Nebraska Agreement between Co-lessees as to Payment of Rent and Taxes

Description

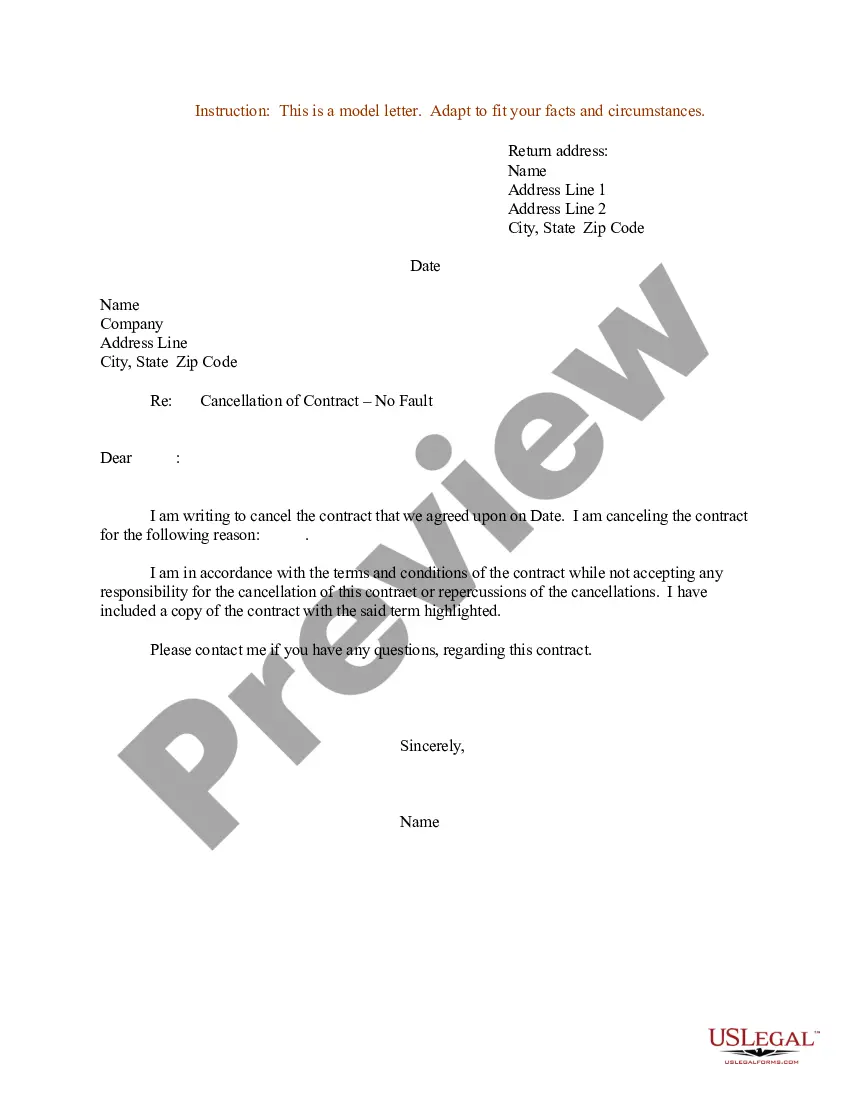

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

US Legal Forms - one of the largest libraries of lawful forms in the United States - offers a wide array of lawful record templates you may down load or print out. Utilizing the site, you may get a huge number of forms for company and specific purposes, categorized by groups, claims, or search phrases.You can get the most recent models of forms just like the Nebraska Agreement between Co-lessees as to Payment of Rent and Taxes within minutes.

If you currently have a subscription, log in and down load Nebraska Agreement between Co-lessees as to Payment of Rent and Taxes through the US Legal Forms catalogue. The Obtain button can look on each and every form you perspective. You get access to all in the past delivered electronically forms in the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed below are basic directions to get you started:

- Make sure you have selected the right form to your city/county. Click the Review button to examine the form`s content material. Browse the form outline to actually have chosen the correct form.

- In the event the form does not match your specifications, utilize the Look for industry at the top of the display to discover the one that does.

- If you are pleased with the form, affirm your decision by simply clicking the Purchase now button. Then, opt for the pricing plan you favor and supply your accreditations to register on an bank account.

- Process the purchase. Make use of charge card or PayPal bank account to finish the purchase.

- Find the file format and down load the form in your system.

- Make changes. Complete, modify and print out and sign the delivered electronically Nebraska Agreement between Co-lessees as to Payment of Rent and Taxes.

Every single format you put into your account lacks an expiry particular date and is your own permanently. So, if you wish to down load or print out one more version, just check out the My Forms section and click in the form you need.

Obtain access to the Nebraska Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms, probably the most extensive catalogue of lawful record templates. Use a huge number of professional and state-particular templates that fulfill your business or specific needs and specifications.

Form popularity

FAQ

Motor vehicles leased for periods of one year or more are subject to sales tax in Nebraska when the location indicated on the application for registration of the vehicle is in this state, regardless of the location of the lessor.

Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement. While any sort of property can be leased, the practice is most commonly associated with residential or commercial real estate?a home or office.

Sales Tax¹ Nebraska sales tax is imposed upon the gross receipts from: all sales, leases, rentals, installation, application, and repair of tangible personal property; ? every person providing or installing utility services; retailers of intellectual or entertainment property; the sale of admissions, bundled ...

A Nebraska month-to-month lease agreement is a real estate contract that allows a person to be able to occupy and lease property on a continuous basis which restarts every thirty (30) days upon the payment of rent.

A major disadvantage of renting to own is that renters lose their down payment and other non-refundable charges if they decide not to purchase the home.

A Nebraska rent-to-own lease agreement is a contract between a landlord and tenant for the renting of property with an option to buy. The terms of the purchase should be negotiated at the time of lease signing with the sale to occur upon the tenant giving notice to the landlord.

Rental agreements are very similar to lease agreements. The biggest difference between lease agreements and rental agreements lies in the length of the contract. Unlike a long-term lease agreement, a rental agreement provides tenancy for a shorter period of time?usually 30 days.

All applications for residency will be processed through a credit reporting agency. All adults 18 years of age or older must complete and sign an application.