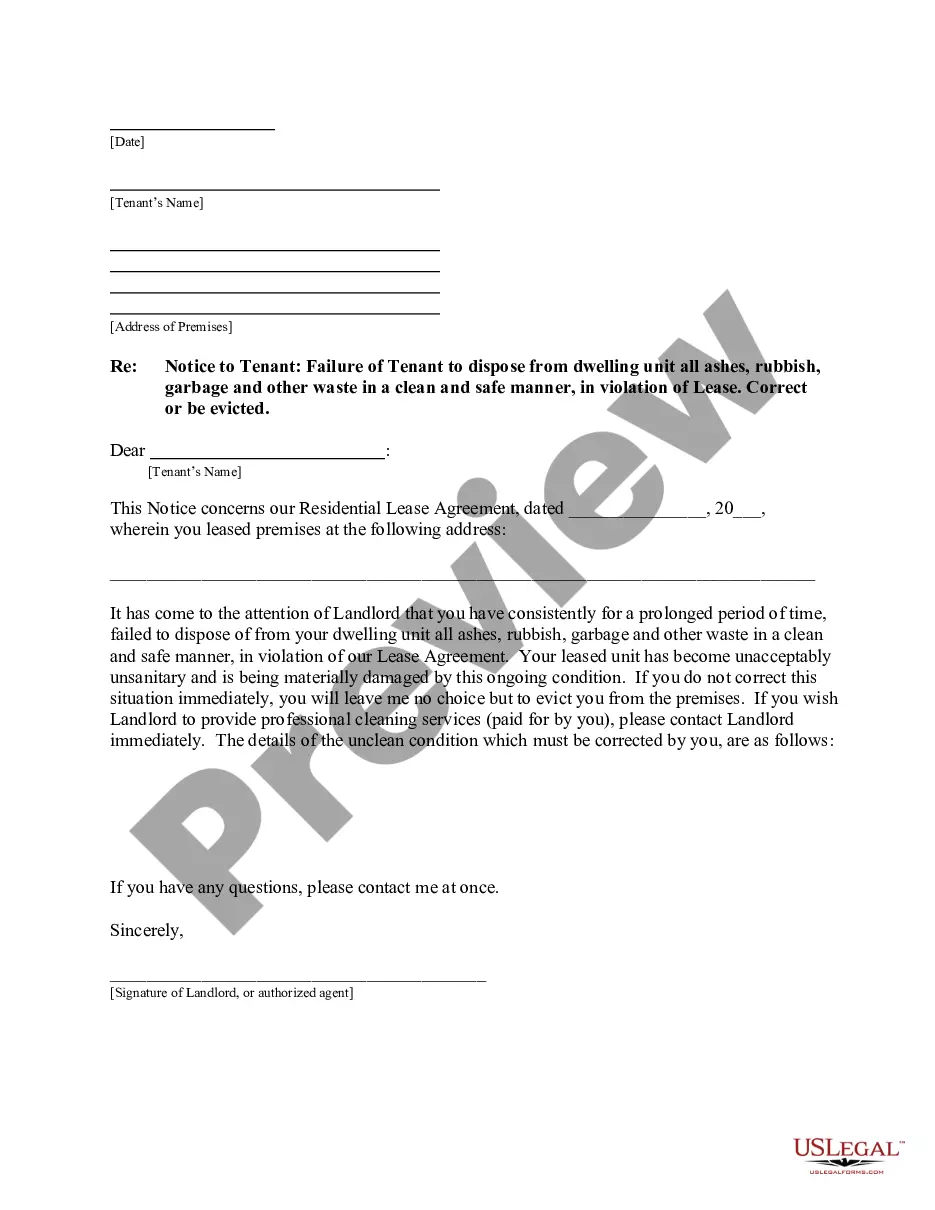

How to fill out Nebraska Unrestricted Charitable Contribution Of Cash?

You are able to devote several hours on the web attempting to find the legal papers web template that meets the state and federal needs you need. US Legal Forms provides thousands of legal forms that are analyzed by specialists. It is simple to download or print the Nebraska Unrestricted Charitable Contribution of Cash from our service.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Acquire key. Following that, it is possible to full, change, print, or indicator the Nebraska Unrestricted Charitable Contribution of Cash. Each and every legal papers web template you buy is your own property for a long time. To have yet another backup for any obtained kind, proceed to the My Forms tab and then click the corresponding key.

If you use the US Legal Forms web site the very first time, adhere to the basic recommendations beneath:

- Initially, make certain you have chosen the correct papers web template for that county/metropolis of your choice. Look at the kind information to ensure you have selected the appropriate kind. If accessible, take advantage of the Preview key to look from the papers web template as well.

- If you want to discover yet another edition of your kind, take advantage of the Look for industry to get the web template that fits your needs and needs.

- Once you have discovered the web template you want, click Get now to proceed.

- Select the rates strategy you want, type your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can use your bank card or PayPal bank account to cover the legal kind.

- Select the formatting of your papers and download it in your system.

- Make changes in your papers if needed. You are able to full, change and indicator and print Nebraska Unrestricted Charitable Contribution of Cash.

Acquire and print thousands of papers templates utilizing the US Legal Forms Internet site, that offers the most important assortment of legal forms. Use expert and express-specific templates to deal with your organization or personal needs.

Form popularity

FAQ

You can deduct up to $300 if you're single or married filing separately (or $600 if you're married filing jointly) for cash contributions made to qualifying charitieseven if you don't itemize.

To be eligible, donations have to be made in cash or via check, credit card or debit card. (The IRS says "amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with their volunteer services to a qualifying charitable organization" count, as well.)

Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes (AGI) for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI.

Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax Exempt Organization Search uses deductibility status codes to identify these limitations.

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize.

The adjusted gross income (AGI) limit for cash contributions to qualifying public charities remains increased for individual donors. For cash contributions made in 2021, you can elect to deduct up to 100 percent of your AGI (formerly 60 percent prior to the CARES Act).

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.