Nebraska Internal Application Form

Description

How to fill out Internal Application Form?

If you want to be thorough, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, which are available online.

Employ the site's straightforward and user-friendly search tool to locate the documents you require. Various templates for both business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to access the Nebraska Internal Application Form in just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Compete and download, and print the Nebraska Internal Application Form with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are an existing US Legal Forms customer, sign in to your account and click on the Download button to obtain the Nebraska Internal Application Form.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

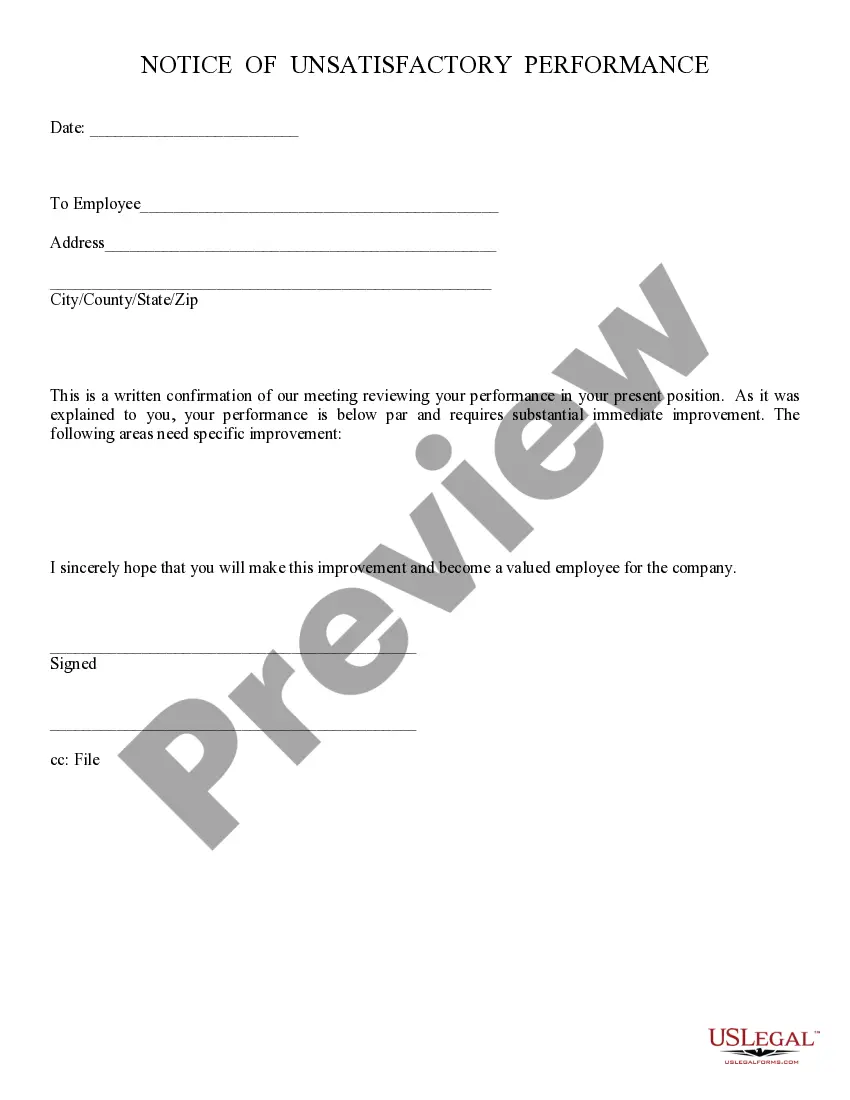

- Step 2. Use the Preview option to review the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, revise and print or sign the Nebraska Internal Application Form.

Form popularity

FAQ

Any eligible individual may file the Purchase of a Nebraska Residence in a Designated Extremely Blighted Area Credit, Form 1040N-EB to claim the credit and compute any unused tax credit to carry forward.

Taxpayers who were resident aliens at the beginning of the tax year and nonresident aliens at the end of the tax year should file Form 1040NR labeled "Dual Status Return" with Form 1040 attached as a schedule and labeled "Dual Status Statement."

The state income tax table can be found inside the Nebraska Form 1040N instructions booklet. The Nebraska Form 1040N instructions and the most commonly filed individual income tax forms are listed below on this page. Preparation of your Nebraska income tax forms begins with the completion of your federal tax forms.

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Form 1040-NR is often required for nonresident aliens who engaged in a trade or business in the United States or otherwise earned income from U.S. sources. A non-resident alien is somebody who is not American and lives abroad, but who earns taxable income in the U.S.

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

The standard deduction in Nebraska is $7,100 for single filers and $14,200 for joint filers. You can claim a larger standard deduction if you or your spouse is over 65 years old or blind.

Do I have to file a Nebraska Individual Income Tax Return? Yes. You must file a Form 1040N. For regular income, you will receive credit for any taxes paid to the other state by completing a Nebraska Schedule I and attaching a copy of the other state's income tax return.

If you file form 1040 (U.S. resident return), you must report, and are subject to taxation on your worldwide income. Non-Residents, who file form 1040NR, must only report their US sourced income.

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040.