Nebraska Payroll Deduction Authorization Form is a legal document used by employers to obtain an employee's consent for deducting specific amounts from their wages. This deduction is usually for various purposes, such as employee benefits, charitable donations, loan repayments, or other authorized expenses. The form ensures transparency and compliance with state laws and regulations related to payroll deductions in Nebraska. Keywords: Nebraska, Payroll Deduction, Authorization Form, employer, employee, wages, deduction, benefits, charitable donations, loan repayments, authorized expenses, transparency, compliance, state laws, regulations. Different types of Nebraska Payroll Deduction Authorization Forms may include: 1. Employee Benefits Deduction Authorization Form: This form is used to authorize deductions from an employee's wages for the purpose of funding various benefit plans such as health insurance, retirement savings, or flexible spending accounts. 2. Charitable Donations Deduction Authorization Form: Employers may offer employees the option to contribute a portion of their wages to charitable organizations. This form authorizes the deduction and specifies the chosen charities. 3. Loan Repayment Deduction Authorization Form: In situations where employees have obtained loans from their employer, such as tuition reimbursement or advance payments, this form enables the deduction of agreed-upon amounts to repay the loan over a specific period. 4. Union Dues Deduction Authorization Form: Employees who are members of a union may authorize their employers to deduct union dues from their wages. This form outlines the amount and frequency of the deduction. 5. Miscellaneous Deduction Authorization Form: This form allows employees to authorize deductions for various authorized expenses like uniforms, equipment, or other specific circumstances as agreed upon by the employer and employee. These are some commonly encountered types of Nebraska Payroll Deduction Authorization Forms, each with its own purpose and specific deductions. Employers need to ensure that these forms comply with state regulations and maintain records of authorized deductions for transparency and accountability.

Nebraska Payroll Deduction Authorization Form

Description

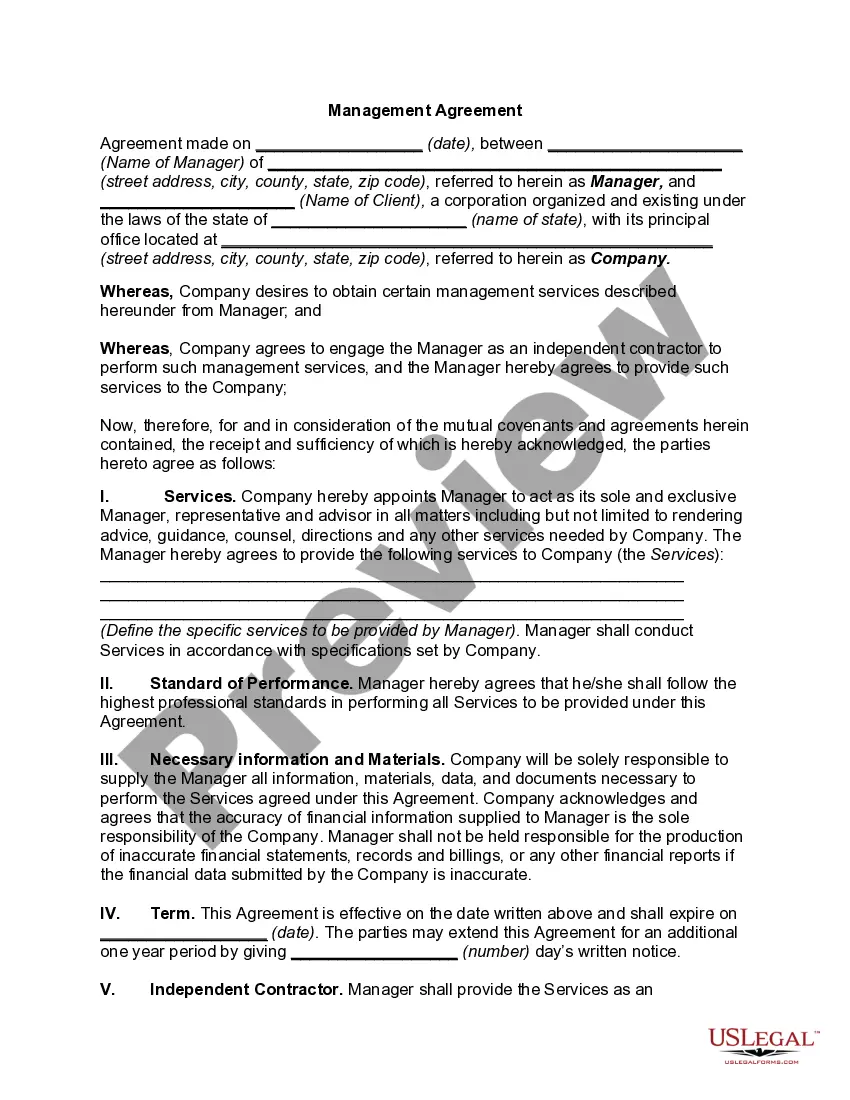

How to fill out Nebraska Payroll Deduction Authorization Form?

Choosing the right lawful papers format can be quite a struggle. Needless to say, there are plenty of themes available on the net, but how do you obtain the lawful form you will need? Make use of the US Legal Forms website. The assistance provides thousands of themes, like the Nebraska Payroll Deduction Authorization Form, that you can use for enterprise and private demands. All of the forms are examined by pros and fulfill federal and state specifications.

Should you be already listed, log in for your accounts and click the Acquire switch to have the Nebraska Payroll Deduction Authorization Form. Make use of accounts to appear through the lawful forms you may have purchased earlier. Check out the My Forms tab of your accounts and have one more copy from the papers you will need.

Should you be a new consumer of US Legal Forms, listed here are straightforward instructions that you can stick to:

- Initially, make certain you have selected the appropriate form for your town/county. You may examine the shape utilizing the Review switch and read the shape description to guarantee this is the right one for you.

- When the form is not going to fulfill your requirements, utilize the Seach discipline to get the proper form.

- When you are sure that the shape is suitable, go through the Purchase now switch to have the form.

- Opt for the costs prepare you would like and type in the necessary information. Create your accounts and buy the order using your PayPal accounts or Visa or Mastercard.

- Choose the data file structure and obtain the lawful papers format for your system.

- Comprehensive, change and printing and indicator the acquired Nebraska Payroll Deduction Authorization Form.

US Legal Forms is the greatest collection of lawful forms where you can see different papers themes. Make use of the service to obtain appropriately-manufactured files that stick to status specifications.