Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

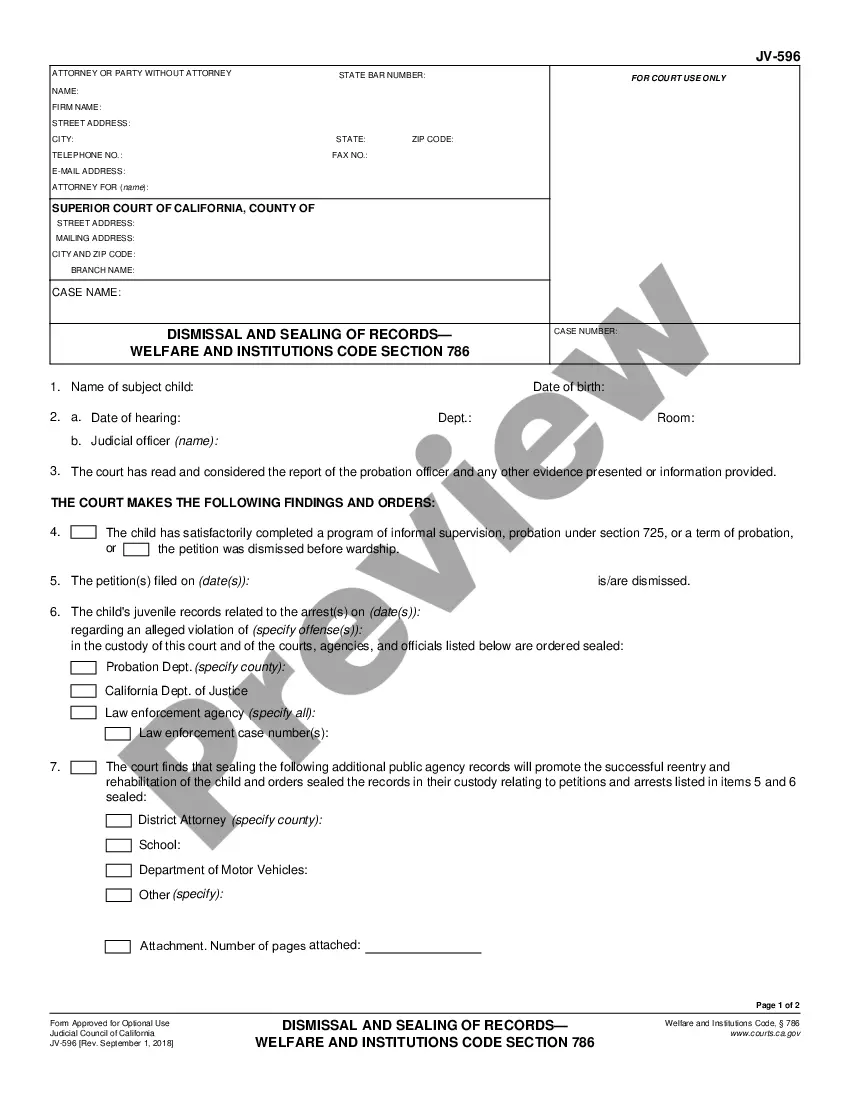

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Choosing the best legitimate papers template can be quite a have a problem. Obviously, there are a lot of themes available online, but how will you discover the legitimate type you will need? Make use of the US Legal Forms web site. The support provides a large number of themes, including the Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that you can use for company and personal needs. Each of the varieties are checked by specialists and meet state and federal demands.

In case you are already listed, log in for your profile and click the Down load switch to find the Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Make use of your profile to appear throughout the legitimate varieties you might have bought earlier. Visit the My Forms tab of your profile and acquire another copy of your papers you will need.

In case you are a fresh user of US Legal Forms, listed here are basic directions that you should stick to:

- Very first, ensure you have chosen the correct type for your personal area/state. You may look over the form while using Review switch and read the form description to make sure this is basically the best for you.

- In the event the type is not going to meet your preferences, use the Seach discipline to obtain the right type.

- Once you are certain that the form is proper, select the Buy now switch to find the type.

- Opt for the costs plan you want and type in the essential info. Make your profile and buy the transaction with your PayPal profile or Visa or Mastercard.

- Choose the data file file format and obtain the legitimate papers template for your gadget.

- Total, change and printing and indication the acquired Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

US Legal Forms is definitely the biggest local library of legitimate varieties for which you can see numerous papers themes. Make use of the service to obtain skillfully-produced papers that stick to status demands.

Form popularity

FAQ

A "5 by 5 Power in Trust" is a common clause in many trusts that allows the trust's beneficiary to make certain withdrawals. Also also called a "5 by 5 Clause," it gives the beneficiary the ability to withdraw the greater of: $5,000 or. 5% of the trust's fair market value (FMV) from the trust each year.

Seven steps to basic estate planning Create an inventory. ... Account for your family's needs. ... Establish your directives. ... Review your beneficiaries. ... Note your state's estate tax laws. ... Weigh the value of professional help. ... Plan to reassess.

The Estate Planning Process: 6 Steps to Take CREATE AN INVENTORY OF WHAT YOU OWN AND WHAT YOU OWE. ... DEVELOP A CONTINGENCY PLAN. ... PROVIDE FOR CHILDREN AND DEPENDENTS. ... PROTECT YOUR ASSETS. ... DOCUMENT YOUR WISHES. ... APPOINT FIDUCIARIES.

An expert adviser can help you navigate the rules and pass on more of your wealth. After taking inheritance tax advice you will: Understand how the rules apply to your situation. Get expert recommendations on how to pass on your assets in a tax efficient way.

Get a head-start on planning and follow these 7 easy steps: Take Inventory of Your Estate. First, narrow down what belongs to you. ... Set a Will in Place. ... Form a Trust. ... Consider Your Healthcare Options. ... Opt for Life Insurance. ... Store All Important Documents in One Place. ... Hire an Attorney from Angermeier & Rogers.

There are a variety of ways that money can be left to your children, including wills, trusts, or by naming them beneficiaries of retirement plans, life insurance, and 529 plans. The best ways to leave your children money are through estate planning tools, such as wills and trusts.

Lay out Your Assets & Think About Final Wishes. ... Consider Your Digital Assets. ... Gather Documents Needed for Will Preparation. ... Choose Your Executor & Beneficiaries. ... Nominate Guardians. ... Sign Your Will. ... Store Your Will. ... Update or Amend Your Will.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.