Nebraska Assignment of Profits of Business

Category:

State:

Multi-State

Control #:

US-1340811BG

Format:

Word;

Rich Text

Instant download

Description

An assignment agreement is a contract in which one party assigns contractual rights. Assignment of rights under a contract is the complete transfer of the rights to receive the benefits accruing to one of the parties to that contract. While contractual assignment of rights is legal, some types of rights cannot be given away.

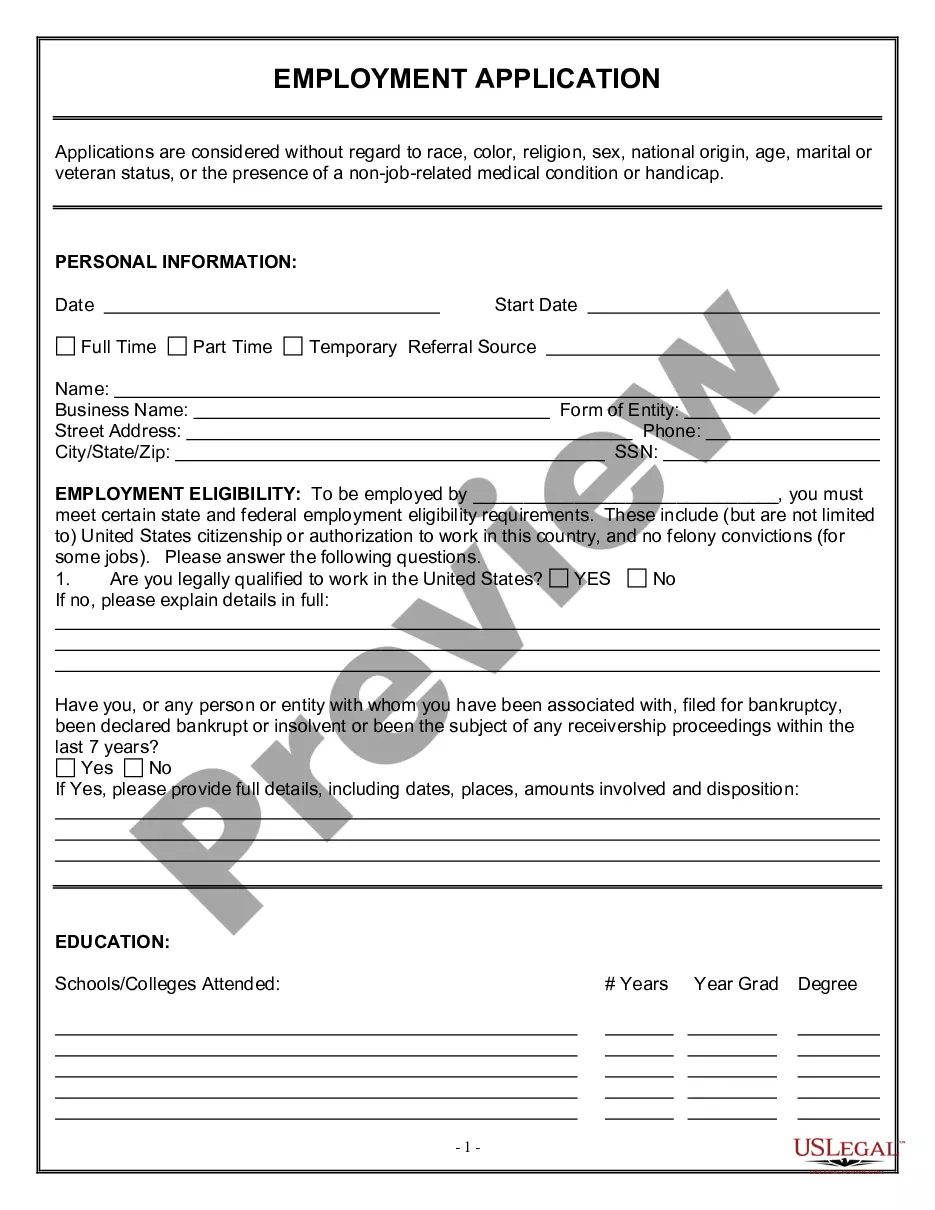

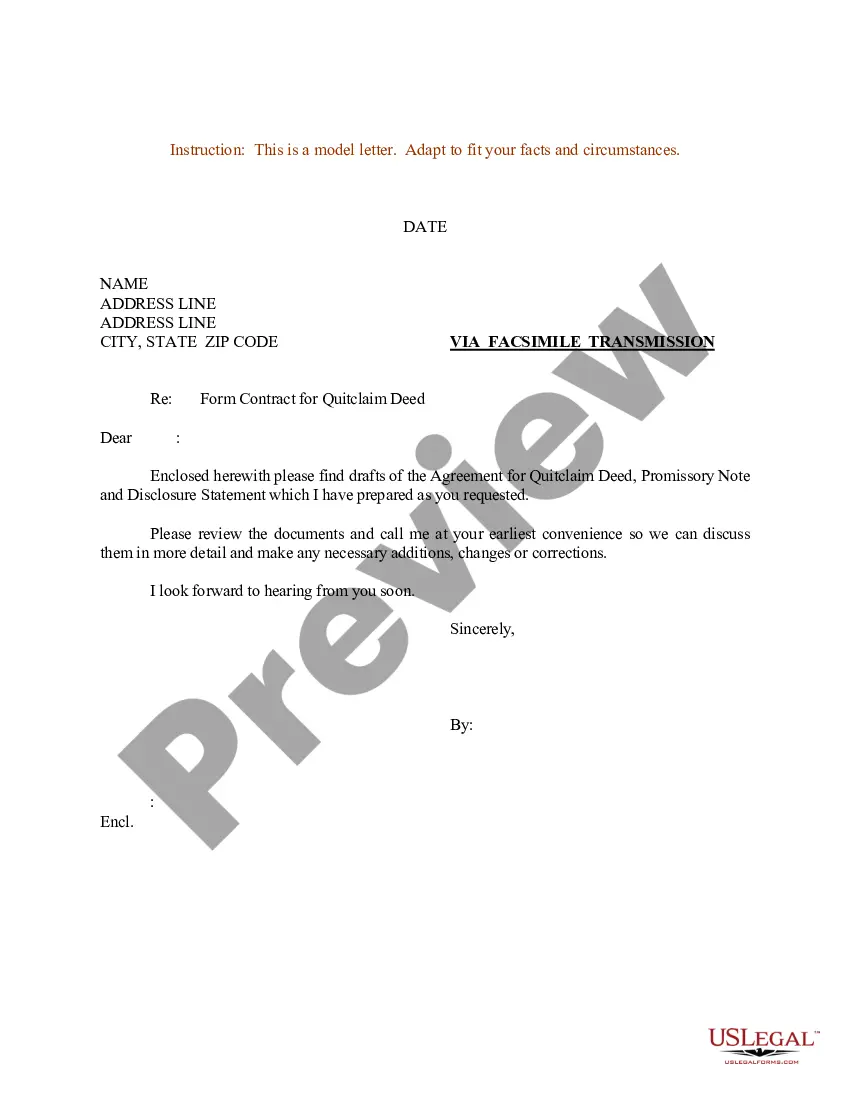

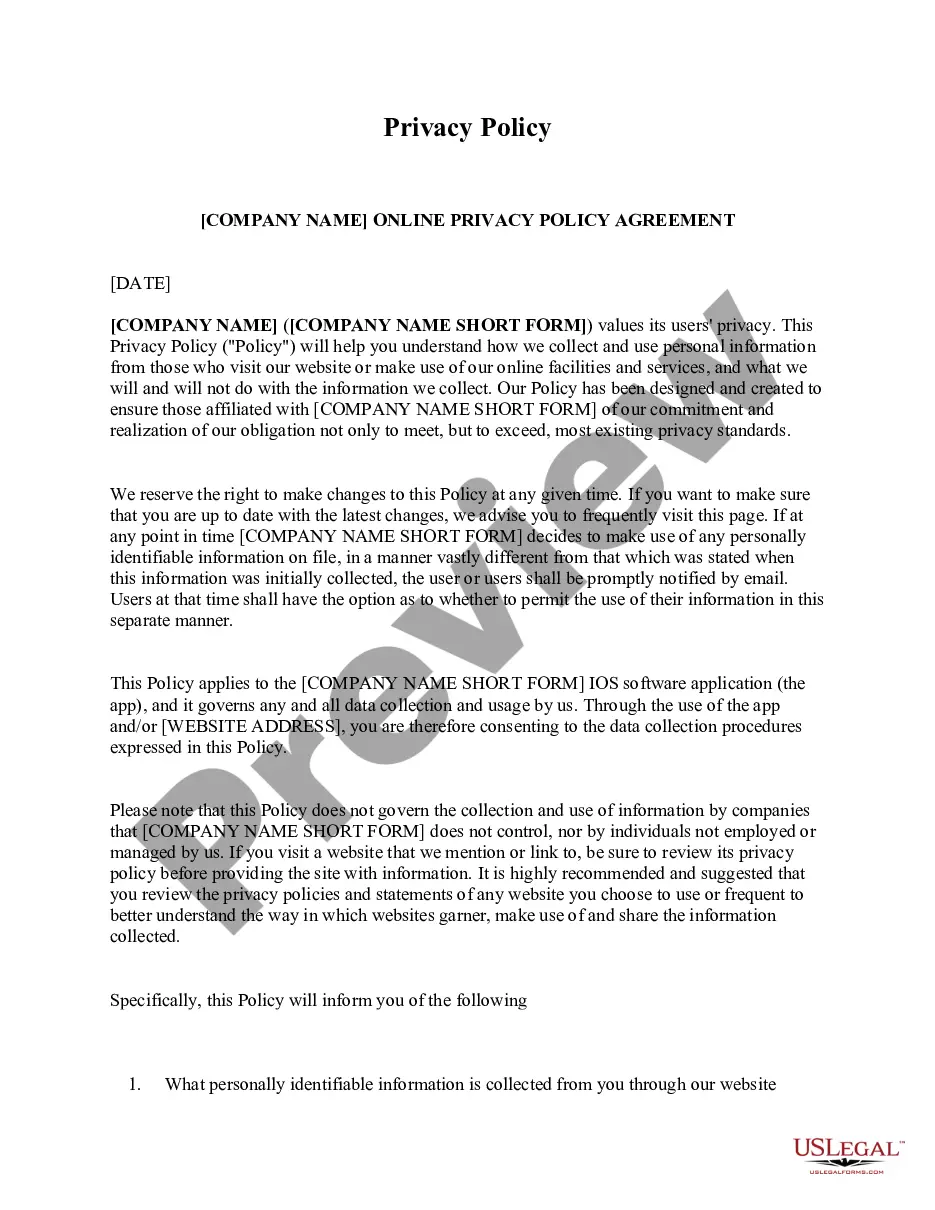

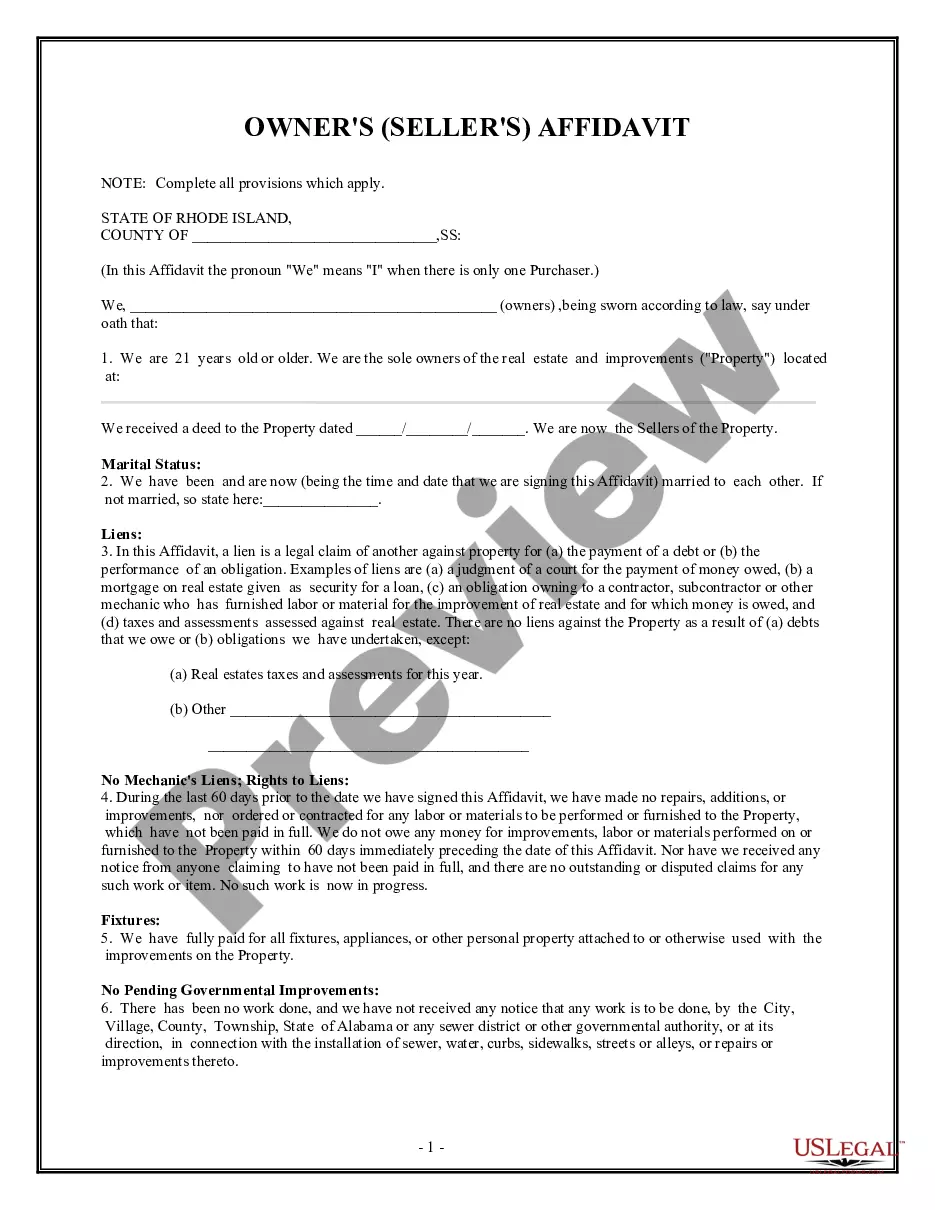

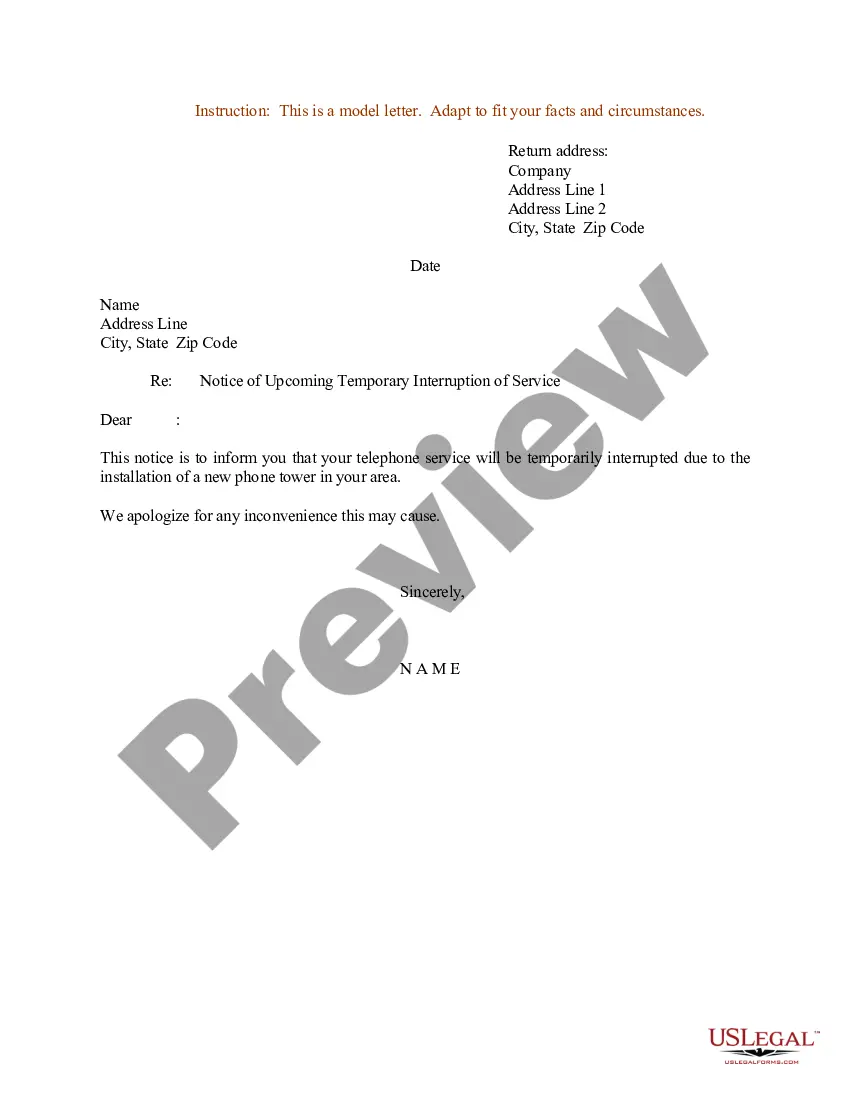

Free preview

How to fill out Assignment Of Profits Of Business?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

It's easy to download or print the Nebraska Assignment of Profits of Business from my service.

If available, use the Review option to check through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the Nebraska Assignment of Profits of Business.

- Each legal document template you purchase is yours forever.

- To get another copy of the purchased form, go to the My documents tab and click on the appropriate option.

- If you are visiting the US Legal Forms site for the first time, follow these simple instructions.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Check the form description to confirm that you have chosen the correct form.