Nebraska Repossession Services Agreement for Automobiles is a legally binding contract that outlines the terms and conditions between a lender and a repossession agency. This agreement governs the repossession process of automobiles in the state of Nebraska. Relevant Keywords: Nebraska, Repossession Services Agreement, Automobiles, lender, repossession agency, contract, terms and conditions, repossession process. There are different types of Nebraska Repossession Services Agreements for Automobiles, including: 1. Voluntary Repossession Agreement: This type of agreement occurs when the borrower willingly surrenders their vehicle to the lender or repossession agency due to financial difficulties. The agreement will outline the terms of surrender, the condition of the vehicle, and any repayment arrangements. 2. Involuntary Repossession Agreement: In situations where a borrower fails to make timely payments or violates the terms of their auto loan agreement, the lender may initiate an involuntary repossession. This type of agreement establishes the terms and conditions under which the repossession agency can lawfully retrieve the vehicle, ensuring compliance with state laws and regulations. 3. Impound Repossession Agreement: When a vehicle is impounded due to various reasons such as accidents, illegal activities, or unpaid fines, this agreement is used. It specifies the process by which the lender authorizes the repossession agency to retrieve the vehicle from the impound lot. 4. Repossession Sale Agreement: In cases where the repossessed vehicle is sold at auction or through private sale to recover the outstanding loan amount, a Repossession Sale Agreement is utilized. This agreement outlines the terms of the sale, the division of proceeds between the lender and repossession agency, and any liabilities associated with the sale. 5. Repossession Release Agreement: Once the vehicle has been repossessed and the borrower has fulfilled their obligations, a Repossession Release Agreement is used to document the release of the vehicle to the borrower. This agreement verifies that the outstanding debt has been satisfied and that all parties are released from further liabilities. In summary, a Nebraska Repossession Services Agreement for Automobiles is a crucial legal document that safeguards the rights and responsibilities of both lenders and repossession agencies throughout the repossession process. It ensures that all parties involved adhere to state laws and regulations, while protecting the interests of borrowers and lenders in Nebraska.

Nebraska Repossession Services Agreement for Automobiles

Description

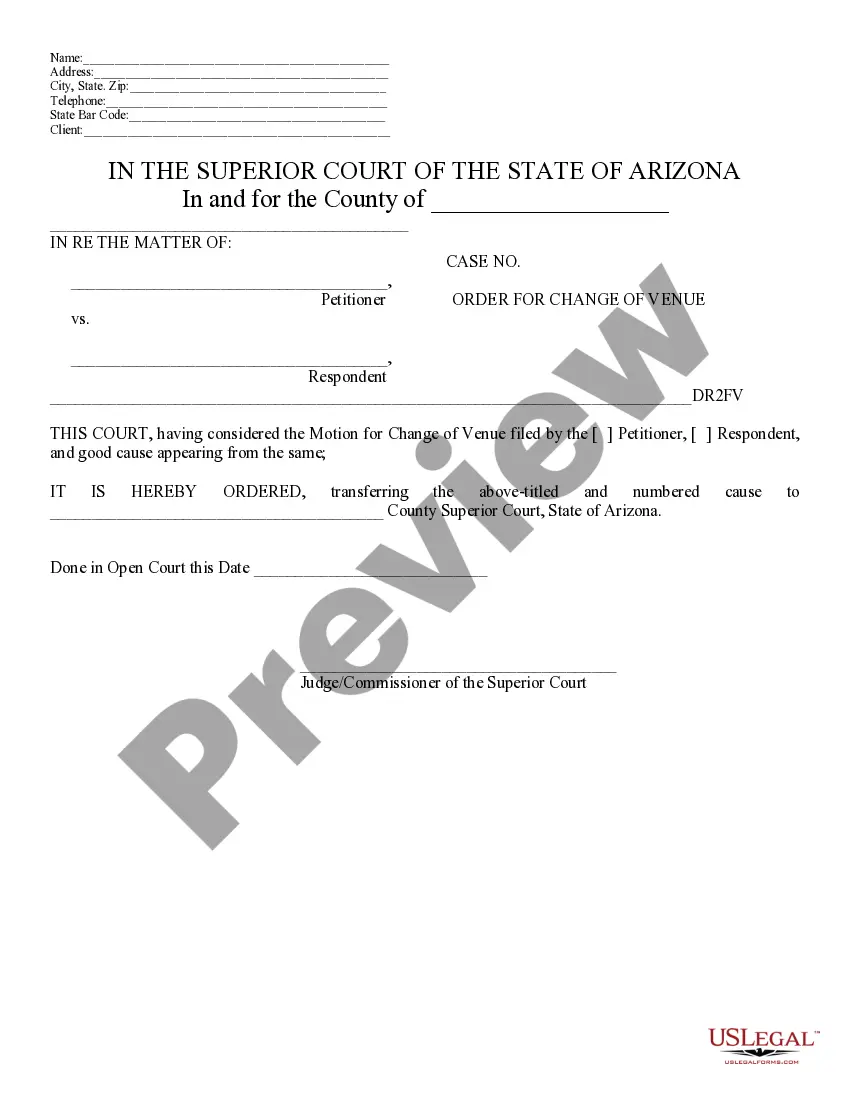

How to fill out Repossession Services Agreement For Automobiles?

If you have to full, acquire, or print lawful document layouts, use US Legal Forms, the greatest assortment of lawful varieties, which can be found online. Take advantage of the site`s simple and hassle-free search to get the paperwork you require. Various layouts for company and individual purposes are sorted by types and states, or keywords and phrases. Use US Legal Forms to get the Nebraska Repossession Services Agreement for Automobiles in just a number of mouse clicks.

In case you are already a US Legal Forms customer, log in to your profile and click the Download key to have the Nebraska Repossession Services Agreement for Automobiles. You may also accessibility varieties you previously acquired inside the My Forms tab of your own profile.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/country.

- Step 2. Take advantage of the Preview option to check out the form`s content. Don`t neglect to read the description.

- Step 3. In case you are unhappy using the develop, make use of the Research area on top of the screen to discover other variations from the lawful develop web template.

- Step 4. Upon having found the shape you require, go through the Purchase now key. Choose the pricing strategy you favor and add your credentials to register for an profile.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal profile to complete the transaction.

- Step 6. Select the structure from the lawful develop and acquire it on the system.

- Step 7. Total, modify and print or indication the Nebraska Repossession Services Agreement for Automobiles.

Every single lawful document web template you purchase is your own eternally. You may have acces to every develop you acquired within your acccount. Go through the My Forms section and pick a develop to print or acquire yet again.

Compete and acquire, and print the Nebraska Repossession Services Agreement for Automobiles with US Legal Forms. There are thousands of skilled and status-specific varieties you can utilize for your company or individual demands.

Form popularity

FAQ

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

Repossession happens when your lender or leasing company takes your car away because you've missed payments on your loanand it can occur without warning if you've defaulted on your auto loan.

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

Example Repossessed because of previous owner's debt A few months later, the car is repossessed by the company who sold it to the previous owner, who owed money on it and had not been making payments.

Often, a bank or repossession company will let you get your car back if you pay back the loan in full, along with all the repossession costs, before it's sold at auction. You can sometimes reinstate the loan and work out a new payment plan, too.

Nebraska allows for self-help repos. This means a repo company can take your car without a court order. But they can't use force or breach the peace while repossessing your car under Nebraska state law. This generally means that they can't make a scene and can't make threats or incite violence.

Repossession happens when somebody stops paying their secured loans. When that happens, the creditor can take back the property securing the loan. The process of taking back this property is called repossession.

Repossession is used to help lenders ensure that their debt is paid or as close to paid as is possible.

Generally, most lenders start the repossession process once you're in default usually at least 90 days past due on a payment. When the loan is actually considered in default can depend on the language in your loan contract.

Ideally, you should start these negotiations before the repossession process. If you negotiate after repossession, however, you may be able to use any questionable actions by the lender during that process to help bolster your bargaining position.