Nebraska Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

Have you ever entered a location where you require documents for either business or personal purposes nearly every day.

There are numerous authentic document templates accessible online, yet finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Nebraska Annuity as Consideration for Transfer of Securities, which can be crafted to meet federal and state guidelines.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Nebraska Annuity as Consideration for Transfer of Securities anytime, if needed. Click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nebraska Annuity as Consideration for Transfer of Securities template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Locate the form you need and ensure it pertains to the correct city/region.

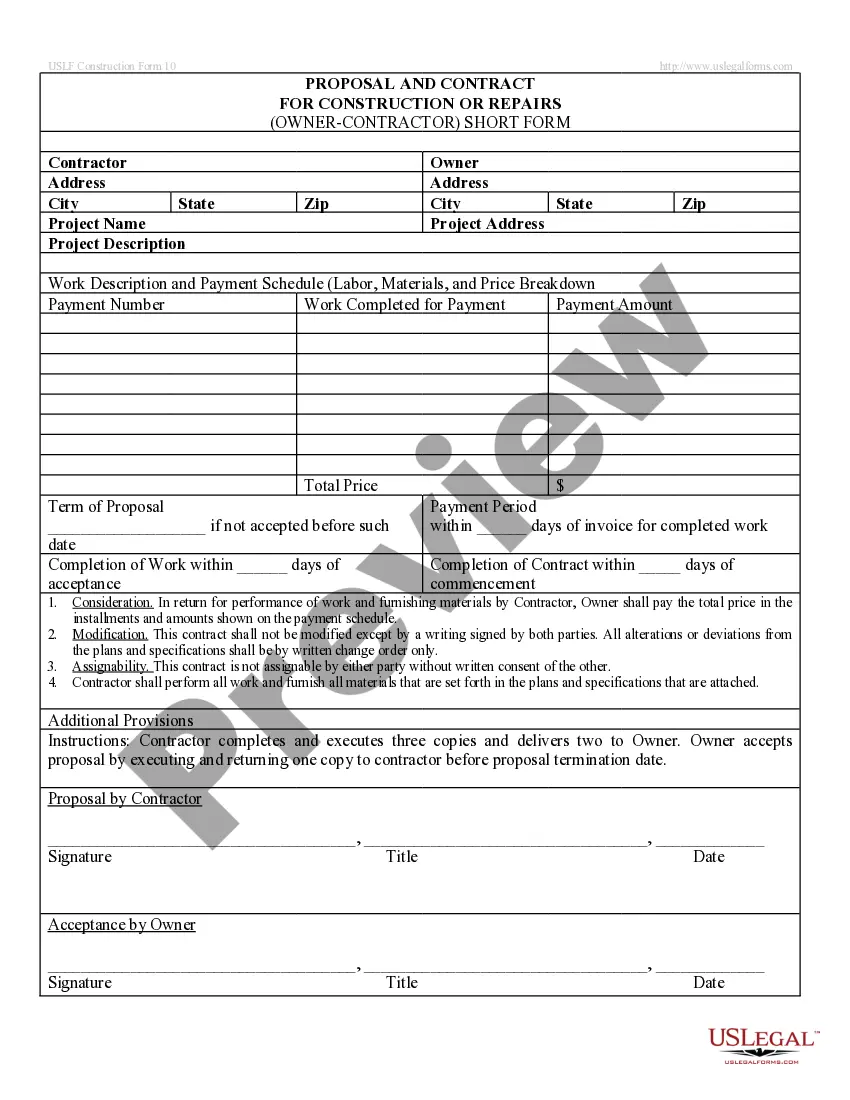

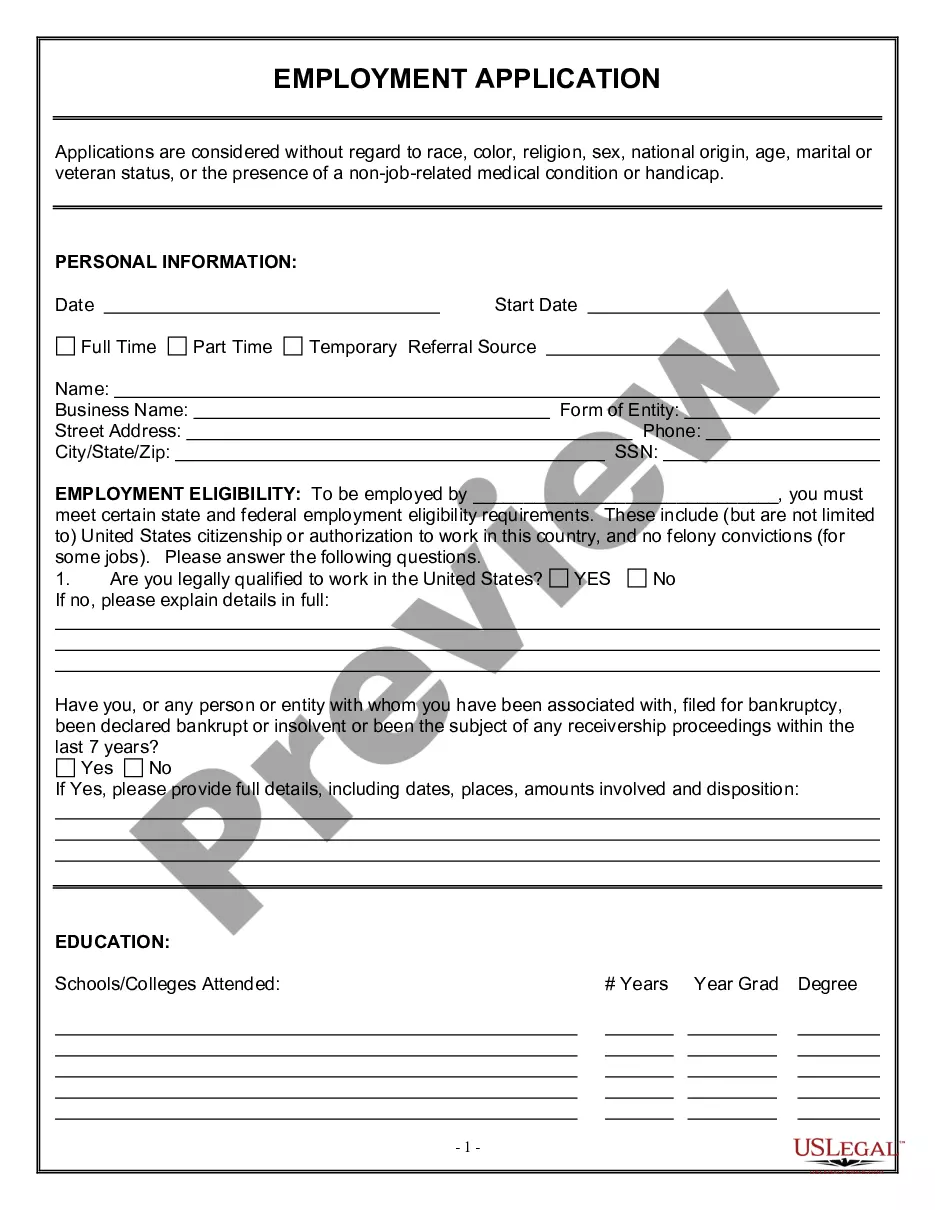

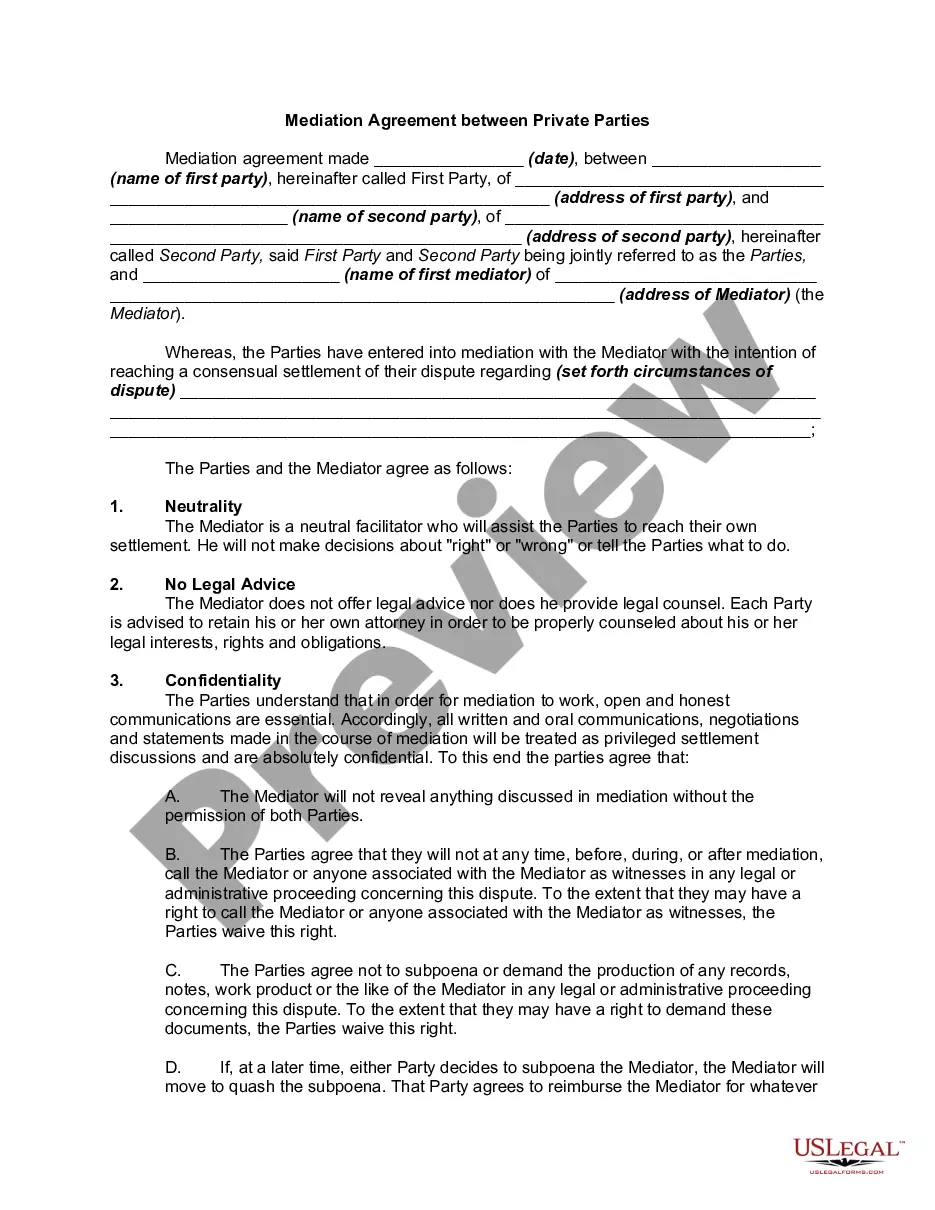

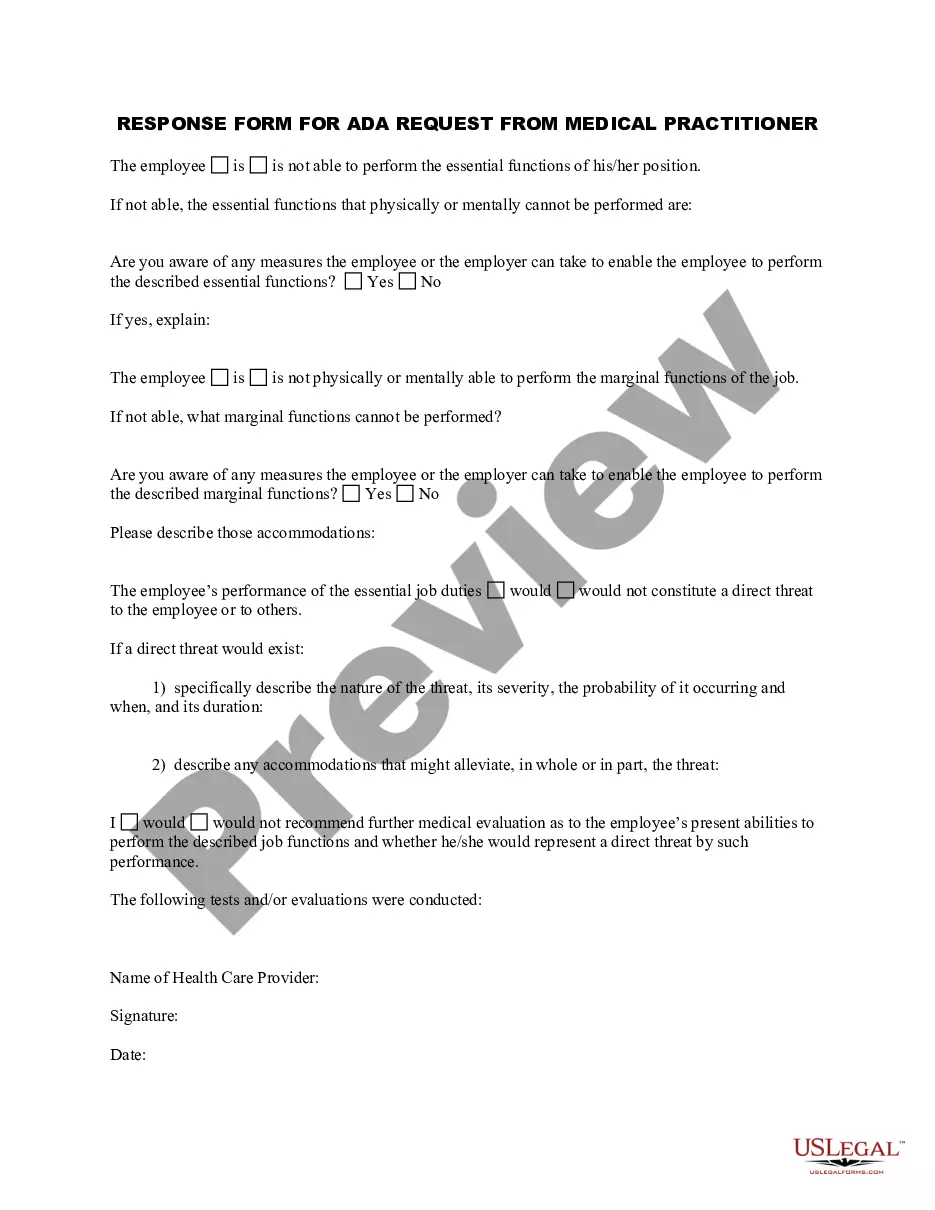

- Utilize the Review button to examine the form.

- Check the description to verify you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that satisfies your requirements.

Form popularity

FAQ

Non-qualified annuities are purchased with after-tax dollars so only the earnings on your investment are taxable. There is no legal age requirement for withdrawing from a non-qualified annuity.

Suitability Information Gathered by an InsurerAge.Annual income.Financial situation and needs, including the financial resources you're using to fund the annuity.Financial experience.Financial goals and objectives.Intended use of the annuity.Financial time horizon.More items...

There are three parties to an annuity contract: the owner, annuitant and the beneficiary. The owner makes the initial investment, decides when to begin taking income and can change the beneficiary designation at will. The annuitant's life is used to determine the benefits to be paid out under the contract.

There are four parties to an annuity contract: the annuity issuer, the owner, the annuitant, and the beneficiary. The annuity issuer is the company (e.g., an insurance company) that issues the annuity.

A qualified annuity is a retirement savings plan that is funded with pre-tax dollars. A non-qualified annuity is funded with post-tax dollars.

There are four basic types of annuities to meet your needs: immediate fixed, immediate variable, deferred fixed, and deferred variable annuities. These four types are based on two primary factors: when you want to start receiving payments and how you would like your annuity to grow.

A qualified annuity is a retirement savings plan that is funded with pre-tax dollars. A non-qualified annuity is funded with post-tax dollars. To be clear, the terminology comes from the Internal Revenue Service (IRS).

Although you don't receive any upfront tax break with a nonqualified annuity, the earnings on your subaccounts grow tax-deferred. That is the unique tax advantage of these annuities.

qualified annuity is a type of investment you buy with the money you have already been taxed on. It is not connected to any retirement account, such as an IRA or 401K.

For non-qualified annuities: You won't owe tax on the amount you paid into the annuity. But you will owe ordinary income tax on the growth. And when you make a withdrawal, the IRS requires that you take the growth first meaning you will owe income tax on withdrawals until you have taken all the growth.